Institutions Likely To Show Interest in Bitcoin DeFi Applications

Institutions Likely To Repeat Hobby in Bitcoin DeFi Functions

Bitcoin (BTC) is suddenly evolving. Whereas the Bitcoin community has basically been inclined for cost transactions, most up-to-date task appears to be like to be similar to that of Ethereum at some point of the tip of decentralized software (Dapp) projects.

The introduction of Bitcoin Runes and BRC-20 tokens – which emerged at some point of the time of the fourth Bitcoin halving match – has likely sparked the evolution of Bitcoin-native decentralized finance (DeFi).

The Emergence of Bitcoin DeFi

Rena Shah, VP of Products at Belief Machines – a staff alive to on growing the Bitcoin economy – told Cryptonews that two years ago, Bitcoin DeFi wasn’t a legend the ecosystem used to be discussing.

Yet Shah valuable that the emergence of staking platforms and lending protocols right throughout the Bitcoin community has created pastime amongst merchants in transitioning belongings from a retailer of value to a source of value.

Enhance within the Bitcoin DeFi (BTCFI) ecosystem is staggering 🧡

🟧 @ALEXLabBTC main the price, with @Bitflow_Finance & @StackingDao following.

– Files from @signal21btc pic.twitter.com/87MP5hMCbL

— stacks.btc (@Stacks) Would possibly per chance per chance per chance 8, 2024

“The deserve to skedaddle from a passive to a productive Bitcoin asset is true in 2024,” she said. “We’ve been building towards this future on yarn of we can judge about that Bitcoin DeFi is appealing no longer valid to retail merchants however also to institutional merchants.”

Institutions Will Repeat Hobby in Bitcoin DeFi

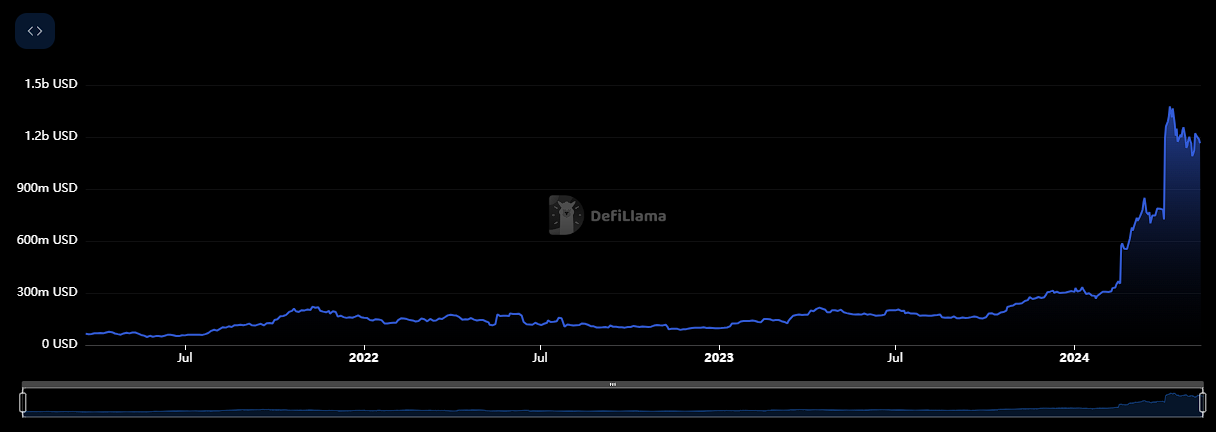

Files from DeFiLlama exhibits that Bitcoin’s whole value locked (TVL) is roughly $1.2 billion. Yet, in accordance to Shah, nearly $1 trillion in capital is locked on the Bitcoin blockchain.

“Even the smallest percentages of capital changing into productive in DeFi will construct expansive waves within the Bitcoin ecosystem,” Shah pointed out.

This, along with the most modern approval of method Bitcoin switch-traded funds (ETFs) within the united states, is rising the aptitude for Bitcoin DeFi capabilities. In particular, this also can likely attraction to establishments holding Bitcoin and retail merchants.

Tycho Onnasch, the co-founding father of Zest Protocol, told Cryptonews that he believes BTC is a extra institutional asset than the leisure of crypto.

“Hence, I request of establishments to play the next section within the use of and bootstrapping Bitcoin DeFi,” said Onnasch.

Bitcoin DeFi Functions For Institutions

Despite the indisputable truth that Bitcoin DeFi continues to be a moderately new procedure, a replacement of projects search to enable and approach the sector.

Shall we narrate, Onnasch defined that Zest Protocol is making a lending protocol built particularly for Bitcoin. He mentioned that the aim within the abet of the platform is to produce a permissionless monetary infrastructure for BTC lending markets.

“Zest permits customers to collateralize BTC to borrow other tokens equivalent to stablecoins,” he said. “The platform also lets customers extinguish yield on their BTC.”

Indeed, the main use case within the abet of Bitcoin DeFi capabilities appears to be like to be guaranteeing that Bitcoin becomes a extra productive asset for merchants.

Dr. Chiente Hsu, Co-Founder of ALEX and XLink, told Cryptonews that Alex is a new finance layer for the Bitcoin community.

“Our purpose is to seamlessly mix Bitcoin with layer-2 (L2) solutions and the Ethereum Virtual Machine (EVM) world,” said Hsu. “This might per chance also enable us to expand the Bitcoin economy,” said Hsu.

Shall we narrate, Hsu defined that merchants can extinguish yield on their BTC by connecting a Bitcoin pockets to XLink. He valuable that XLink is powered by ALEX’s automatic market maker (AMM) and decentralized switch (DEX). This might per chance also enable rotten-chain swaps between Bitcoin L2s and the EVM world.

“Bitcoin DeFi for establishments might per chance be the pursuit of Bitcoin yield generating belongings,” said Hsu.

Hsu believes this also can likely be the case due to the spacious quantity of capital on the Bitcoin community.

“There’s properly over $1 trillion in Bitcoin capital that is ‘sluggish’ within the sense that its value rises and falls relative to the Bitcoin method ticket,” he said. “But unlike Ethereum, Bitcoin can’t be natively locked to generate a yield. Here’s a answer that ALEX is actively pursuing, that might per chance also enable establishments that have Bitcoin to extinguish yield through their Bitcoin capital.”

Bitcoin DeFi Resembles Ethereum Counterparts

One other attention-grabbing point is that while Bitcoin DeFi is gripping, capabilities are inclined to resemble DeFi projects on Ethereum (ETH). Here is crucial to set in thoughts, as establishments procure began to present pastime in so much of most up-to-date DeFi capabilities.

Digital asset management firm Fireblocks recently chanced on increased institutional DeFi task on the Fireblocks platform. Basically based entirely on the firm, there used to be a 75% soar within the first quarter of 2024.

Fireblocks reported that some of the crucial most current Dapps that institutional potentialities work in conjunction with right through swapping, lending, staking, and bridging embody Uniswap, Aave, Curve, 1inch, and Jupiter.

Jeff Yin, CEO of Merlin Chain – a Bitcoin L2 facilitating like a flash, cost-effective transactions with toughen for BTC Dapps – told Cryptonews that DEXs, derivatives, and lending are all areas the set BTC has realized extensively from ETH. He added that many new protocols are rising.

“Shall we narrate, ‘Surf’ is a derivatives trading protocol that launched on Merlin Chain and now boasts a daily trading volume of over $10 million. These are linked to their Ethereum counterparts,” said Yin.

Yin elaborated that a particular Bitcoin DeFi software would replicate one in every of the ideal ETH DeFi protocols, Lido – which holds $28 billion and accounts for half of Ethereum’s DeFi TVL.

“SolvBTC is at repeat growing an underlying BTC yield protocol,” said Yin. “Additionally, Unicross has applied a Rune trading protocol on a BTC L2, permitting customers to interchange Layer 1 (L1) belongings extra cheaply on L2. These portray the extra innovative aspects of the sector.”

Bitcoin DeFi Would possibly per chance per chance per chance Overtake Ethereum

Whereas Bitcoin DeFi might per chance also seem linked to Ethereum, Shah believes that decentralized finance the use of BTC might per chance also indirectly surpass Ethereum.

“Having a judge about at DappRadar, Ethereum has over 600 active apps with varied volume and task,” said Shah. “I fabricate no longer procure any reason to request of that Bitcoin DeFi can not match Ethereum, and indirectly flip it for Dapps within the ecosystem.”

Particular solutions are also making it more uncomplicated to train Ethereum Dapps to Bitcoin.

Zack Voell, Director of Advertising and marketing and marketing and marketing at Botanix Labs, told Cryptonews that Botanix had created a “Spiderchain” that with out anguish permits DeFi on Bitcoin.

“Spiderchain creates a entirely EVM-linked atmosphere for Dapps and dapper contracts on Ethereum to be reproduction-pasted to speed natively on Bitcoin,” said Voell. “Botanix Labs is building the Spiderchain to mix the 2 most Lindy technologies in crypto — the EVM and Bitcoin — as one more of attempting to reinvent a fully new protocol or digital machine.”

Challenges Would possibly per chance per chance per chance Behind Adoption

Despite the indisputable truth that it’s too soon to search out out the fate of Bitcoin DeFi, definite challenges might per chance also dull adoption.

Shall we narrate, Yin pointed out that liquidity fragmentation on the whole outcomes from the topic of implementing DeFi on an L1 community. This, in turn, forces most activities to disperse right through varied L2 solutions, but Yin valuable that this also can construct it subtle to focus liquidity.

“A potential answer might per chance also very properly be to produce omnichain liquidity, linked to the Stone protocol within the Ethereum ecosystem,” he said. “We ogle ahead to future implementations love M-STONEBTC and Solv Protocol that might per chance also unify BTC L2 liquidity.”

Additionally, Shah mentioned that Bitcoin’s hassle is keeping the unfriendly layer valid, valid, and untampered.

“That is the set scaling becomes paramount,” she said. “A wholesome and diverse L2 ecosystem might be what indirectly drives Bitcoin DeFi, as a vertical, to be triumphant.”

Shah added that programming environments on Bitcoin are inherently subtle since many builders from other ecosystems are less accustomed to Bitcoin script.

She valuable that one potential to fight right here is to produce WebAssembly (WASM) or diversified speed-time environments love Rust, Solidity, and Cosmos with L2s.

“This attain will likely reduction train new builders into the ecosystem,” she remarked.

Source : cryptonews.com