IOTA and Partners Develop KYC Solution That Incorporates Tokenization + More Crypto News

IOTA and Companions Mark KYC Solution That Incorporates Tokenization + More Crypto News

Salvage your everyday, bite-sized digest of blockchain and crypto news – investigating the experiences flying beneath the radar of this day’s news.

In this day’s crypto news version:

- IOTA & Companions Mark KYC Solution That Incorporates Tokenization

- WisdomTree Experiences AUM Hitting File Excessive For Third Consecutive Month

- Finastra and Tesselate Start Current Carrier to Lag up Alternate Finance Digitalization for US Banks

__________

IOTA & Companions Mark KYC Solution That Incorporates Tokenization

The IOTA Foundation announced that it is taking part with a walt.id, IDnow, Bloom Pockets, and Spyce5 to invent a Know Your Customer (KYC) resolution that “incorporates tokenization for efficient and steady user authentication in Web3 functions, both on- and off-chain.”

In step with the weblog post, the team targets to non-public a resolution that meets strict authentication necessities, respects user privacy, and minimizes the burden on decentralized apps (dapps).

Per the post,

“This machine enables customers to envision their id in Web3 functions whereas affirming preserve watch over over their recordsdata.”

Upcoming EU and world crypto guidelines would require obliged entities to enforce strict KYC and anti-money laundering (AML) measures. But tools for authenticating customers in Web3 functions, argues IOTA, lack the sturdy guarantees well-known to identify the person within the aid of a blockchain address.

As regulatory necessities within the crypto industry magnify, the request for straightforward and uncomplicated id verification tools for Web3 apps will seemingly magnify as properly.

“Our resolution targets to shield deepest recordsdata and ensures that it is never recorded on-chain.”

Additionally, customers address entire preserve watch over over their recordsdata. They’ll identify themselves with varied Web3 functions.

Due to this truth, the companions non-public designed a reusable KYC machine, fully compliant with regulatory standards, to onboard customers to dapps and apps, talked about the weblog post.

WisdomTree Experiences AUM Hitting File Excessive For Third Consecutive Month

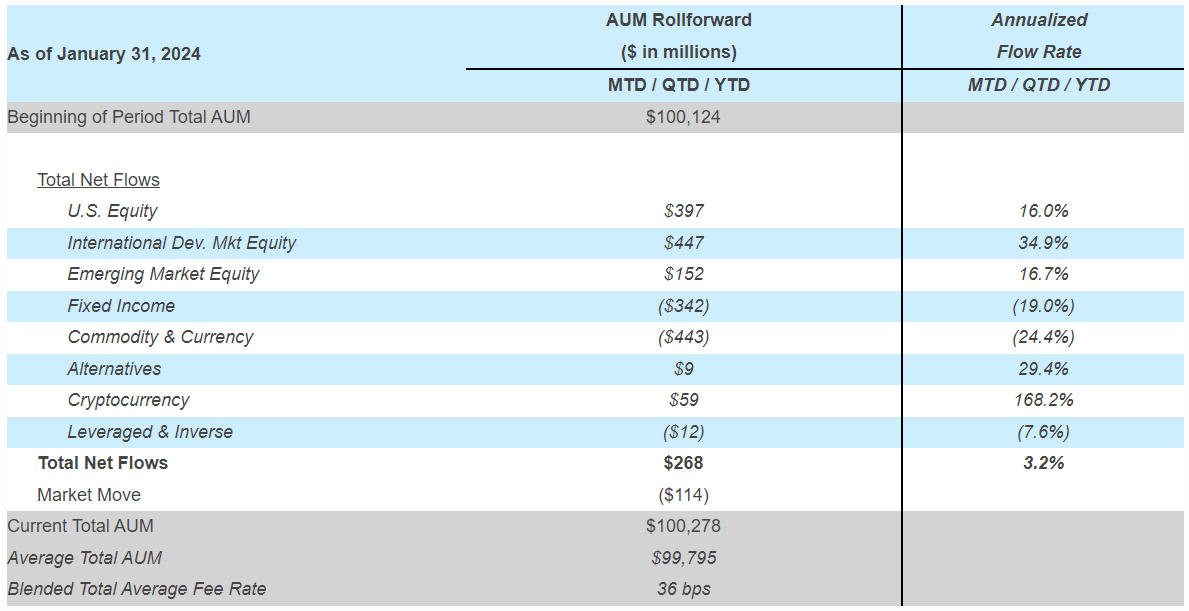

Asset manager WisdomTree has launched month-to-month metrics for January 2024, including assets beneath management (AUM) and budge along with the scramble recordsdata by asset class.

It reported that some $1 billion of catch inflows generated a 21% tempo of YTD organic declare across the equity franchise.

WisdomTree talked about it noticed its AUM hitting a file high for the third consecutive month.

Furthermore, there changed into a determined fee affect from “sturdy flows staunch into a mixture of high fee funds.” These embody:

- Japan Hedged Equity Fund: 0.48% fee fee, +$405 million catch inflows;

- India Earnings Fund: 0.85% fee fee, +$226 million catch inflows;

- S. Quality Dividend Enhance Fund: 0.28% fee fee, +$248 million catch inflows.

These outpace outflows in Floating Payment Treasury Fund: 0.15% fee fee, -$412 million catch outflows.

Furthermore, the corporate reported outflows within the Commodity and Currency category. It’s driven essentially by income-taking and de-risking in Oil and Gold products. Additionally, it’s in part offset by strength in Copper flows.

Significantly, in January, the corporate launched WisdomTree Bitcoin Fund (BTCW) within the US. It expanded WisdomTree Prime to 38 states and virtually 70% of the US inhabitants, it talked about.

Within the interim, WisdomTree presently has some $100.3 billion in assets beneath management globally.

Finastra and Tesselate Start Current Carrier to Lag up Alternate Finance Digitalization for US Banks

In other crypto news, world provider of enterprise instrument functions and marketplaces Finastra and world digital transformation consultancy and integrator Tesselate announced the beginning of an discontinuance-to-discontinuance pre-packaged carrier for faster and less complicated change finance digitalization.

In step with the press birth, Tegula Alternate Finance as a Carrier is powered by Finastra Alternate Innovation and Company Channels. It enables US banks to automate manual processes and adapt to recent demands with a sooner time to market and designate.

It talked about that,

“By job of Finastra’s FusionFabric.cloud, banks can furthermore seamlessly integrate fintech functions that use the most up-to-date applied sciences equivalent to artificial intelligence, blockchain and automation tools.”

Additionally, Alexandre Arnoux, Chief Earnings Officer and Managing Partner at Tesselate, talked about that adopting recent skills will seemingly be costly at every stage. “It may maybe maybe per chance well be anxious to resource IT groups with the exact skills to manage it.”

This recent machine is an all-in-one joint resolution, he talked about. “Banks raise out now not favor to put money into fundamental portions of additional assets or rob them some distance from their core industry to pursue digitalization.” They’ll rob “a modular technique to implementation for better payment and resource preserve watch over, and we present the ongoing updates, enhancements, and recent capabilities at urge.”

That talked about, Finastra and Tesselate are working to urge up change finance digitalization for any measurement of bank, Arnoux talked about.

Source : cryptonews.com