Bitcoin Price Drops Back Below $49,000 After Hot US CPI Data Deals Blow to Fed Rate Cut Bets – Where Next for BTC?

Bitcoin Mark Drops Wait on Below $49,000 After Hot US CPI Details Presents Blow to Fed Rate Lower Bets – The place Subsequent for BTC?

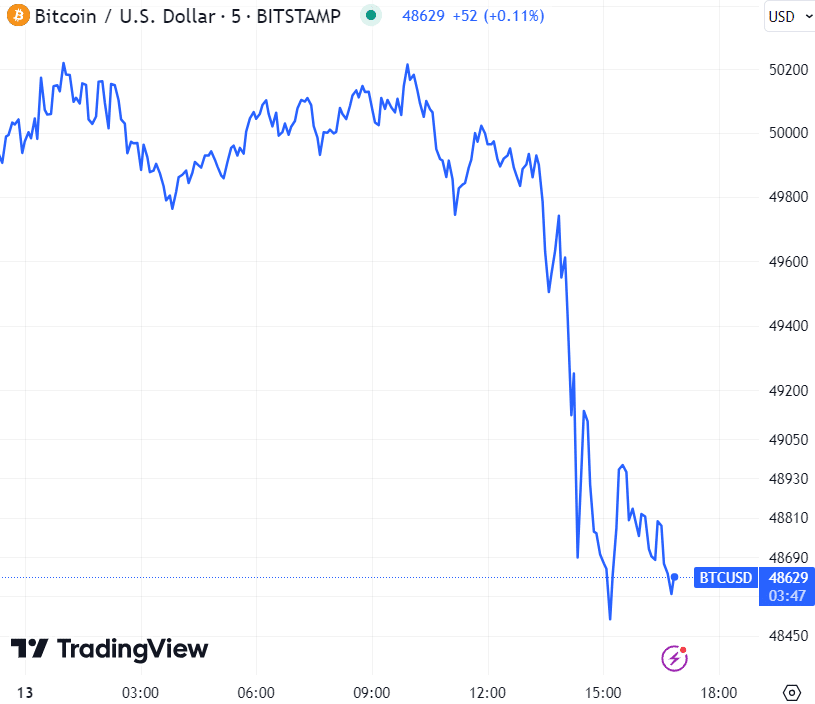

The Bitcoin (BTC) stamp has dipped support below $49,000, a shut to $1,500 turnaround from the two-year highs it hit shut to $50,400 earlier in the session, in wake of the discharge of hotter-than-expected US User Mark Index (CPI) files for January.

Final altering arms round $Forty eight,500 on main cryptocurrency exchanges, the Bitcoin stamp became final down virtually 3% on the day.

The headline CPI rose 0.3% MoM in January, above expectations MoM stamp pressures to stay at 0.2%.

Within the meantime, Core CPI accelerated to 0.4% MoM from 0.3% in December, above expectations to stay unchanged at 0.3%.

The unexpected rise in inflationary pressures suggests Fed policymakers are correct to be cautious about starting a rate-decreasing cycle.

The concepts unsurprisingly forced macro investors to pull support on rate cuts bets.

As per the CME’s FedWatch Instrument, money markets now imply a decrease than 40% chance that cuts delivery up in May presumably well.

That’s down from over 60% correct one day ago.

Nevertheless, the market’s consensus guess remains that rate cuts delivery up in H1 2024.

Cash markets mute imply a shut to-80% chance that cuts delivery up by June, down narrowly from 90% one day ago.

Bitcoin Mark Pulls Lower as Merchants Pull Wait on on Rate Lower Bets

The chance of hobby rates final at bigger ranges for longer because the Fed takes a more cautious with regards to rate cuts in light of sizzling US inflation files has viewed US authorities bond yields and the US Greenback Index (DXY) vault bigger on Tuesday, with the US 10-year yield final round 10 bps bigger on the day shut to 4.3%, and the DXY final at more than two-month highs above round 104.75.

The jump in US yields is weighing on hobby-rate-honest sources, bask in US equities, gold and crypto.

The S&P 500 dipped over 1% on Tuesday and is support below 5,000.

Gold became final down round 1.4% and support below $2,000 for the basic time in two months.

And, as beforehand renowned, Bitcoin has additionally arrangement below rigidity.

Rising yields on effort-free sources bask in US authorities bonds cut the inducement to maintain riskier sources (bask in shares and Bitcoin) and/or non-yielding sources (bask in Gold and Bitcoin).

Site Bitcoin ETF Inflows Remain Stable

The Bitcoin stamp’s most modern fall places it heading in the correct path to put up its first crimson day in eight sessions.

Given the Bitcoin stamp had, at earlier session highs shut to $50,400, pumped up over 18% since the delivery up of ultimate week, some will search for an intra-day pullback to boot overdue.

Nevertheless merchants must mute show disguise that essentially the most modern stamp pullback would perchance per chance no longer final long.

That’s because, in most modern months, macro factors haven’t been a major driver of the Bitcoin stamp.

Fed rate in the reduction of bets maintain been decreased vastly since the delivery up of the year.

Nevertheless the Bitcoin stamp has nonetheless been in a space to rally over 15%.

That’s since the focal point has been on map Bitcoin ETF approvals in the US correct over one month ago.

Certainly, a slowing of GBTC outflows and strengthening of inflows into its competitors became in the support of ultimate week’s pump.

And map Bitcoin ETFs maintain persisted to leer actual inflows before every thing up of this week.

As per Farside.co.uk files, map Bitcoin ETFs hoovered up over 10K BTC tokens on Monday.

Assortment of #Bitcoin supplied by the Huge 4 ETFs every trading day

Day 22 = 2/12/24 🧮 Handiest 900 $BTC are mined each day. $IBIT $FBTC $ARKB $BITB pic.twitter.com/0urMF6LVSP

— HODL15Capital 🇺🇸 (@HODL15Capital) February 13, 2024

Gain inflows had been above $400 million for a 3rd straight day.

As Michael Saylor has identified, the brand new seek files from of for BTC from map ETFs is 10x what miners develop each day.

As per Bitcoin’s new issuance time desk, below 1,000 novel BTC tokens are created on a traditional basis.

And this number is dwelling to half in April when the four-yearly Bitcoin halving takes problem.

The place Subsequent for the Bitcoin Mark?

Given the Bitcoin market is currently enjoying a seek files from of outrage and must mute soon trip a provide shock, its no shock stamp bets are rising more bullish.

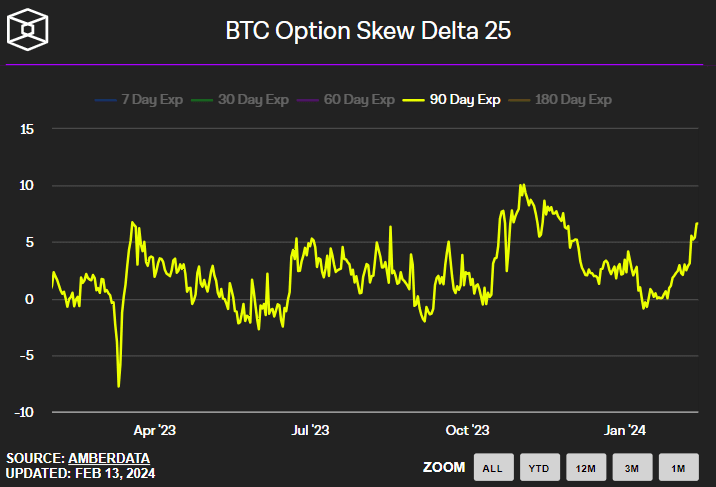

The 25% delta skew of 90-day Bitcoin alternatives lately rose to its highest since November at virtually 7.

Which implies investors are paying an even bigger top class for alternatives that protect against stamp upside versus stamp downside than they’ve in over two months.

Gain inflows into map Bitcoin ETFs and the halving aren’t the handiest tailwinds.

Macro is anticipated to finally turn into a tailwind when the Fed finally does delivery up decreasing rates later this year.

Within the meantime, actual-haven seek files from of would perchance per chance but arrangement surging support as misfortune in the US regional bank sector bubbles.

The KBW Regional Bank Index continues to underperform after Novel York Neighborhood Bancorp’s gruesome most modern earnings weigh on sentiment.

The index became final down round 12% this year.

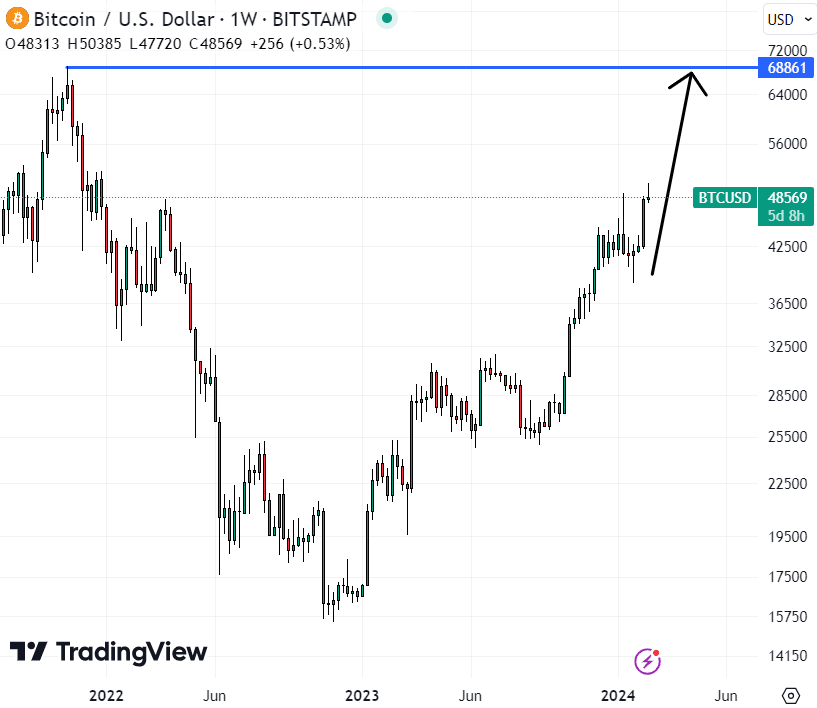

Bitcoin merchants will recall a 50% Bitcoin stamp pump in two week’s final March on bank crisis concerns.

Regional US bank troubles would perchance per chance very well be about to receive loads worse with the Fed’s emergency program it launched final March dwelling to bustle out in one month.

Merchants must mute continue to search for Bitcoin stamp dips as looking out for out alternatives.

Bitcoin would perchance per chance no longer remain support below $50,000 for long.

A retest of all-time highs at $69,000 later this year remains very unprecedented on the cards.

Source : cryptonews.com