Bitcoin Price Prediction: BTC Hits $52,000; Surges with ETF Inflows & Coinbase's Q4 Optimism

Bitcoin Model Prediction: BTC Hits $52,000; Surges with ETF Inflows & Coinbase’s Q4 Optimism

Bitcoin Model Soars Past $52,000: A Milestone Pushed by ETF Inflows and Market Optimism

Coinbase’s Inventory Soars Earlier than Q4 Earnings Amid Rising Self belief in Cryptocurrency

In anticipation of its Q4 earnings narrative, Coinbase saw its stock designate surge by 37%, buoyed by investor optimism over expected tough exchange volumes.

Consultants are predicting a predominant uptick in the company’s performance, with exchange volumes projected to almost triple to $142.7 billion.

This surge is anticipated to rob the company’s earnings by 22% to $825 million, with Q4 earnings per half estimated at $0.02, turning around from a $0.01 loss in the outdated quarter.

Key Highlights:

- Inventory Surge: Coinbase’s stock leap precedes its Q4 earnings, hinting at sturdy monetary performance.

- Alternate Quantity Enhance: Analysts quiz exchange volumes to skyrocket, riding immense earnings will increase.

- Restoration Signs: No matter a slack commence for Bitcoin ETFs, fresh inflows indicate a market rebound.

- Regulatory Challenges: Coinbase remains embroiled in SEC litigation nonetheless is optimistic about prevailing.

$COIN Earning is day after at the moment, everyone along side myself is attempting to estimate as shut as that it is seemingly you’ll well accept as true with. So we zoomed in and monitoring volume, asset designate and etc.

I deem it’s actual time to step attend and peek at how Coinbase has developed from 2021 to 2023 pic.twitter.com/VN4pCyh5p8

— CBduck 🛡️ (@CoinbaseDuck) February 14, 2024

The company’s resilience, even in the face of regulatory challenges, coupled with a broader cryptocurrency market rally—highlighted by Bitcoin’s ascent to $50,000—indicators increasing investor self belief.

This uptrend in Coinbase shares reflects a broader belief in the cryptocurrency market’s doable and particularly in Bitcoin’s value proposition.

Fidelity Lowers Expenses for European Bitcoin ETFs

In a strategic pass to discontinue competitive, Fidelity has announced a predominant reduction in charges for its Fidelity Physical Bitcoin ETP (FBTC) from 0.75% to 0.35%.

This adjustment comes as Fidelity objectives to align with the evolving landscape of cryptocurrency investments, following the footsteps of deal of asset managers delight in Invesco and CoinShares.

The reduction is a response to the burgeoning interest in cryptocurrencies worldwide and the brand new originate of pronounce bitcoin ETFs in the U.S.

NEW:

🇪🇺 Fidelity has cleave the rate on its European #Bitcoin ETF from 0.75% to 0.35%, essentially based on etfstream. pic.twitter.com/RhAksSsrvw— Day-to-day Bitcoin News (@DailyBTCNews_) February 14, 2024

Christian Staub, Fidelity’s Managing Director in Europe, highlighted the choice’s motivation: to cater to the increasing search records from from traders searching for value-efficient entry capabilities into the cryptocurrency market.

By reducing the costs, Fidelity objectives to strengthen the accessibility of its Bitcoin ETP, positioning it among the many most fairly priced choices in Europe.

This pass is anticipated to no longer finest attract extra traders nonetheless additionally per chance broaden the acceptance and search records from for Bitcoin, contributing to its market boost and price appreciation.

Bitcoin Model Prediction

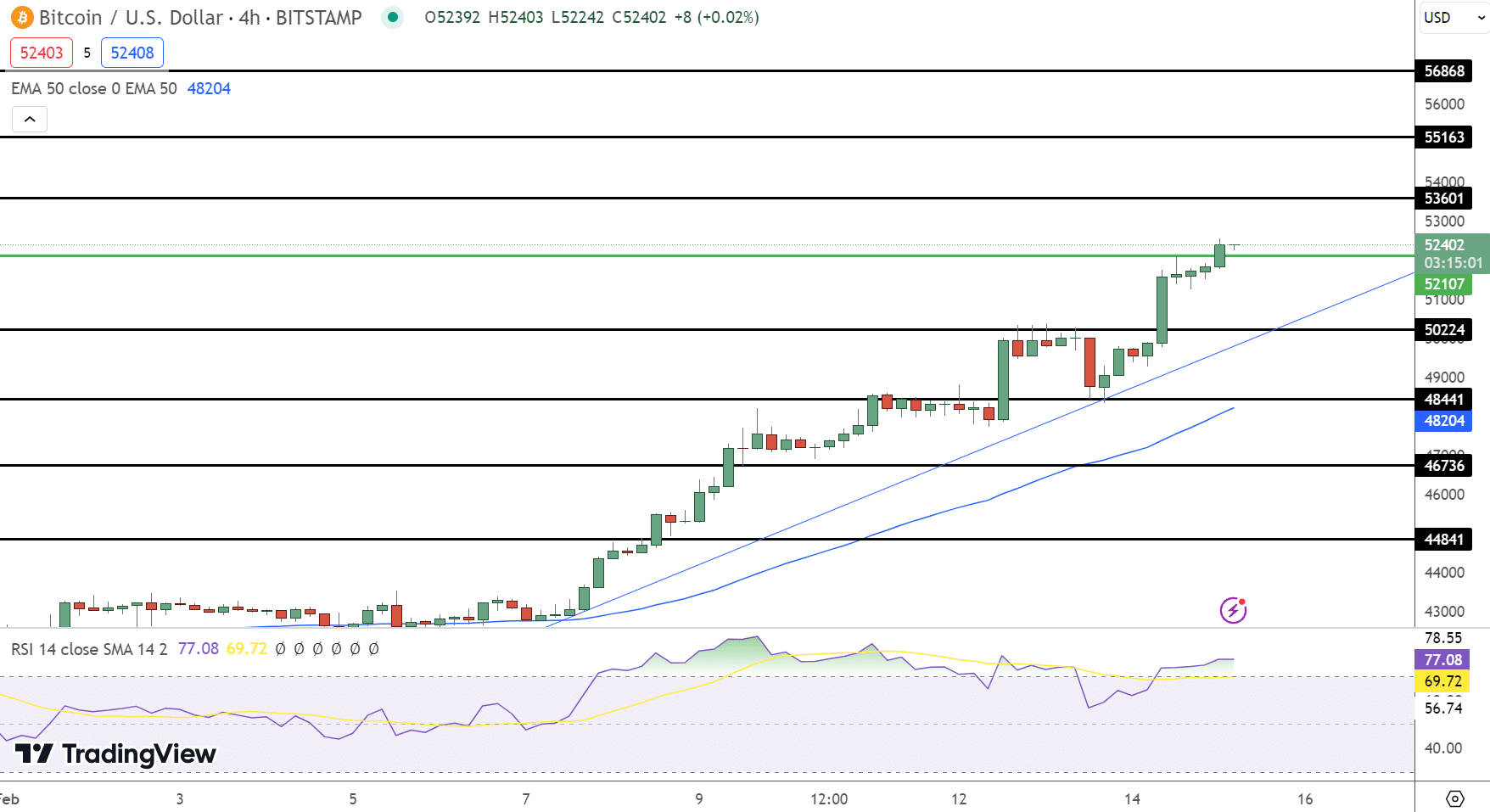

Bitcoin’s technical diagnosis shows Bitcoin hovering above its pivot level of $52,100, suggesting a doable climb.

Resistance stages lie forward at $53,601.00, $55,163.00, and $56,868.00, whereas helps are seen at $50,224.00, $forty eight,441.00, and $46,736.00.

With an RSI at 75, we’re nudging into overbought territory, implying vigilance. The 50 EMA at $forty eight,200.00 extra helps bullish sentiment.

A bullish engulfing candle sample aligns with deal of indicators, endorsing essentially the latest uptrend.

Which means, the outlook remains bullish above the pivot level, with any movement under this level warranting a reassessment.

Top 15 Cryptocurrencies to See in 2023

Preserve up-to-date with the field of digital resources by exploring our handpicked sequence of the finest 15 different cryptocurrencies and ICO initiatives to care for an survey on in 2023. Our checklist has been curated by professionals from Alternate Talk and Cryptonews, guaranteeing expert recommendation and serious insights on your cryptocurrency investments.

Rob profit of this probability to seem the functionality of those digital resources and care for your self instructed.

Source : cryptonews.com