SEC Chair Gensler Warns of Bitcoin's Role in Ransomware, Advocates for Centralized Money

SEC Chair Gensler Warns of Bitcoin’s Characteristic in Ransomware, Advocates for Centralized Money

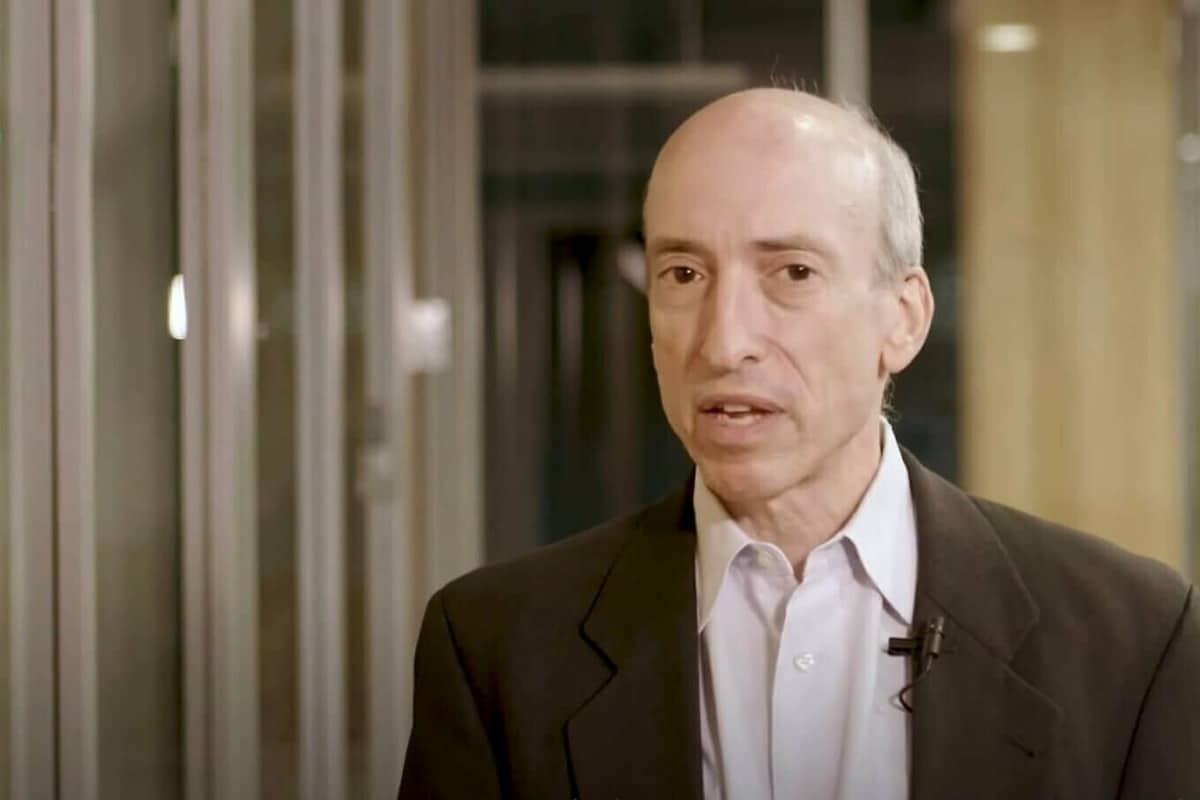

United States Securities and Trade Commission (SEC) Chair Gary Gensler spoke about Bitcoin, stating that it is the leading market part for ransomware attacks.

Despite the agency’s approval of 11 Scheme Bitcoin ETFs earlier this 365 days, Gensler has persisted to right his disapproval of the asset and the cryptocurrency commerce as a whole.

SECs Gensler As soon as Again Calls Out Bitcoin’s Connection to Ransomware

Talking to CNBC, SEC Chair Gary Gensler talked about that Bitcoin is the leading market part for ransomware attacks. On the other hand, here’s similar to statements that Gensler revealed following the approval of the Bitcoin ETFs. In an announcement, he referenced ransomware as one of the distinguished illicit activities of which Bitcoin is prominently a segment.

In his statement, he known as Bitcoin “a speculative, volatile asset that is furthermore worn for illicit converse including ransomware, cash laundering, sanction evasions, and terrorist financing.” Furthermore, he used to make certain to execute the dignity that the funding product approvals were not an approval or endorsement of Bitcoin as an asset.

Gary Gensler perfect purchased fully roasted by Joe Kernan on CNBC this morning relating to #Bitcoin 🤯 pic.twitter.com/a6dtvZhXVH

— The ₿itcoin Therapist (@TheBTCTherapist) February 14, 2024

All over his tenure as SEC Chair, Gary Gensler has been renowned for his enforcement-first plan to cryptocurrency laws. Furthermore, he has not been disquieted about sharing his point of view on the commerce’s illicit converse. Certainly, he has maintained his opinion of the volatility inner the asset class and the hazard it poses to investors.

On Jan. 10, the U.S. Securities and Trade Commission (SEC) popular Bitcoin ETF functions from ARK 21Shares, Invesco Galaxy, VanEck, WisdomTree, Fidelity, Valkyrie, BlackRock, Grayscale, Bitwise, Hashdex, and Franklin Templeton. most of which started procuring and selling on Jan. 11.

Following these landmark approvals, Gensler launched an announcement. Inner it, he renowned that the functions mirrored “these now we absorb disapproved of prior to now.” While stating that “conditions absorb modified,” leading to the approval. On the other hand, in that statement, he furthermore spoke of Bitcoin’s connection to ransomware as a motive at the support of his disapproval of it.

Gensler emphasized that the approval of funding products corresponding to ETFs may well perhaps composed not be construed as an endorsement of Bitcoin as an asset. While acknowledging the changing conditions that resulted in the ETF approvals, he maintained his reservations about Bitcoin’s volatility and its likely converse in illicit activities.

Approval of Bitcoin ETFs Raises Questions and Speculation

Gensler has served because the pinnacle of the SEC since April 2021, with a term anticipated to result in 2026. All over his tenure as SEC Chair, Gensler has adopted an enforcement-first plan to cryptocurrency laws and has repeatedly raised issues relating to the commerce’s illicit activities.

Despite the landmark approvals of Scheme Bitcoin ETFs, Gensler remains steadfast in his subject on Bitcoin’s risks. Below his management, the commission has filed enforcement actions in opposition to several crypto companies, including Binance, Coinbase, and Kraken.

The decision by the SEC to approve a subject cryptocurrency ETF in the U.S. for the predominant time raised questions relating to the intentions of Gary Gensler, the commission’s chair. Since taking subject of job, Gensler has essentially spoken relating to the dangers of crypto investments, connecting digital assets to fraud and scams.

On the other hand, Gensler used to be one of three commissioners who voted to approve the offerings. The 3-2 vote tally suggests the SEC chair can had been the deciding vote. Some neighborhood members suggested the SEC chair “vote with Wall Avenue,” because the enlargement of crypto products is more probably to lift in investor funds.

Others speculated that “the writing used to be already on the wall” for the SEC to approve a subject Bitcoin ETF, provided that the commission had been mandated by a federal court docket to evaluate Grayscale’s offering.

Source : cryptonews.com