Bitcoin Price Prediction Rallies as Coinbase Profits Soar, ETFs Drive $1T Market

Bitcoin Label Prediction Rallies as Coinbase Profits Waft, ETFs Drive $1T Market

Bitcoin designate prediction is nonetheless bullish amid Coinbase Global’s revelation of its first quarterly income in two years, buoyed by the SEC’s approval of Bitcoin ETFs, underscores a predominant moment for the cryptocurrency market.

This development, alongside a 57% surge in Bitcoin’s designate in Q4 2023, propelled Coinbase’s transaction income up by 64% to $529.3 million.

The enthusiasm surrounding Bitcoin ETFs and the predicted prolong in institutional investments own catalyzed optimism for Bitcoin’s future designate trajectory.

As Coinbase projects additional boost, the crypto market’s valuation hovering past $1 trillion indicators a pivotal shift in Bitcoin’s poke in direction of original monetary integration and investor confidence.

Coinbase Reports Profit Surge Post-Bitcoin ETF Approval

Coinbase Global Inc. has reported its first quarterly income in two years, marking a predominant turnaround in its monetary efficiency. This achievement is available in the wake of the U.S. Securities and Change Rate’s (SEC) approval of build bitcoin alternate-traded funds (ETFs), sparking renewed curiosity in the cryptocurrency market.

The approval led to a in actual fact extensive 57% prolong in Bitcoin’s designate in the fourth quarter of 2023, contributing to a 64% upward thrust in Coinbase’s transaction income, which reached $529.3 million.

Crypto alternate Coinbase posts first income in two years on sturdy buying and selling https://t.co/z1DPft2KIj pic.twitter.com/oPRMuFPqwh

— CNA (@ChannelNewsAsia) February 15, 2024

The corporate’s success in the closing quarter has build a determined tone for its future, with projections for its subscription and products and providers division’s income to tumble between $410 million and $480 million in the arrival quarter.

A indispensable allotment of this income boost in Q4 also can moreover be attributed to stablecoin transactions, particularly throughout the partnership with Circle for USD Coin.

This most recent profitable quarter, coupled with a hopeful outlook, is anticipated to bolster investor confidence in the cryptocurrency sector, potentially main to an uptick in Bitcoin prices.

Blackrock’s Bitcoin ETF Soars: A Fresh Chapter in Cryptocurrency Funding

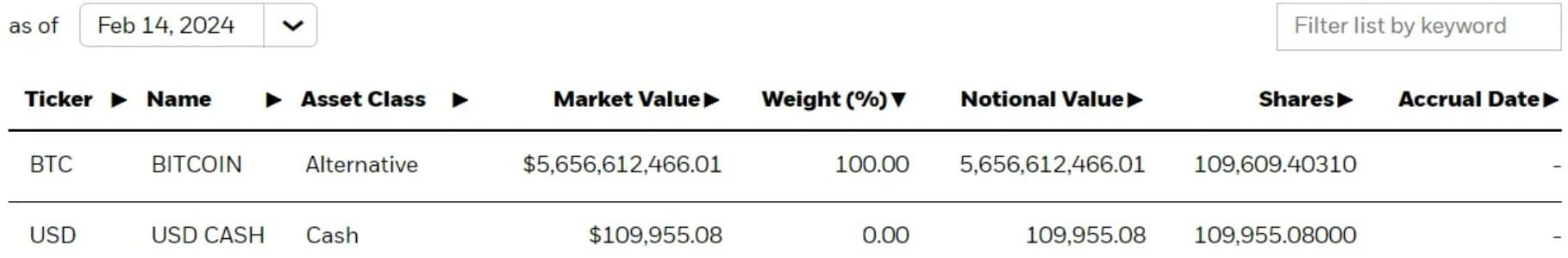

Blackrock’s Ishares Bitcoin Have confidence (IBIT) has all of a sudden change into a predominant participant in the cryptocurrency build, gathering almost $5 billion in obtain sources and roughly 110,000 bitcoins since its originate a pair of month ago. This marks it because the main build alternate-traded fund (ETF) for bitcoin.

On February 14 on my own, build bitcoin ETFs skilled a noteworthy inflow of $339.8 million, with IBIT shooting the largest fragment at $224.3 million.

Larry Fink, CEO of Blackrock, has publicly voiced his derive perception in bitcoin’s doable, additional fueling investor enthusiasm despite considerations expressed by SEC Chairman Gary Gensler relating to bitcoin’s use in ransomware assaults.

The SEC’s endorsement of 11 build bitcoin ETFs has vastly contributed to this bullish sentiment.

The sturdy accumulation of sources by IBIT highlights a rising institutional curiosity in bitcoin, suggesting a determined outlook for its market valuation.

Bitcoin ETFs Gas Surge in Institutional Investments

Since the approval of ten build Bitcoin alternate-traded funds (ETFs) in the US on January 11, a predominant shift has occurred in the cryptocurrency funding panorama.

These ETFs now listing a striking 75% of all fresh Bitcoin investments, underscoring a sturdy institutional curiosity that has notably contributed to Bitcoin’s designate rally.

Here’s a smarter detect at how Bitcoin ETFs are shaping the market:

- Dwelling Bitcoin ETFs Propel Market Narrate: The introduction of Bitcoin ETFs has been a catalyst for Bitcoin’s designate surge, pushing it above $50,000 and lifting its market capitalization to over $1 trillion for the first time since November 2021.

- Dominance of BlackRock’s iShares Bitcoin Have confidence ETF: Among the many Bitcoin ETFs, BlackRock’s iShares Bitcoin Have confidence ETF leads with a in point of fact mighty inflows, gathering about 4,115 Bitcoin, valued at roughly $215 million.

- Market Capitalization and Future Projections: The total market capitalization of cryptocurrencies now stands at $1.96 trillion, reflecting a 2.01% prolong. With institutional adoption and demand for ETFs on the upward thrust, analysts predict Bitcoin’s designate also can wing beyond $56,000, though a resistance diploma at $52,000 suggests doable short-term challenges.

Bitcoin Label Prediction

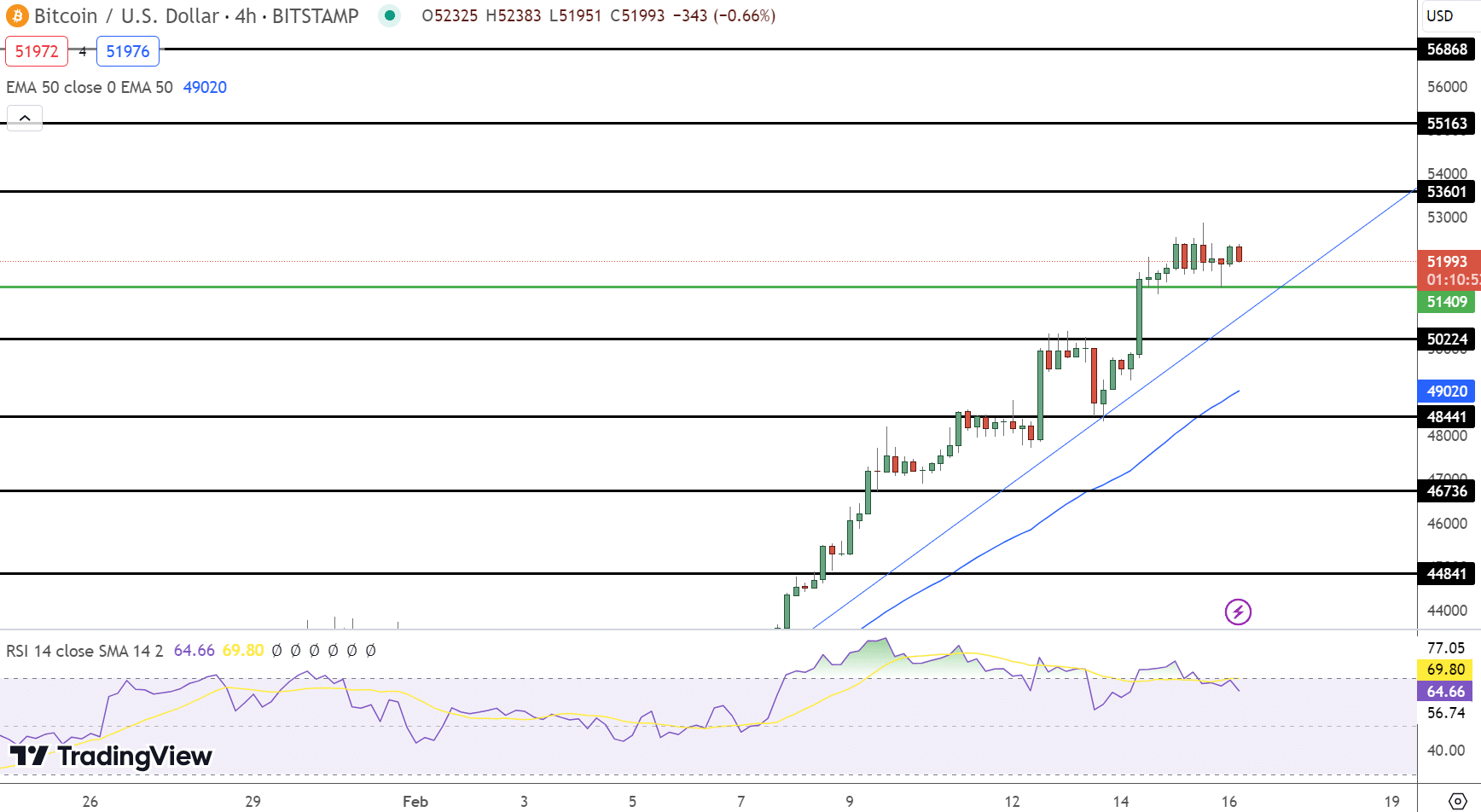

Bitcoin’s novel pivot level stands around of $51,500, Bitcoin faces resistance ranges between $53,601 and $56,863, delineating the hurdles for upward development.

Conversely, back ranges are established at $50,224, $Forty eight,441, and $46,736, offering a safety obtain in opposition to doable declines.

The Relative Energy Index (RSI) signifies a collection at 64, hinting at an overbought direct that can lead to a corrective pullback.

The 50-Day Exponential Transferring Reasonable (EMA) at 49,020 supports a bullish outlook, but the proximity to overbought territory suggests vigilance for a that it is doubtless you’ll be ready to imagine shut to-term retraction.

This intricate stability underscores Bitcoin’s doable for both persisted boost and the need for caution among merchants.

Top 15 Cryptocurrencies to Peek in 2023

Take care of up-to-date with the arena of digital sources by exploring our handpicked collection of the most straightforward 15 different cryptocurrencies and ICO projects to protect an look on in 2023. Our listing has been curated by experts from Industry Talk about and Cryptonews, guaranteeing expert recommendation and excessive insights to your cryptocurrency investments.

Rob fair correct thing about this likelihood to perceive the aptitude of these digital sources and back your self urged.

Source : cryptonews.com