Cambodia's Central Bank Governor Believes Digital Currency Will Boost Fiat Use: Here's Why

Cambodia’s Central Bank Governor Believes Digital Forex Will Enhance Fiat Use: Here’s Why

Central Bank Governor Chea Serey printed On Also can merely 28 that the Central Bank Digital Forex (CBDC) Bakong would possibly per chance per chance amplify the adoption of Cambodia’s Riel forex by facilitating detrimental-border QR payments.

Cambodia’s Central Bank Governor Asserts Unsuitable-Border Transactions Can Enhance Riel Use

In an unheard of interview at Nikkei’s Intention forward for Asia conference in Tokyo, Chea Serey discussed the dynamics of Cambodia’s forex machine and how it’s evolving.

On the occasion of the Nikkei Dialogue board twenty ninth Intention forward for Asia, Secretary-Overall of ASEAN, Dr Kao Kim Hourn, met with the Governor of the Nationwide Bank of Cambodia (NBC), Dr Chea Serey.

They discussed the vital growth made in ASEAN digital payments integration, financial… pic.twitter.com/pmy8pQ0ybk

— ASEAN (@ASEAN) Also can merely 24, 2024

She printed that over 80% of Cambodia’s economic system serene depends on the U.S. greenback as piece of a twin-forex machine. The authorities is attempting to be sure electorate utilize the riel more for native transactions, then all but again.

Cambodia’s central bank governor acknowledged that whereas the US greenback dominates physical transactions, the native forex (riel) is ragged more in digital transactions.

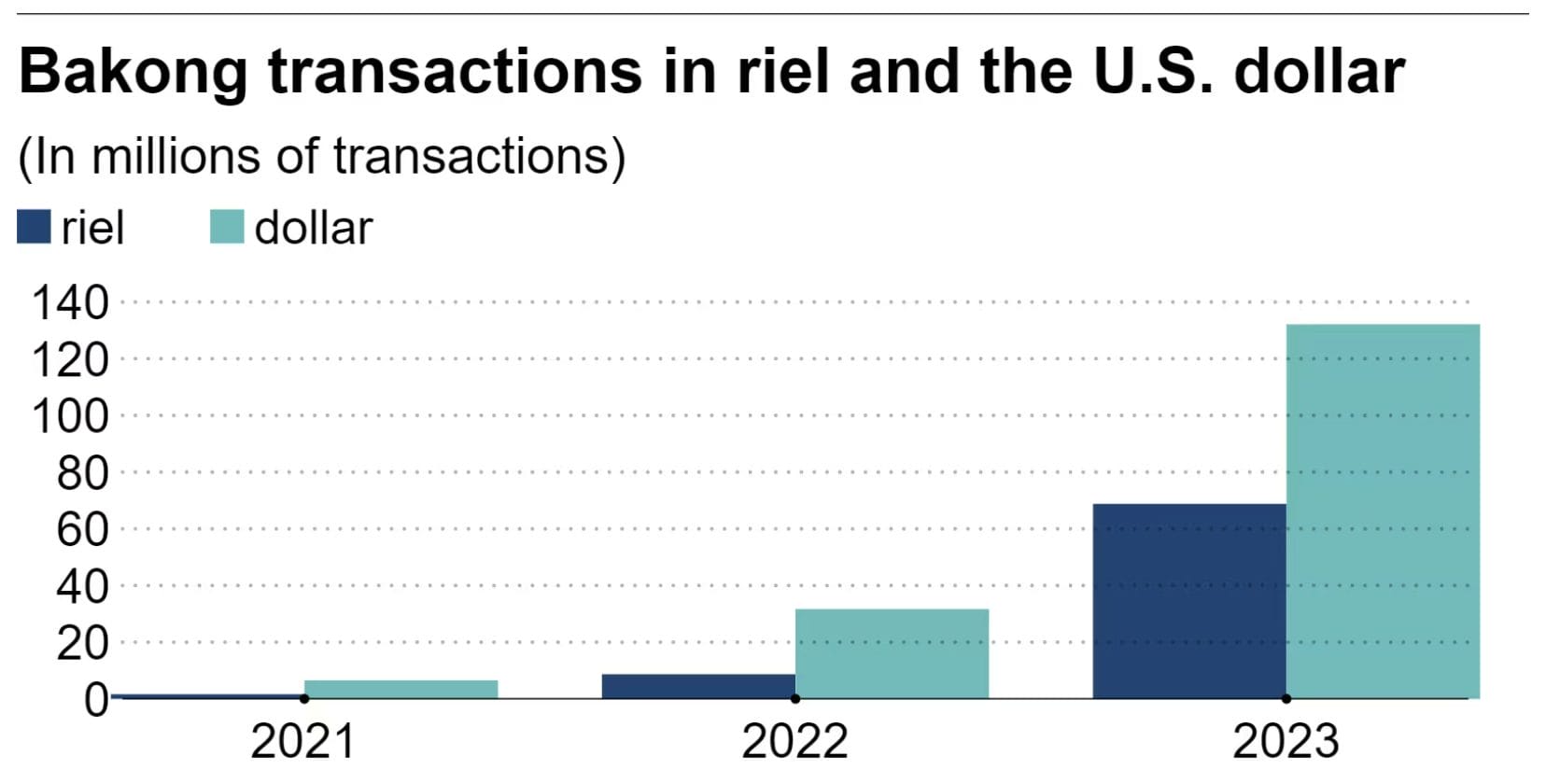

Since its originate in 2020, the Bakong CBDC has facilitated a total of $70 billion in digital payments as of 2023, a resolve roughly double the nation’s GDP.

Home Bakong CBDC transactions would possibly per chance additionally be done in both riel and greenbacks, but the riel accounted for $20 billion of final year’s total, more than twice the price from 2022.

Serey additional reiterated that detrimental-border transactions play an vital role in promoting the utilization of the riel. Bakong’s functionality extends to QR code-based mostly totally payments between Cambodia, Thailand, Laos, and Vietnam, as well as transactions though-provoking China’s UnionPay.

These detrimental-border payments completely utilize the riel, requiring Cambodian electorate to own a riel Bakong yarn to behavior transactions with neighboring international locations.

Equally, Thai vacationers can finest form QR code transactions in Cambodia if the retailers earn riel.

💥 On the present time, Cambodia officially announced the originate of their central bank digital forex (CBDC).

Guess who only in the near past met with the Central Bank of Cambodia? #XRP #XRPCommunity #crypto #blockchain pic.twitter.com/vVut3ZTvNX

— Cryptic Poet (@1CrypticPoet) October 29, 2020

Bakong is diversified from other CBDCs because of it’s backed by both the Cambodian riel and the US greenback. The twin make stronger affords steadiness and mammoth usability inside of Cambodia’s unheard of twin-forex machine, facilitating smoother transactions and financial integration.

Cambodia will not be any longer by myself in exploring CBDC to make stronger its fiat forex. In March 2024, the Hong Kong central bank launched a wholesale CBDC to bolster tokenization and the financial strength of town.

Additionally, the South Korean central bank is speeding up its CBDC conducting to take a look at the digital Korean won (KRW) by the final quarter of 2024. This will per chance be to take a look at the usability and deposit aim of the digital forex.

Cambodia’s Central Bank Plans to Originate Bakong Transactions in India & Japan

Cambodia’s central bank governor printed plans to originate detrimental-border payments the utilization of Bakong CBDC with India as early as June 2024 and is additionally exploring collaboration with Japan.

“We are start to working with other international locations with vital participants drag with Cambodia,” she acknowledged.

Attainable collaboration with technologically evolved international locations esteem Japan would possibly per chance per chance advise technical expertise and enhancements that enhance Bakong’s functionality and enchantment. The collaboration would possibly per chance per chance toughen the associated charge machine’s efficiency, security, and user expertise, making the riel more horny to home and world customers.

Source : cryptonews.com