Ethereum Price Prediction as SEC Approves Ethereum ETFs – Where is ETH Headed Next?

Ethereum Tag Prediction as SEC Approves Ethereum ETFs – Where is ETH Headed Next?

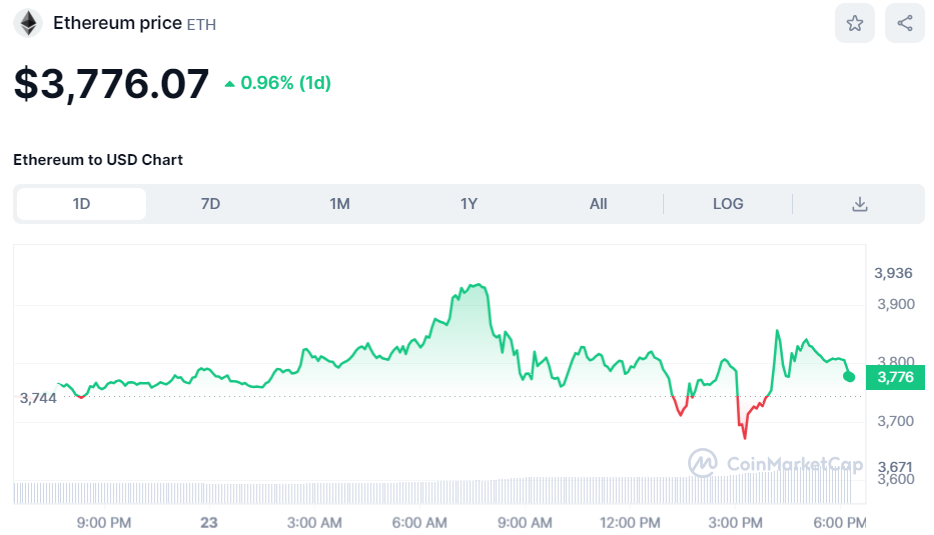

The Ethereum (ETH) impress is trading uneven in leisurely Thursday trade as in wake of data shedding that the US SEC has authorised plan Ethereum ETFs, a spectacular u-flip that has terrorized the market that, up until one week ago, used to be making a wager that Ethereum ETFs might perhaps perhaps be rejected this week.

BOOM!! APPROVED! There it’s some distance. The SEC merely authorised plan #Ethereum ETFs. What a flip of events. It's in spite of everything taking place.

h/t @PhoenixTrades_ pic.twitter.com/KQ39mDyCbT

— James Seyffart (@JSeyff) Could perhaps 23, 2024

The Ethereum impress used to be final trading round $3,800. That’s down sharply from earlier session highs advance $4,000, however also up sharply from earlier session lows at $3,520.

On the week, the Ethereum impress is up 24%. Rumors of an SEC u-flip first started on Monday.

Within the next days, this used to be adopted up by a flurry of engagement between ETF issuers and the SEC.

The full while, traders aggressively recount up the Ethereum impress on bets that ETFs will foster ecosystem bellow.

Every thing culminated on Thursday when the SEC authorised 8 plan Ethereum ETFs.

Why Disaster Ethereum ETF Approval Matters

Disaster Ethereum ETF approvals in the US will push up the Ethereum impress as institutional traders enter the market.

Merchants will recall Bitcoin surging to contemporary portray highs following plan Bitcoin ETF approvals earlier this 300 and sixty five days.

Effectively, the Ethereum impress might perhaps perhaps soon observe swimsuit. Its contemporary portray highs are advance $4,900, 28% up versus contemporary stages.

That will utter extra liquidity to the Ethereum ecosystem, which might perhaps perhaps merely restful spur extra adoption, exercise and vogue.

Ethereum ETFs might perhaps perhaps also merely restful again solidify Ethereum’s situation because the king of vivid-contract-enabled blockchains.

Ethereum Tag Prediction – Where is ETH Headed Next?

Affirmation of the approval of plan Ethereum ETFs might perhaps perhaps lead to a pair of rapid-time length promote power.

Which can be paying homage to what came about when plan Bitcoin ETFs garnered approval earlier this 300 and sixty five days.

Some traders live up for confirmation of a clear market catalyst earlier than taking profit.

Assuming there might perhaps be first price question for Ethereum ETFs when they shuffle dwell, ETH might perhaps perhaps soon shuffle above $4,000.

Uncertainty referring to Ethereum’s regulatory speak in the US brought about masses of traders to rapid ETH versus other cryptos.

The SEC used to be belief to were campaigning to categorise ETH as a security earlier this 300 and sixty five days.

But now that plan Ethereum ETFs were authorised, that reasonably valuable clears things up. ETH is a digital commodity treasure Bitcoin.

Many shorts might perhaps perhaps also merely restful be unwound and that will be an ongoing tailwind for the market.

And cryptocurrencies technicals point out that since breaking its March to mid-Could perhaps downtrend and above its 21 and 50DMAs, a retest of March highs advance $4,100 is most likely.

Once this stage goes, a swiftly push better to 2021 highs advance $4,900 is most likely.

Disclaimer: Crypto is a excessive-distress asset class. This article is outfitted for informational capabilities and would no longer list funding advice. That you just would be in a position to perhaps lose all of your capital.

Source : cryptonews.com