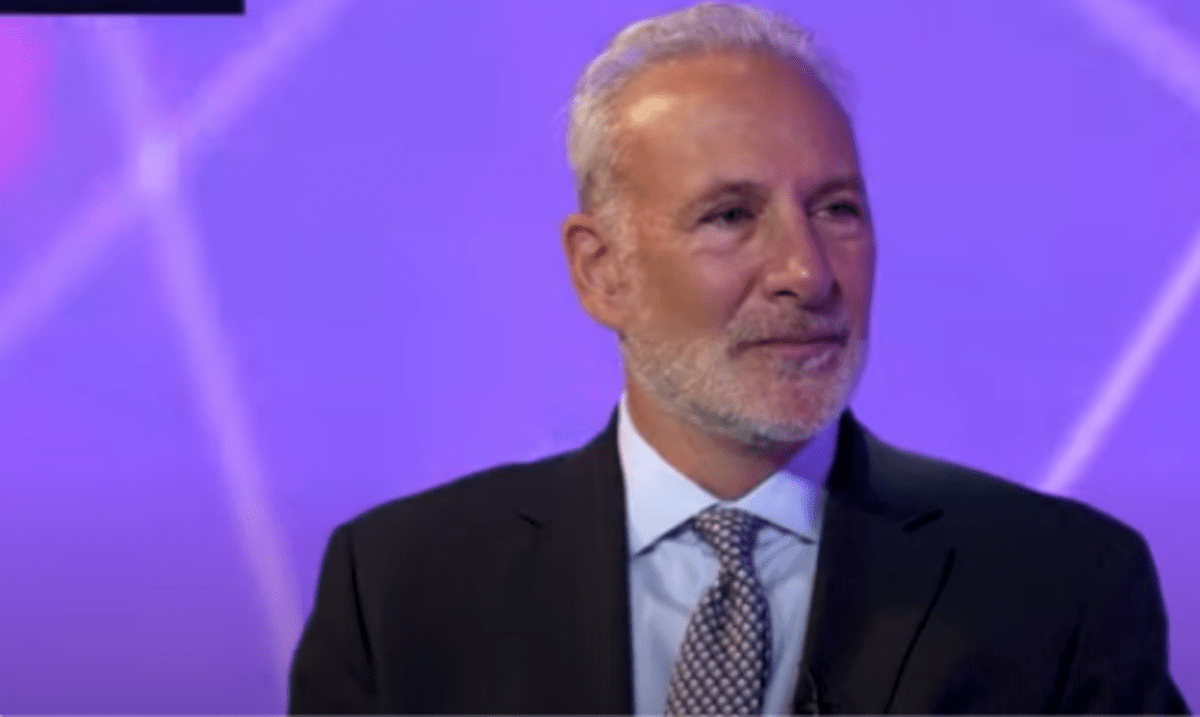

Peter Schiff Predicts Bitcoin To Drop to $20K Price Level

Peter Schiff Predicts Bitcoin To Tumble to $20K Imprint Level

Smartly-liked Bitcoin critic Peter Schiff predicted on April 14 a skill bolt in BTC’s tag to $20K. He also warned that Microstrategy, the largest company holder of Bitcoin, could presumably potentially lose an estimated $2.7 billion if the price crashes.

Peter Schiff disclosed his Bitcoin tag prediction in an X put up while stressing the importance of the asset’s $60K beef up stage.

Peter Schiff Anticipates “Triple High” Pattern

The vocal suggest for gold and Bitcoin skeptic cautioned that a further bolt below Bitcoin’s $60K tag stage could presumably trigger a pointy decline which could presumably lead to a serious fall to $20K.

Schiff proceeded to highlight the skill affect of the price fall on MicroStrategy’s Bitcoin investments.

$60K is extreme beef up for #Bitcoin. A decisive destroy below that stage will develop a formidable triple top. The instant scheme back projection is a switch to $20K. At that tag $MSTR will maintain a $2.7 billion unrealized loss on 214K Bitcoin obtained at an moderate tag of $34K. pic.twitter.com/F1P0NpLS3X

— Peter Schiff (@PeterSchiff) April 14, 2024

MicroStrategy currently holds 1% of the overall offer of Bitcoin, approximately 214,000 BTC, obtained at an moderate tag of $34K. Nonetheless a fall to $20K would lead to an estimated “unrealized loss” of $2.7 billion for the corporate.

While MicroStrategy’s Bitcoin holdings maintain recorded losses throughout bearish markets, the corporate’s CEO, Michael Saylor, has always been optimistic about Bitcoin. He has continuously inspired merchants to preserve with a long-term skill. Per him, chaos in habitual markets tends to serve Bitcoin.

Chaos is correct for #Bitcoin.

— Michael Saylor⚡️ (@saylor) April 13, 2024

Here’s no longer the first time Schiff has focused Microstrategy amid uncertainties within the crypto market. In March, the gold suggest criticized Microstrategy’s acquisition of $623 million price of BTC, warning that the Bitcoin funding firm could presumably myth a large loss if the Bitcoin tag falls to $20K.

Schiff’s prediction of a tag fall to $20K looks to be like unlikely basically basically basically based on new market traits, technical evaluation, and data of doomsday projections for Bitcoin’s tag, nevertheless.

Peter making up numbers for his Bitcoin TA pic.twitter.com/fekexhC1cB

— Walker⚡️ (@WalkerAmerica) April 14, 2024

While there became once a dip in direction of the $60K stage, which Schiff identifies as “extreme,” there’s no grand foundation for a serious fall to $20k.

Per CoinCodex Bitcoin tag prediction evaluation, Bitcoin’s 50-day and 200-day Exponential Transferring Averages (EMAs) of $63,128 and $47,900 can, respectively, provide essential-wanted beef up levels.

A sustained stage above these EMAs could presumably abolish out Schiff’s “triple top” forecasts undertaking. A recovery above $60,000 could presumably beef up bullish sentiments around Bitcoin, while a step forward above new highs advance $67,500 would signal a market recovery.

Peter Schiff Continues to Shun “Bitcoin Rally” Potentials

Schiff had projected a continuous fall in Bitcoin tag forward of this new doomsday prediction on the asset.

#HODLers, end you be wide awake how bullish you all were in Nov. 2021 when #Bitcoin traded $69K? I end. How many clean maintain your laser eyes? A three hundred and sixty five days later Bitcoin traded below $16K, almost 80% lower. Provided that most are even extra bullish now, an even bigger smash possible lies forward.

— Peter Schiff (@PeterSchiff) March 19, 2024

On March 19, Schiff drew a parallel between Bitcoin’s 2021 bullish inch, throughout which the asset tag peaked at $69K but misplaced about 80% of its tag because it traded at $16K in November 2022.

In line with this parallel, Schiff anticipated a essential bigger fall. This became once immediate-lived because the asset scaled past the $71K tag trace on April 4, nevertheless.

Schiff’s most modern $20,000 projection of BTC came amid geopolitical tensions and renewed hostilities within the Israel-Iran war, which has affected the price of BTC and critical markets.

The Bitcoin market suffered a the same fate in February 2022, when the trading volume of BTC dropped within the wake of the Russia-Ukraine warfare, but the market had a grand rebound after the instability it experienced at this time.

Regardless, Schiff’s Bitcoin tag prediction has obtained many and diverse comments from the crypto personnel. Crypto expert Stephan Livera believes the Bitcoin critic’s evaluation is made up and holds no crucial tag, to illustrate.

Source : cryptonews.com