Bitcoin Miner Riot Warns of Profit Risks Due to Chip Shortage and Climate Regulations

Bitcoin Miner Rebellion Warns of Profit Risks Because of Chip Shortage and Local climate Rules

On February 23, well-liked Bitcoin miner Rebellion Platforms issued a cautionary reveal referring to doable profitability challenges in its business operations. The corporate cited a amount of factors, including global supply chain disruptions, chip shortages, and increasing regulatory scrutiny around local climate alternate, as key threats to its operations.

Higher Bitcoin Mining Place Requires Higher Hash Rate

The terminate Bitcoin miner resident in Texas shared this much less-than-optimistic outlook on its skill to earnings in 2024. In its annual investor K-10 anecdote, Rebellion outlined 13 threat factors that can impact its business and monetary operations.

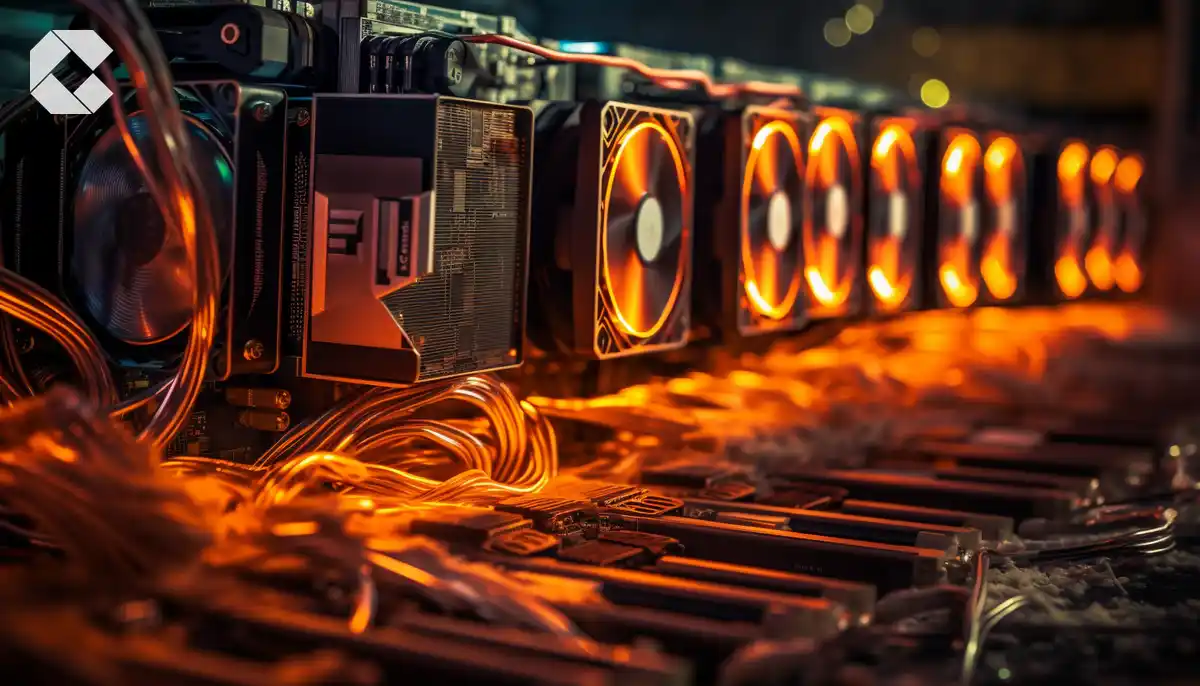

With out a doubt one of these factors is the escalating hash price required to mine a Bitcoin reward. The hash price is the computing vitality important to resolve the cryptographic puzzles that underlie every Bitcoin transaction. To manage with this, Bitcoin miners normally deploy extremely sophisticated Utility Explicit Integrated Chips (ASICs) to resolve the puzzle and keep block rewards.

Rebellion Platforms infamous that hash charges normally develop exponentially because the brand of Bitcoin will enhance. The community’s hash price has surged on account of the renewed pastime in the foremost digital asset.

Rebellion Platforms has stated that if it fails to develop its present 12.4 exahash (EH) per second, its operations could be adversely impacted. The game conception to fight this is procuring new and extra atmosphere pleasant ASIC miners to raise their skill to mine Bitcoins efficiently.

Another screech the annual anecdote considers is the global supply chain wretchedness precipitated by the Covid-19 pandemic. With a lot of countries getting greater from the lockdown, the global supply chain has modified.

This has resulted in a constrained supply of semiconductors wanted to manufacture extremely no doubt fair appropriate ASIC machines. With constrained semiconductor supply, Rebellion Platforms claimed that a lot of mining firms possess been forced to pay top price prices to entry the few ASICs available available in the market.

Besides exiguous ASIC miner entry, the corporate’s progress has been influenced by exiguous entry to mandatory infrastructures cherish electrical energy distribution and building affords.

Rebellion Platforms is one in every of many Bitcoin mining firms working in the US. The corporate boasts a extensive lineup of 112,944 Bitcoin miners. In 2023, Rebellion earned 6,626 in Bitcoin as earnings (price $341 million presently charges) from its mining operations. This resolve represents a 19.3% raise from the 5,554 Bitcoins mined in 2022.

Rebellion Platforms Reports Corpulent twelve months 2023 Monetary Results, Most modern Operational and Monetary Highlights.

$280.7 Million in Complete Earnings, 6,626 Bitcoin Produced, and Document Hash Rate Potential of 12.4 EH/s.

Be taught the tubby press free up right here: https://t.co/SeUytqm5ek. pic.twitter.com/Gr35dX8GmW

— Rebellion Platforms, Inc. (@RiotPlatforms) February 22, 2024

The Bitcoin miner also infamous that its moderate brand to mine 1 BTC has dropped to $7,539 as of 2023.

Crypto Regulatory Scrutiny And Local climate Replace Concerns

Despite its elevated output, Rebellion Platforms has highlighted the escalating scrutiny from government stakeholders referring to the environmental impact of its operations as a serious obstacle.

In accordance to the Texas-based fully miner, altering expectations on its environmental, societal, and governance (ESG) practices and local climate impacts could incur mountainous charges.

The Bitcoin miner elaborated that new legislation and elevated legislation pertaining to local climate alternate could impose main charges on them and their suppliers. This involves charges related to elevated vitality requirements, capital equipment, environmental monitoring and reporting, and a amount of charges associated with compliance with such laws.

For context, stringent regulatory oversights on crypto mining practices are being discussed in the US. The US Vitality Recordsdata Administration (EIA) has created a search targeted at crypto mining firms.

The search, supposed to gauge crypto mining firms’ vitality wants, does not explicitly explain whether or not the gathered knowledge could be deployed in future regulatory actions. Then as soon as more, it brings to mind that crypto mining is now a spotlight for US government agencies.

Rebellion Platforms stated that strict regulatory oversight of its business ecosystem could perceive it lose any diagram of aggressive advantage it has over its peers in a amount of areas.

With regards to the that it’s essential to perchance name to mind implications of the EIA search, Rebellion Platforms’ Head of Public Policy, Brian Morgenstern, stated that it is bigger than a cursory demand into the industry.

“They’re attempting to hand you the rope that they want to utilize to grasp you later.”

The EIA search isn’t very shiny a search. It’s a political weapon designed to strangle US Bitcoin miners.

I fracture down the motivations at the aid of the EIA audit in a brand new podcast with @stephanlivera pic.twitter.com/u16lvsAMpX

— Brian Morgenstern (@MorgensternNJ) February 22, 2024

Morgenstern acknowledged in a podcast that the EIA search is a weapon by regulators designed to strangle US Bitcoin miners.

Source : cryptonews.com