U.S. Credit Unions Adopt Tokenization of Real World Assets

U.S. Credit rating Unions Adopt Tokenization of Exact World Property

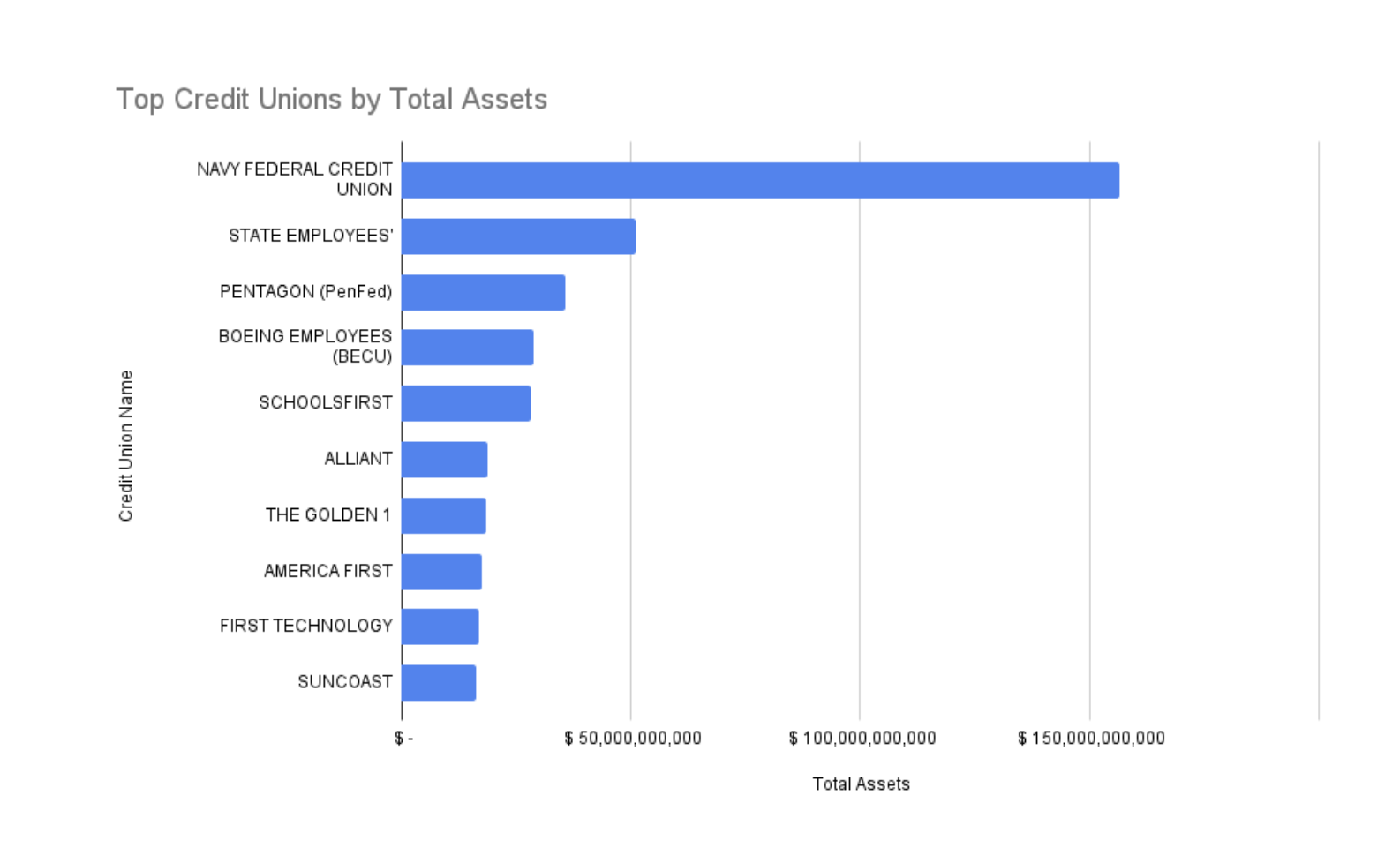

Outmoded banks ought to calm dominate the monetary industry by the utilization of property held, but credit unions are becoming an an increasing kind of widespread possibility for Americans who qualify.

Most modern details reveals that there are roughly 4,600 credit unions within the US. A September 2023 document from The Nationwide Credit rating Union Administration (NCUA) further notes that with regards to 139 million Americans own been members of federally insured credit unions, up 20% from 5 years prior.

Moreover, the credit union market dimension measured by earnings totaled $126.2 billion closing year.

Credit rating Unions Are Ripe For Tokenization of Exact World Property

John Wingate, Chief Executive of monetary platform BankSocial, informed Cryptonews that a credit union is a member owned monetary institution.

“Not like for profit banks which would be owned by shareholders, credit unions are owned by the members, one member, one portion, one vote,” said Wingate. “Given this, the credit union ethos and the decentralized fiance (DeFi) ethos are completely aligned.”

Whereas this may presumably also be right, credit unions face a bunch of challenges that can hamper future enhance.

Kyle Hauptman, Vice Chairman of the NCUA – an self reliant U.S. authorities agency that regulates federal credit unions – informed Cryptonews that credit unions aquire and sell items of loans.

“It is a long way a clunky direction of known as ‘mortgage participations,” said Hauptman.

A compliance blog from the Nationwide Affiliation of Federally Insured Credit rating Unions explained that mortgage participation occurs at any time when the possession pursuits in a mortgage are divided up and sold.

“Below share 701.22, federally insured credit unions (FICUs) need to aquire participation pursuits in loans under sure instances,” the blog states.

Hauptman pointed out that the latest mortgage participation direction of may well well also additionally be advanced. To illustrate, he explained that if a credit union makes a mortgage and one other credit union buys a 20% stake in it, it gets 20% of every mortgage payment.

Hauptman successfully-known that the credit union that buys participation within the mortgage doesn’t know if the payment has essentially been made, on the replacement hand. Moreover, that credit union is undecided if the selling credit union will pay the specified 20%.

“This makes it subtle for the procuring for credit union to devise, and it creates pointless uncertainty,” said Hauptman.

Tokenization Use Cases

Inquisitive regarding the subject, Hauptman believes that tokenizing loans that aren’t large sufficient to be securitized in a bond offering may well be priceless.

“A lovely contract would mechanically pay the procuring for credit union their 20%,” said Hauptman. “That credit union may well well also not ever must quiz ‘did they procure a payment?’ or ‘when discontinue I procure my half?.’”

Ravi de Silva, Managing Companion at compliance likelihood management firm de Risk Companions, informed Cryptonews that tokenization may well well also additionally lend a hand field up compliance likelihood by providing bigger transparency, security, and effectivity.

To illustrate, de Silva believes that tokenization may well well be priceless for credit unions and Anti-Money Laundering (AML) expend conditions.

“Transaction monitoring is a key attend watch over requirement in AML, which entails inspecting customer transactional details to identify probably suspicious or counterfeit actions,” de Silva said. “Tokenization can allow atmosphere pleasant diagnosis of transactional details.”

To illustrate, de Silva remarked that tokens may well well also additionally be extinct as a particular identifier to song transactional patterns and detect anomalies. He added that credit unions can analyze token details to detect great money transactions, structuring or unfamiliar transaction patterns.

“AML regulations also require monetary establishments, including credit unions, to procure thorough customer due diligence and take care of right details of their customers’ identities,” de Silva mentioned.

Attributable to this truth, he believes tokenization can further lend a hand securely store and reference customer identification details.

Credit rating Unions Adopt Tokenization

Given the advantages that tokenization can carry to credit unions, it shouldn’t be surprising that some own started enforcing these solutions.

In accordance with Wingate, BankSocial is working with several credit unions for expend conditions equivalent to tokenizing identification.

“Credit rating unions are the utilization of our ‘verified product’ for interoperable expend between techniques and fintechs, deposits for interoperability between monetary institution accounts, other banks, and for DeFi expend conditions,” he said.

Wingate explained that BankSocial’s verified product tokenizes transactional details by hashing.

“This is completed in a quantum resistant procedure, on-chain, to fabricate immutability to details and outcomes for regulators and third party audits,” he said. “We own future conditions within the pipeline for merchant funds, treasury management, and lending/borrowing.”

Wingate added that Sizable Lakes Credit rating Union just currently utilized BankSocial’s Exact Time Rate Solution. The answer uses Hedera Hashgraph’s disbursed ledger expertise (DLT) to tokenize funds and deposits for admire-to-admire transactions made on the Hedera community.

He added that BankSocial uses the immutable ledger on Hedera as transaction resilience for faded monetary rails.

We’ve partnered with @CornerstoneCUR to Future Proof your Credit rating Union with BankSocial Exchange!

Fight deposit outflows from member’s crypto purchases with our co-branded, self-custody exchange expertise – protected, staunch, and designed for Credit rating Unions!

🔹 Immediate signup in forty five… pic.twitter.com/OzwF22hTAm

— BankSocial.io (@BANKSOCIALio) March 28, 2024

Marshall Hayner, Metallicus’s Chief Working Officer, informed Cryptonews that Metallicus can be working with credit unions on blockchain solutions.

“Metallicus has built the Steel blockchain, which is a layer-zero blockchain to allow banks, credit unions, monetary establishments, and fintechs to form interoperable ledgers that may well talk seamlessly,” said Hayner.

A contemporary Forbes article successfully-known that Metallicus is working with three credit unions, Captivating, Meritrust Credit rating Union, and Fairwinds, to allow blockchain-basically based entirely mostly solutions.

Credit rating Unions Embody Tokenization, But Concerns Remain

Whereas it’s essential that some credit unions own begun exploring tokenization expend conditions, regulatory considerations are a fixed area.

In accordance with Hauptman, the large quiz that credit unions face is whether or not or not tokens are securities.

“Credit rating unions wretchedness if that participation may well be deemed a security,” he said. “We at NCUA own cleared the procedure for tokenization expend, but we can’t in point of fact assuage other considerations regarding the tokens themselves.”

Hauptman added that KYC processes, along with which platforms custody tokens, is a inform for credit unions.

“After which all the procedure by the platform the inform is ‘who’re the node operators?’” Hauptman pointed out. “There’s already been political questions about a node being in North Korea or Iran. No one wants an OFAC investigation for breaking sanctions.”

On a particular gift, Hauptman shared that credit unions are transferring forward with blockchain projects that allow identification.

“This is the build any token is clearly not something ever ‘bought or sold,’” he said. “But tokenization for exact world property remains an area.”

Yet, all things thought of as, Hauptman believes that U.S. credit unions are calm greater off enforcing tokenization expend conditions than U.S. banks. He believes it’s a long way because NCUA has delivered steering that offers sure clarity around regulations for credit unions.

To illustrate, Hauptman successfully-known that in July 2021, NCUA revealed a “Rely on of for Knowledge and Snarl on Digital Property and Linked Technologies” document. Later that year, NCUA launched a document known as “Steering on Relationships with Third Parties that Provide Companies and products Linked to Digital Property.” Moreover, in Might possibly 2022, NCUA launched one other file known as “Steering on Federally Insured Credit rating Union Use of Distributed Ledger Technologies.”

Credit rating Unions Will own to calm Work With Compliance Teams

Moreover to sure steering, de Silva believes that the regulatory challenges of enforcing tokens may well well also additionally be solved by demonstrating how tokenization is utilized, monitored, and audited.

“Credit rating unions want to frequently show screen their tokenization processes and conduct traditional likelihood assessments to identify and take care of any vulnerabilities or rising threats,” he said. “This entails staying up so a long way on the evolving regulatory panorama and making foremost adjustments to make crawl that compliance.”

Given this, de Silva pointed out that credit unions ought to work carefully with compliance teams to undertake industry perfect practices for tokenization.

“It is foremost to construct a mighty framework that aligns tokenization practices with appropriate regulations, while prioritizing the safety and privateness of customer details,” he said.

Source : cryptonews.com