Robert Kiyosaki Says No to Spot Bitcoin ETF Investments

Robert Kiyosaki Says No to Build of residing Bitcoin ETF Investments

On April 12, Robert Kiyosaki, the notorious creator of “Rich Dad, Unhappy Dad,” expressed his lack of passion in investing in space Bitcoin change-traded funds (ETFs) and any other “Wall Avenue monetary products.”

The Unique York Times most attention-grabbing-selling creator, who has been a stoic supporter of Bitcoin over time, famend that he favors advise possession of physical resources due to this of his entrepreneurship pathway.

Robert Kiyosaki Claims Bitcoin ETFs Are For Institutions

In an X put up, Robert Kiyosaki shared his notion that space Bitcoin ETFs and other asset-backed “ETFs are most attention-grabbing for most other folks and establishments.”

Q: Will you buy the Bitcoin ETF?

A: No. Correct as I have gold and silver coin and mines and have rental properties I design not have gold or silver ETFs or REITS, genuine property ETFS. ETFs are most attention-grabbing for most other folks and establishments. In my notion I am an entrepreneur and favor to smash as some distance…— Robert Kiyosaki (@theRealKiyosaki) April 12, 2024

Having invested in a mixture of resources love gold, silver, Bitcoin, and genuine property, which he mentioned are bargains this day, Kiyosaki is sticking to his weapons. He believes in making his have monetary strikes that align along with his entrepreneurial spirit.

However, the notorious creator reiterated that traders may perchance well just mute at all times resolve what is most attention-grabbing for them, noting that his stance against Bitcoin ETFs works most attention-grabbing for him. If he makes a mistake, he has no one else responsible but himself, he famend.

Meanwhile, the Bitcoin ETFs market is at an all-time high, with tokenization of genuine-world resources (RWAs) selecting up meander.

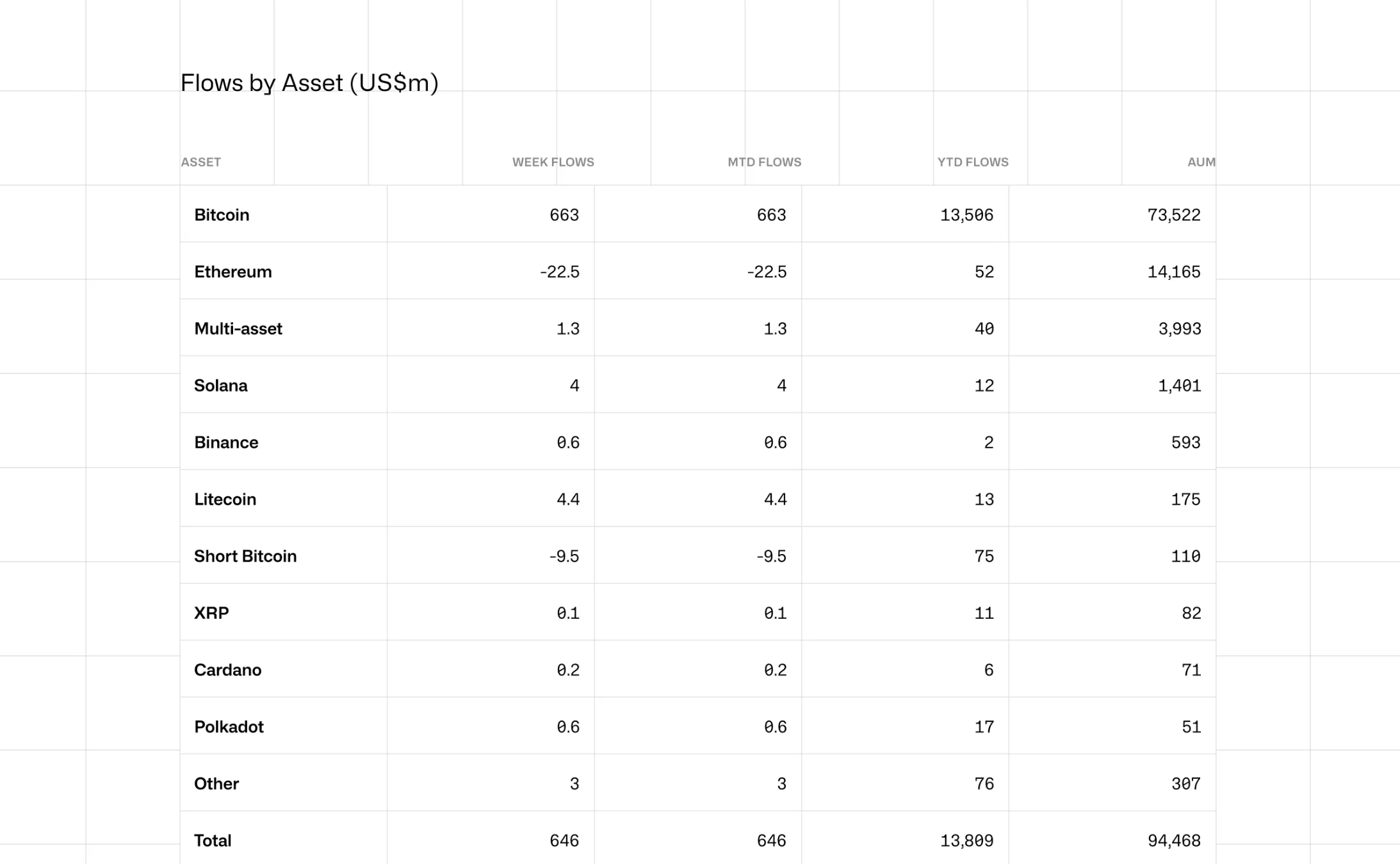

CoinShares info confirmed that cryptocurrency investment products, along with Bitcoin ETFs, glean recorded certain inflows of slack. Total inflows were $646 million on April 8, and the year-to-date (YTD) inflow changed into as soon as $13.8B, the wonderful quantity ever recorded.

Howard Lutnick, the CEO of Cantor Fitzgerald, predicted an upward shift against the tokenization of RWAs, such as bonds issued on blockchains, throughout a Chainalysis Links Convention held in Unique York.

Robert Kiyosaki Endorses Cathie Woods BTC Put Prediction

The remarks of Robert Kiyosaki, who has at all times been bullish on Bitcoin, came on the heels of the bullish model prediction made by Cathie Woods, the founder of Ark Make investments asset administration company, who has been optimistic concerning the chance of space Bitcoin ETFs encouraging establishments to put money into Bitcoin.

For the length of the Bitcoin Investor Day conference in Unique York on March 22, Wood acknowledged that the BTC model may perchance well fly to $2.3M per token.

NEW: “Cathie Wood ensures #Bitcoin will hit 💵 $2.3M per #BTC.

Cease I possess her? Sure I design.

Cathie Wood is extremely super. I trust her notion,” says Robert Kiyosaki. pic.twitter.com/GpHokUfd6N

— Bitcoin Data (@BitcoinNewsCom) April 11, 2024

Whereas Wood’s prediction generated criticism for being unreasonable, Kiyosaki praised her and highlighted his trust in her notion.

“Kathie Wood ensures Bitcoin will hit $2.3 million per BTC. Cease I possess her? Sure, I design. Kathie Wood is extremely super. I trust her notion,” he wrote. “Could also she be repulsive? Sure, she’s going to seemingly be. So what? The extra well-known query is ‘What design you watched?’ What if Kathie is honest? What if Kathie is repulsive? And most importantly, ‘How many Bitcoin design you have?’ If Kathie is honest, I will wish I sold extra.”

Whereas Kiyosaki and Cathie Wood may perchance well disagree on ETFs, they each be taught about unparalleled likely in Bitcoin. Their optimism sparks discussions concerning the asset’s future trajectory and anguish in the investment space.

Source : cryptonews.com