Bitcoin Traders Target Test of $53,000 Support as BTC Price Predictions Remains Bearish Following Fed Meeting

Bitcoin Traders Target Take a look at of $53,000 Make stronger as BTC Price Predictions Stays Bearish Following Fed Meeting

The Bitcoin (BTC) be conscious is consolidating within the mid-$57,000s, down roughly 5% on the day, though up around 1.5% or $1,000 from earlier session lows as merchants weigh the outlook for Fed rate cuts this 365 days in wake of the latest policy announcement from the US central monetary institution.

As anticipated, the Fed left ardour rates at multi-decade high ranges of 5.25-5.5% and slowed its steadiness sheet tear-off.

The central monetary institution will now allow its portfolio of sources to shrink by handiest $25 billion per month. Sooner than, the central monetary institution had been allowing its steadiness sheet to shrink by $60 billion per month.

That reduction used to be a chunk of increased than some merchants appeared as if it may possibly possibly probably no longer sleep for and may list the dovish market response to the initial policy announcement.

Bitcoin briefly pushed the total capability to the mid-$59,000s, and US stocks pumped, though these moves lickety-split reversed.

Currently, Bitcoin is procuring and selling fingers roughly in step with where it used to be sooner than the Fed’s announcement.

As expected, Fed Chair Jerome Powell famend latest increased-than-expected inflation details readings to this level this 365 days.

POWELL: INFLATION DATA RECEIVED THIS YEAR HAVE BEEN HIGHER THAN EXPECTED

— *Walter Bloomberg (@DeItaone) Can even 1, 2024

He commented that gaining self assurance to lower ardour rates will snatch longer than expected.

POWELL: GAINING CONFIDENCE TO CUT WILL TAKE LONGER THAN THOUGHT

— *Walter Bloomberg (@DeItaone) Can even 1, 2024

In step with CME details, the money market-implied odds that the Fed will possess lower ardour rates by 25 bps by September rose to 54% from 46% in some unspecified time in the future within the past.

Meanwhile, the likelihood of no rate cuts this 365 days dropped to 16% from 27% in some unspecified time in the future within the past.

Finally, the market interpreted the Fed meeting as a exiguous extra dovish than expected, explaining the Bitcoin be conscious soar from lows.

The set Next for the Bitcoin Price?

While Bitcoin may possess recovered from earlier session lows, latest technical inclinations point out extra way back is coming.

Earlier than Wednesday’s Fed meeting, Bitcoin had dropped nearly 5% from just appropriate under $61,000.

That tumble came after it fell 5% from shut to $65,000 on Tuesday.

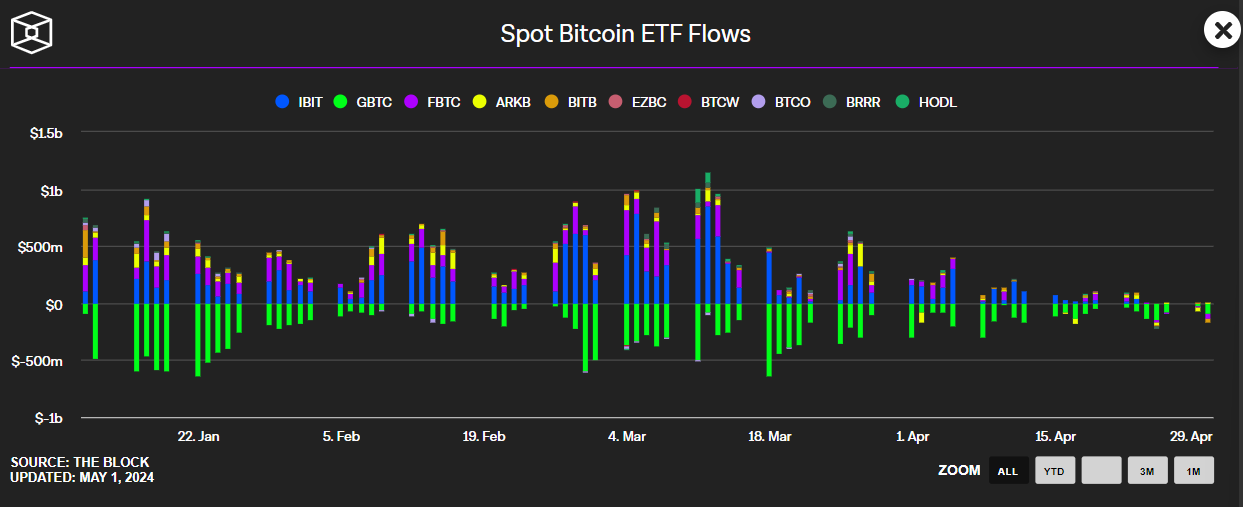

The decrease from earlier weekly highs comes as US economic details formulation to sticky inflation pressures and accelerated ETF outflows.

In step with details presented by The Block, US Bitcoin ETFs possess viewed outflows for five days straight.

Importantly, Wednesday’s dip saw Bitcoin ruin to the south of its two-month $60,000-$74,000ish differ.

The following famous degree of strengthen for Bitcoin isn’t till the mid-February highs at $53,000.

Many analysts are now predicting that BTC will hit the low $50,000s.

Bitcoin will tumble 13% to $50,000 after falling under a key strengthen degree as macro drivers slack, Celebrated Chartered says

Bitcoin has fallen past the ETF buy be conscious of around $58,000, hanging over half of of ETF positions underwater, Celebrated Chartered wrote.— Ajay Bagga (@Ajay_Bagga) Can even 1, 2024

A few analysts mentioned that the frequent entry be conscious of US Bitcoin ETF investors at $57,300 is severe to search out.

“There may possess been a full bunch ‘TradFi’ vacationers in crypto pushing longs into the halving,” 10x CEO Markus Thielen wrote. “This time is now over. We query extra unwinding as… Bitcoin trades under $57,300. This is capable of possibly likely lower prices to… a -25% to -29% correction from the $73,000 high. That explains our be conscious target of $52,000/$55,000 within the center of the the rest three weeks.”

Disclaimer: Crypto is a high-chance asset class. This article is supplied for informational capabilities and would no longer describe funding recommendation. You may lose all of your capital.

Source : cryptonews.com