Bitcoin Price Prediction as Weak U.S Jobs Data Spurs Rate Cut Hopes – Will BTC Surge?

Bitcoin Sign Prediction as Old U.S Jobs Data Spurs Charge Prick Hopes – Will BTC Surge?

Bitcoin (BTC) dipped a little by 0.20%, settling at $63,000, yet maintains a bullish stance in the latest bitcoin designate prediction. The upward thrust in jobless claims to 231,000, the ideally suited since August 2023, suggests a cooling U.S. labour market, prompting anticipatory actions by the Federal Reserve.

This is in a position to perhaps lead to charge reductions earlier than projected, influencing Bitcoin’s appeal as a non-damaged-down funding.

U.S. Jobs Data Sparks Charge Prick Speculation—What’s Next for BTC

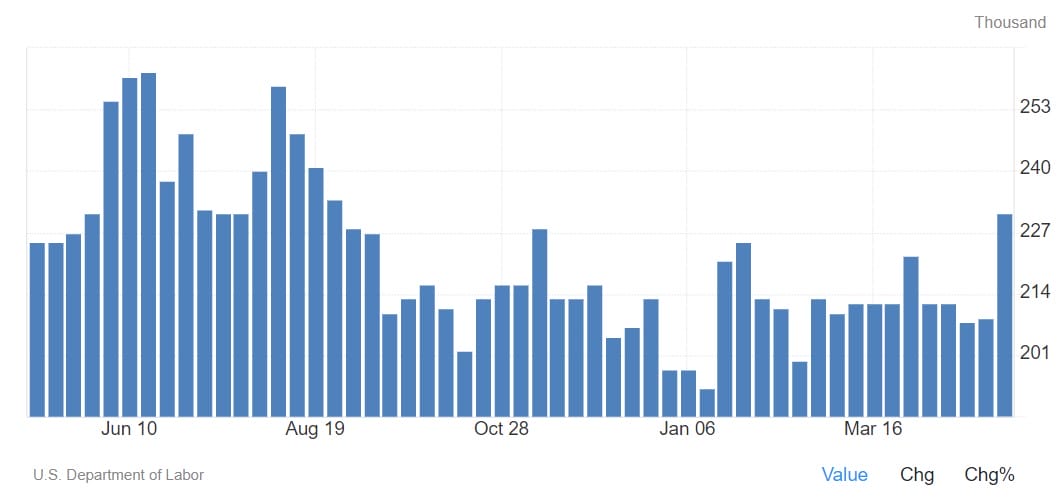

The Labor Division reported a famous amplify in initial jobless claims for the week ending Can even fair 4, reaching 231,000—22,000 more than the previous week and effectively above the Dow Jones estimate of 214,000.

This marks the ideally suited level since August 26, 2023, signalling that you would possibly per chance well perhaps presumably imagine financial traces and a cooling labour market that had previously shown resilience.

Continuing claims also increased, rising by 17,000 to 1.78 million, while the four-week transferring moderate of claims climbed to 215,000. These figures counsel a insensible financial slowdown, prompting discussions about the Federal Reserve’s potential early charge cuts to stimulate articulate.

This type of softening in the labour market has historically been a catalyst for Bitcoin designate as merchants turn to non-damaged-down sources.

Nonfarm Payroll Adds to Self-discipline

April’s nonfarm payroll information added to those issues, exhibiting a spot of handiest 175,000 jobs, a long way below the anticipated 240,000. This changed into the smallest amplify since October 2023. Nonetheless, the unemployment charge remains proper at 3.9%, below 4% since February 2022, indicating that the job market is no longer in disaster but will seemingly be normalizing.Analysts Christopher Rupkey and Robert Frick possess noted the volatility and aesthetic rise in jobless claims, suggesting potential additional fluctuations in the labour market. Officers of the Federal Reserve, whose aim is to take care of a 2% inflation charge, fastidiously peep these cases.

- The sizzling spike in U.S. jobless claims suggests a potential financial slowdown.

- April’s modest job gains and proper unemployment tag at market normalization.

- The Fed would possibly per chance well sever charges sooner, presumably boosting Bitcoin funding as lower charges sever fixed-earnings asset yields.

As expectations mount for the Fed to ease financial policy primarily primarily based solely on a weakening job market, presumably starting charge cuts as early as September, Bitcoin would possibly per chance well abet. Lower pastime charges secure riskier sources worship cryptocurrencies more attention-grabbing.

Bitcoin Sign Prediction

Bitcoin

(BTC) observes a minor decline of 0.20%, with the new trading designate at $63,000, then again, bitcoin designate prediction smooth remains bullish.

The pivot point at $61,011 devices the stage for determining directional movements, with quick resistance noticed at $64,851. Can even fair smooth bullish momentum prevail, subsequent resistance stages at $67,084 and $69,356 will seemingly be examined.

Conversely, quick make stronger kinds at $58,852, with additional downside security viewed at $56,677 and $54,327. The RSI at 54 signifies a moderately neutral market stance, while the 50-day EMA at $62,375 provides underlying make stronger approach the $62,000 designate, suggesting a balanced yet cautious market sentiment.

A decisive pass below $62,500 would possibly per chance well space off a necessary selling pattern, highlighting the significance of this threshold in BTC’s approach-term designate actions.

Unlock Early Advantages: 99Bitcoins Token Presale Now Reside!

The 99Bitcoins presale is for the time being underway, offering a obvious different in cryptocurrency training. By taking part on this ‘learn-to-scheme’ platform, customers would possibly per chance well aid their working out of digital currencies while acquiring $99BTC tokens, which shall be both a reward mechanism and a gateway to top charge roar material and community advantages.

With the token designate space at $0.00104 every, early merchants are equipped a worth-effective entry camouflage starting up rising their journey and funding concurrently.

As of now, the presale has successfully raised $1,169,037, transferring nearer to the target of $1,892,544. With handiest four days and upright over an hour closing earlier than the subsequent stage designate amplify, this little-time provide provides a necessary 2d for merchants to aquire into $99BTC and place access to quick staking alternate suggestions.

Get grasp of Your 99Bitcoins Nowadays

Disclaimer: Crypto is a excessive-ache asset class. This text is equipped for informational applications and does not constitute funding recommendation. You would possibly per chance well perhaps lose your whole capital.

Source : cryptonews.com