78% of Institutional Traders Have No Interest In Crypto: JP Morgan

78% of Institutional Merchants Have No Pastime In Crypto: JP Morgan

Novel files reveals that just about all world institutional merchants would no longer accept as true with any pastime in exposing holdings to digital resources even supposing the number of authentic-crypto corporations has recorded a slight declare.

A most unusual JP Morgan 2024 peek from over 4000 monetary market participants reveals creeping acceptance of Bitcoin and various cryptocurrencies by institutional merchants.

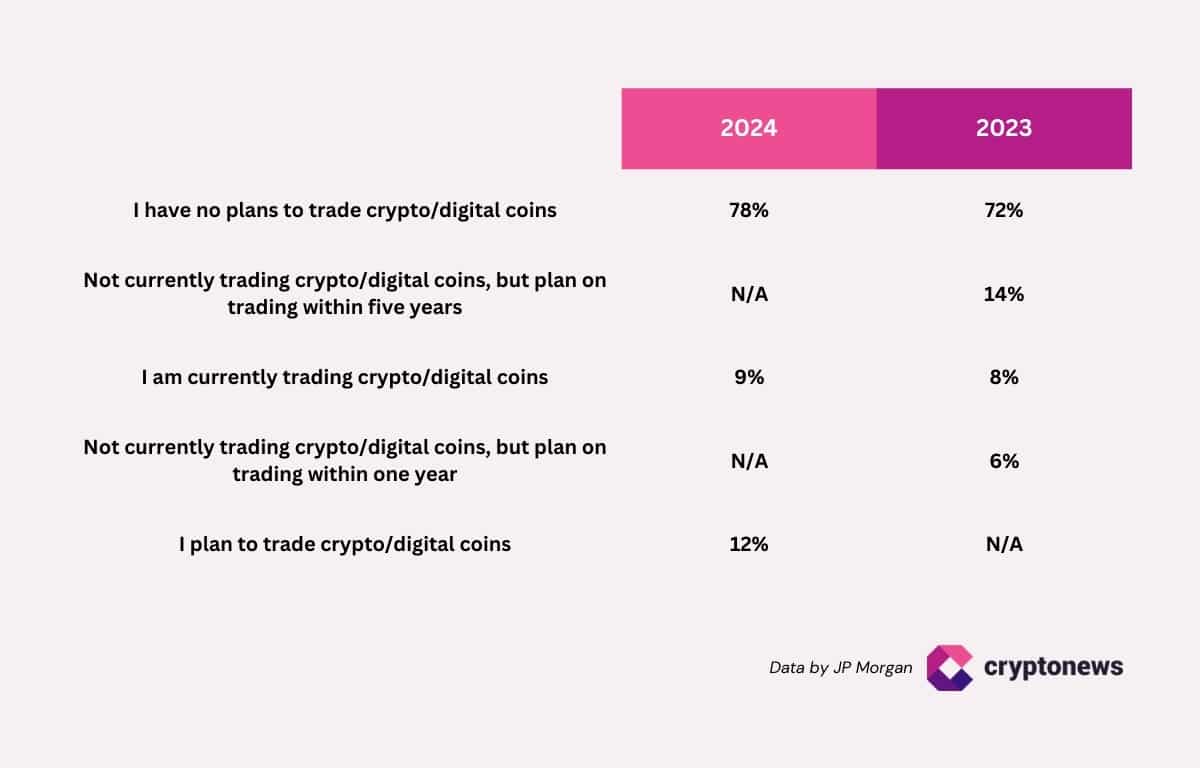

In step with participants, 78% of these merchants would no longer accept as true with any plans to trade digital resources quickly, recording an magnify from 2023’s numbers.

Final yr, 72% of trades smartly-known that they’d no longer add crypto resources to their portfolios, with loads of analysts pointing to the scarcity of uniform regulations available within the market as a that it’s likely you’ll well presumably also bear in mind living off of pushing out investors.

Simplest 9% of corporations spoke back positively to the reality that they trade digital resources, a slight 1% magnify from supreme yr when investors faced the FTX saga.

For prospects, no longer one amongst the corporations no longer at the moment buying and selling digital resources view on opening that division within the following five years no topic 14% responding positively supreme yr.

2023 peek results also show masks that 6% of participants affirm they’re going to open buying and selling digital resources within the following 300 and sixty five days. This yr, 12% confirmed pastime in resuming buying and selling digital resources.

Despite the indisputable reality that figures from the peek show masks a racy stance against the crypto market, the positives will also be viewed within the 12% of the 4,000 merchants who wish to reach exposure to the market on the encourage of most unusual traits.

Furthermore, participants within the JP Morgan peek were asked in regards to the following huge abilities in buying and selling, and a lot of corporations pointed to Synthetic Intelligence (AI) sooner than dispensed ledger abilities (DLT). Whereas 61% voted for AI, finest 7% backed blockchain abilities.

Scams and Uncertainty Damage The Market

Analysts accept as true with lamented reoccurring digital asset scams within the previous two years as a hurdle on the avenue to mass adoption.

#PeckShieldAlert 2023 saw 600+ predominant hacks within the crypto house, main to ~$2.61B in losses, with $674.9M recovered.

$1.51B misplaced to hacks (other than #Multichain unauthorized withdrawals) & $1.1B to scams. This marks a 27.78% lower from 2022. #DeFi protocols remained top… pic.twitter.com/G7PIU3WyrX— PeckShieldAlert (@PeckShieldAlert) January 29, 2024

Frequent hacks costing investors hundreds of thousands are among the many explanations why institutional merchants and extinct market avid gamers discontinue off the crypto market. Final yr, the broader market misplaced $2 billion to cryptocurrency immoral actors opening up additional debates on the safety of user resources.

In 2022, the collapse of the Terra Network and the following implosion of FTX wiped hundreds of thousands off the market while attracting bottleneck regulations to the sectors.

In the United States, regulators accept as true with filed more than one complaints against cryptocurrency corporations without bellow suggestions in device. This has led some corporations to hint at a that it’s likely you’ll well presumably also bear in mind circulation to various jurisdictions.

All these market conditions accept as true with resulted in reduced investment from extinct finance avid gamers. Nonetheless, most unusual actions love the approval of a spot Bitcoin ETF were tipped to trade the tide.

Following the United States Securities and Alternate Rate (SEC) approval of Bitcoin ETFs, there used to be an inflow of funds available within the market as many extinct investors accept as true with a new window of investment.

Source : cryptonews.com