Bitcoin Should Remain Well-Supported On Institutional Inflows For Several Months: Coinbase Research

Bitcoin Must gentle Remain Effectively-Supported On Institutional Inflows For Numerous Months: Coinbase Learn

Coinbase research analysts provocative in ample toughen for Bitcoin (BTC) within the market for the next three to 6 months attributable to institutional inflows.

The institutional research arm of the digital asset change explained the trajectory of Bitcoin, Ethereum, and diverse on-chain facts put up-ETF approvals in a as much as the moment file.

In our contemporary weekly Market Call, the crew discusses the set aside we’re within the contemporary BTC bull market cycle, why enthusiasm has been constructing for ETH, and what the most recent inflation facts mean for crypto and DeFi.

— Coinbase Institutional 🛡️📞 (@CoinbaseInsto) February 14, 2024

Following the approval of predicament Bitcoin ETFs by the United States Securities and Substitute Commission on Jan 10, events within the market occupy been dominated by ETF narratives.

The Bitcoin market has recorded critical inflows following the launch of ETFs, propelling the asset’s mark above $52,000. Bitcoin has now not traded above that modify since December 2021, tapping yearly highs as market job rebounds.

Station ETFs Consequence in Bitcoin Inflows

In step with the file, the newly permitted ETFs occupy raked in secure inflows of $3.3 billion since launch. This has resulted in a surge in Property Under Administration (AUM) to $36.8 billion and the wider crypto AUM tapping $58 billion.

These figures are increased than the median expectations from institutional gamers earlier than the approvals, which stood at $1 billion.

The soaring inflows and diverse indices led analysts to create that the market must stay effectively-supported for the next three to 6 months.

“We imagine bitcoin in particular (and crypto extra most ceaselessly) must stay effectively-supported within the next 3-6 months, as extra institutional gamers modify to the contemporary ETF actuality alongside the ongoing global story of monetary reflation. That acknowledged, there are some detrimental seasonal components in March that would possibly possibly maybe presumably help to unsettle that route.”

Closing week, CoinShares reported weekly inflows into Bitcoin institutional funds at over $1 billion, 98% of the market’s influx.

At press time, Bitcoin is priced at $51,850, up 9.6% within the final seven days, with its market cap breaching $1 trillion.

Institutional Funding Could maybe Trigger ETH Mark Spikes

Coinbase analysts request extra institutions to expose their attention to Ethereum within the upcoming months attributable to the success of Bitcoin ETFs.

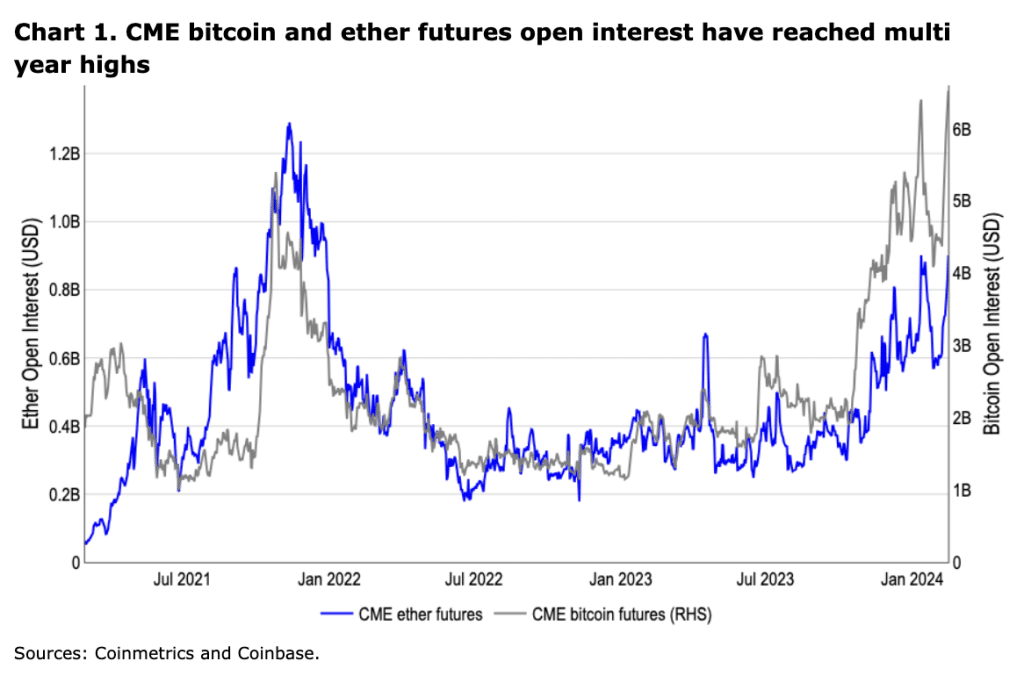

Per the file, open passion in CME Bitcoin and Ether futures recovered within the final six days. In response to this, open passion in Ether would possibly possibly maybe presumably file upticks relative to BTC.

A attainable predicament Ethereum ETF would also be a sport-changer for the sources whose dispute has been eclipsed by Bitcoin. With the success of BTC ETFs, Ethereum is subsequent for many institutions searching for to onboard outmoded investments to the market.

“Given the gain inflows into predicament bitcoin ETFs, we request extra issuers to expose their attention to the 2d greatest cryptocurrency over the following few months. Market gamers are staring at to recognize if the SEC begins to actively have interaction with issuer capabilities, as that would possibly possibly maybe presumably have an effect on their perceived odds of approval.”

Source : cryptonews.com