BTC Bears Eye Break Below $60,000 as ETF Flows Slow, Macro Headwinds Grow – Here’s Where the Bitcoin Price is Headed Next

BTC Bears Peep Shatter Below $60,000 as ETF Flows Sluggish, Macro Headwinds Grow – Here’s Where the Bitcoin Heed is Headed Subsequent

Bitcoin (BTC) bears are eyeing a destroy below the key psychological $60,000 level, with ETF flows having slowed this week, and macro headwinds persevering with to pile up, with some predicting that the Bitcoin tag would possibly maybe well be headed against $50,000 next.

The Bitcoin tag snappily dipped as little as $ 59,800 on Wednesday. On the other hand, the sphere’s largest cryptocurrency by market capitalization has since recovered to the $60,400s, down around 5% on the day.

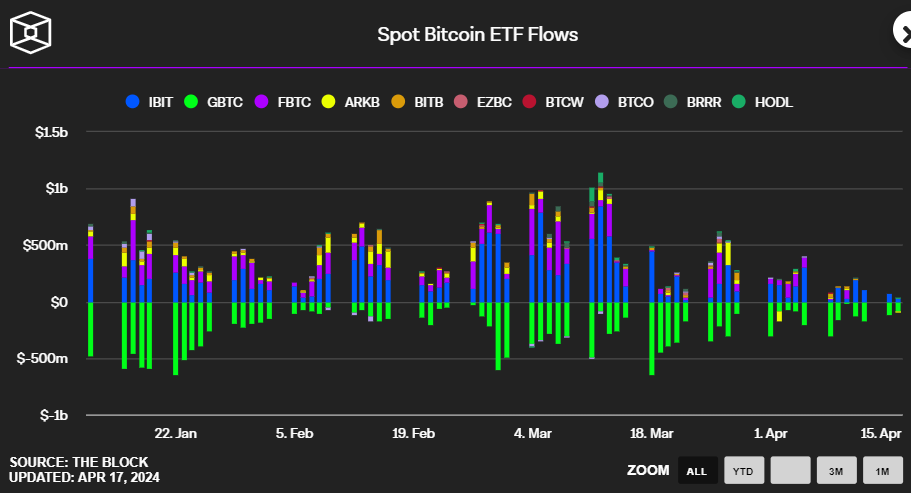

In step with files presented by The Block, earn ETF flows were negative to this level this week. That’s attributable to persevered, albeit serene slowing GBTC outflows of $110 million on Monday and $80 million on Tuesday.

At modern ranges, the Bitcoin tag is down around 18% from its file high of close to $74,000 final month.

Macro Risks Grow

As macro headwinds grow sooner than the halving on Saturday, tag dangers would possibly maybe well be tilted toward extra losses.

Since final November, US bond yields and the US Buck Index (DXY) acquire only recently vaulted up to their highest ranges.

US economic files has strategy in stronger than anticipated in recent weeks, forcing the Fed to point out more hawkish. Fed Chair Jerome Powell emphasised a lack of growth on inflation this week.

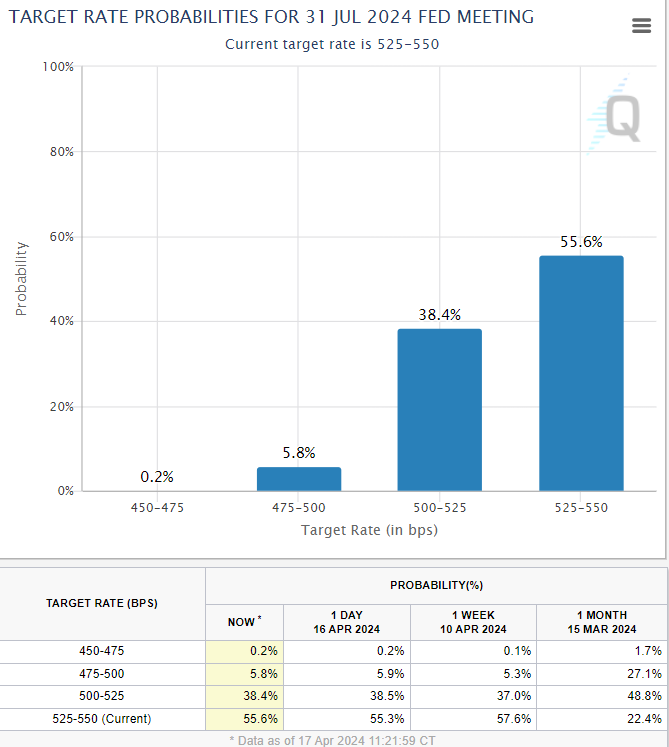

This has pressured traders to downsize their Fed fee-decrease bets substantially. As per the CME’s Fed Ogle Tool, the money market implied likelihood of a July fee decrease has extinct to below Forty five% from around 80% one month ago.

This has hit risk resources throughout the board. As Bitcoin probes $60,000, the S&P 500 is down 5% from its recent peak and at its lowest in close to 2 months.

In spite of all the pieces, elevated geopolitical tensions within the Middle East between Iran and Israel acquire also dented sentiment only recently. The specter of one more foremost battle that would possibly maybe well acquire an equally disruptive affect on world oil provide continues to hang.

Bitcoin Halving to Suppress the BTC Heed

Nerves are also increasing that the upcoming Bitcoin halving is on the total a “sell-the-news” event.

Broadly followed crypto be taught dwelling 10x Analysis only recently predicted miners would possibly maybe well dump $5 billion of BTC after the halving.

The selling stress would possibly maybe well proceed for as noteworthy as 4-6 months, which plot the next leg higher within the BTC market would possibly maybe desire to wait till October this 300 and sixty five days.

Bitcoin miners would possibly maybe well sell $5 billion value of BTC after halving , analysts at 10x Analysis believe .

The stress on BTC from miners can proceed for 4-6 months, and handiest then will a “put up-halving rally” open.

This has came about traditionally, analysts swear. The chart exhibits an… pic.twitter.com/gyxniDON8h— Crypto 4 Gentle (@vladi4light) April 15, 2024

There are diverse reasons for Bitcoin traders who are sat on sizable paper positive aspects to take profit.

Here’s Where the Bitcoin Heed is Headed Subsequent

Closing weekend, Bitcoin’s technical outlook became bitter after it bearishly broke out of its recent pennant structure consolidation sample.

On the other hand, the bears’ first profit goal has been hit now that it has hit $60,000 and examined its March lows.

The most critical inquire of of now would possibly maybe well be whether or not Bitcoin can sustain above $60,000 crimson meat up.

The whole above-talked about arguments—i.e., slowing ETF flows, increasing macro headwinds, and possible put up-halving sell stress—point out dangers are tilted toward a strategy-term destroy into the $50,000s.

On the other hand, primarily the latest pullback within the Bitcoin tag has flushed sizable froth out of the market.

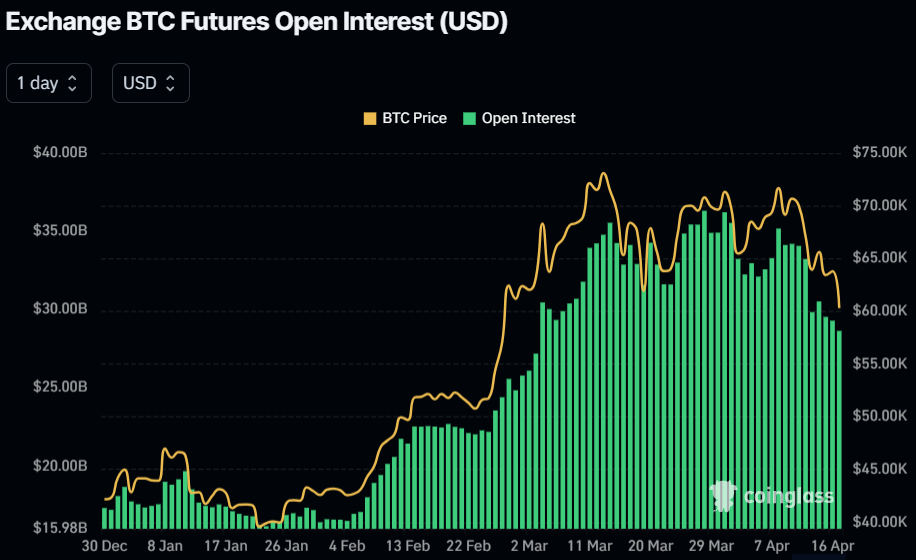

As only recently as March 28, the value of commence leveraged futures positions (or commence interest) turned into $36.31 billion. In step with coinglass.com files, it turned into final 22% decrease at $28.64 billion.

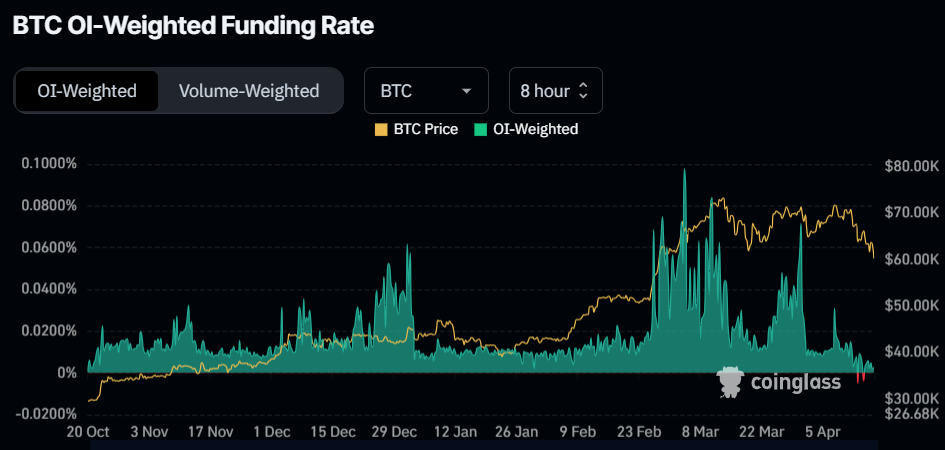

In the meantime, funding rates to commence leveraged Bitcoin futures positions only recently flipped negative for the first time in over 6 months.

This means weakness in inquire of amongst traders to take out leveraged lengthy bets and maybe a rising appetite to pass short.

A less frothy market suggests that the foundations are there for a more sustained restoration within the value.

If fundamentals proceed to deteriorate, a sustained breakdown into the $50,000s remains primarily the most probable consequence.

As soon as the $60,000 crimson meat up zone goes, a swift tumble aid to the next foremost crimson meat up level at $Fifty three,000 is seemingly.

Investors to Buy the Dip?

On the other hand, as soon as the BTC tag drops aid to these areas, we would look foremost traders stepping in to amass the dip.

Bitcoin’s lengthy-term outlook remains highly certain. The narrative that it is “digital gold” continues to create flooring.

Many foremost US brokerages and wirehouses are yet to produce space Bitcoin ETFs to purchasers, so earn entry to will proceed to widen.

US govt deficit spending is liable to remain high in an election 300 and sixty five days. And the US election would possibly maybe well look the US regulatory panorama swivel more professional-crypto.

In the meantime, the Fed is serene anticipated to originate cutting rates moderately later than the market’s hoped.

In the meantime, as soon as put up-halving miner sell stress eases, the decrease BTC issuance fee will originate appearing as more of a tailwind.

On Saturday, the fee of BTC issuance to miners will tumble 50% from 6.25 BTC per block to three.125.

Bitcoin remains heading within the true course to hit and depart exceed $100,000 within the coming years. And if something else came about to drive the Fed to originate cutting interest rates sooner, quiz the positive aspects to strategy aid sooner.

Source : cryptonews.com