Payment Use Cases Fuel Increasing Stablecoin Growth

Price Exercise Cases Gasoline Increasing Stablecoin Growth

The realm stablecoin provide currently stands at over $150 billion, demonstrating unique query for rather true digital resources.

The stablecoin market has also grown more aggressive. As an instance, XRP issuer Ripple recently announced plans to commence a United States dollar-backed stablecoin.

Launching a stablecoin is a pure step for Ripple as we bridge the gap between feeble finance and crypto. We score now 1/ the years of skills 2/ regulatory footprint 3/ a true steadiness sheet and 4/ a community with shut to world payout protection, to give primarily the most interesting of… https://t.co/GlyqhYl9ES

— Brad Garlinghouse (@bgarlinghouse) April 4, 2024

Ripple’s stablecoin will likely compete with the two most dominant stablecoin issuers, Tether (USDT) and Circle (USDC). The provision of Tether’s USDT and Circle’s USDC expanded by nearly $10 billion combined within the direction of the last month.

Is The Bull Market Driving Stablecoin Query?

Interestingly, rising query for stablecoins coincides with the newest crypto bull market.

Yet while stablecoin progress is also correlated with rising cryptocurrency costs, industry consultants deem query for digital resources pegged to the U.S. dollar are surging for other causes.

Austin Campbell, Adjunct Professor at Columbia Change College, advised Cryptonews that while there might be a correlation between stablecoins and the broader crypto market cap, it has been declining over time.

“It appears that stablecoins are being weak independently of crypto trading for payments,” said Campbell.

He added that dollar-backed stablecoins are addressing a broader market segment compared with digital resources fully weak for speculation.

Stablecoin Exercise Cases For Funds On The Upward push

Their utility is also rising as effectively, as a selection of stablecoin payment employ circumstances are coming to fruition.

For excolossal, David Uhryniak, Head of TRON Ecosystem Improvement, advised Cryptonews that an app called Grasp – identified because the “Uber of Singapore” – recently began accepting USDT on TRON for payments.

“TRC20-USDT holders can now pay for their rides or food supply straight with out changing to fiat forex,” said Uhryniak. “I predict a growing model where more world e-commerce platforms will integrate with TRON to settle for crypto transactions for everyday services.”

According to Uhryniak, the TRON blockchain has change into regarded as one of primarily the most traditional transport layers for traditional stablecoins esteem USDT due to the its low transaction charges and like a flash processing.

“TRON has the supreme circulating provide of USDT, at over $54.8 billion,” said Uhryniak. “Since early February of this One year, USDT on TRON has been averaging over 2 million transactions day by day.”

Jelena Djuric, CEO and Co-Founder of digital asset issuance chain Noble, advised Cryptonews that while stablecoins is also weak for decentralized finance (DeFi), the platform has recently considered a surge in stablecoins for payments.

“An example of here is being considered with Cypher Wallet, where users can load USDC from Noble and spend those dollars in stores wherever Mastercard is current,” said Djuric.

Djuric added that she believes primarily the most interesting stablecoin employ circumstances currently point of curiosity on digital dollars.

“Stablecoins are more convenient, efficient and scalable than the feeble financial rails,” she said.

Djuric shared that Noble is currently dealing with $1 billion of quantity month-to-month of USDC transactions from the platform to other Cosmos and Inter-Blockchain Verbal replace Protocol chains.

“We score now grown USDC issuance better than most other native issuance chains for the previous few months. This represents staunch adoption by users and Dapp chains that walk into Noble for liquidity,” said Djuric.

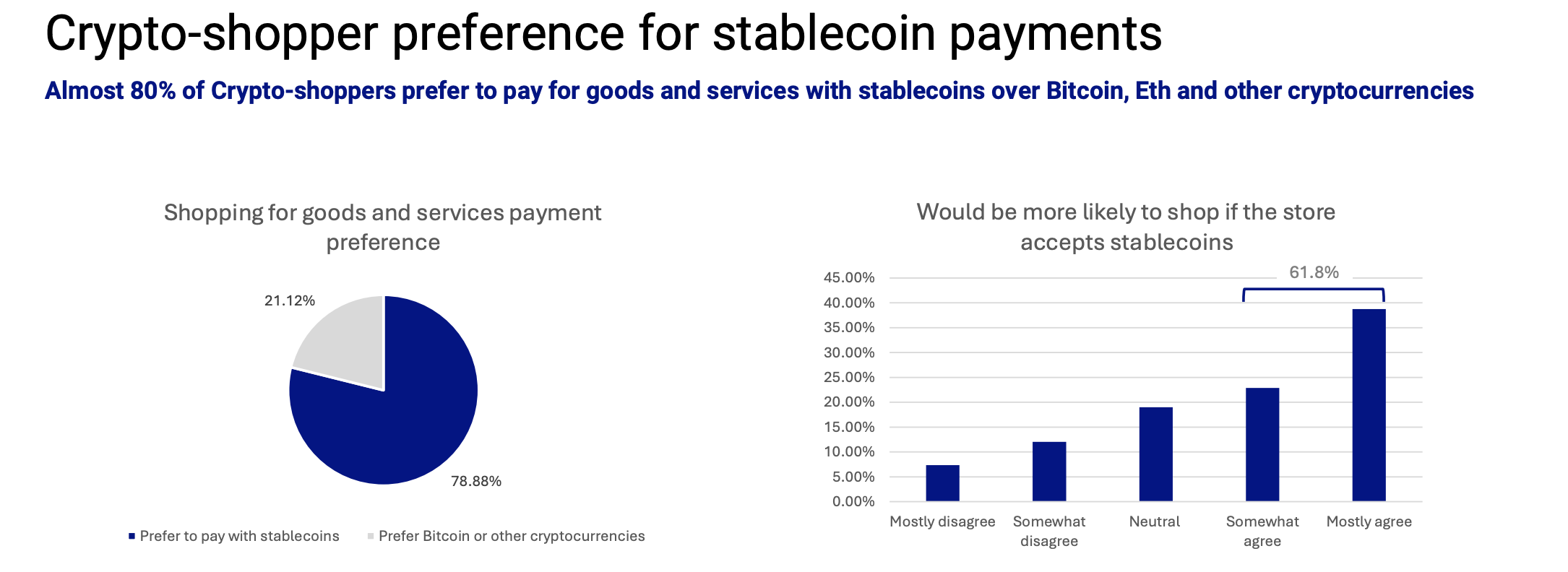

Massimiliano Silenzi, CEO of research company Cryptorefills Labs, advised Cryptonews that newest findings from Cryptorefills explain nearly 80 p.c of crypto-buyers prefer to pay for items and services with stablecoins versus other cryptocurrencies.

While distinguished, Silenzi identified that due to the transaction speeds and charges, most interesting one-sixth of stablecoin payments rob place on the Ethereum mainnet.

“The bulk of stablecoin payments are dispersed pretty evenly within the direction of replacement networks esteem Polygon, TRON, Solana, and Avalanche as effectively as Ethereum layer-2s esteem Optimism and Arbitrum,” said Silenzi. “As a consequence, when it involves stablecoin payment networks that are like a flash, cheap, and scalable, there isn’t but a definite winner.”

Challenges Also can merely Bog down Stablecoin Adoption

While it’s distinguished that stablecoin adoption is also rising due to the staunch-world payment employ circumstances, guidelines and other issues can also slack adoption.

As an instance, while stablecoin guidelines can also collect passed this One year within the U.S., Senator Elizabeth Warren recently criticized the proposed stablecoin bill.

As Cryptonews beforehand reported, Warren argues that developing unique regulatory frameworks for stablecoins might maybe maybe possibly “develop and entrench” dangers they pose to the American banking sector.

Furthermore, David Pope, Commissioner of The Wyoming Valid Token Price, advised Cryptonews that tax principles around stablecoins live a barrier to adoption as effectively.

“The IRS views all crypto (along with Stablecoins) as property (as against money),” said Pope. “This system each time a US person or entity makes employ of a stablecoin for the leisure, it must be reported on their tax return (despite the proven truth that there might be continuously no design or loss).”

Pope believes that if stablecoins change into recurrently weak, this can also likely consequence in hundreds of transactions desirous to be documented.

Moreover to guidelines, Djuric believes that non-crypto natives quiet fight with Web3 ideas equivalent to deepest keys, wallets, on-ramps, bridged variations of the identical stablecoins, and more.

“Noble is attempting to resolve all of those challenges, but it absolutely doesn’t occur overnight. In the end, we need to take into legend chain and asset abstraction as stable but highly intuitive pockets interfaces,” she said.

Indeed, these challenges can also within the wreck lead to lowering query in stablecoins.

As an instance, Paxos’ most newest transparency listing on PayPal USD renowned the circulation of PYUSD in March totaled $188.5 million. This marks a 39% decrease in PayPal’s stablecoin compared with the old month.

Ways To Be bolt Stablecoin Growth Spicy Forward

Challenges aside, Campbell believes that stablecoins will proceed to grow because the crypto web page matures.

“Stablecoins will presumably outgrow DeFi and switch into a tool for staunch-world payments within the direction of the globe,” he said.

Though adoption is also slack, training, along with retail query for stablecoins, will ensure progress within the lengthy flee.

Notably, Tether is already taking steps to design better stablecoin training.

On April 10, Tether announced a partnership with Coins.ph – a favored digital asset swap within the Philippines – to advertise financial training for blockchain skills, Bitcoin, and stablecoins within the region.

According to a Tether weblog post, the educational initiatives being launched will purpose various segments of the Filipino inhabitants. This entails finance consultants esteem bankers and fintech companies, but also distant places Filipino workers seeking efficient remittance solutions.

Pope also believes that as various the contributors moves via the finding out curve, retail query for stablecoins will extend.

“This all means that stablecoins are slowly being adopted,” he said. “Nonetheless can anybody aquire their cup of morning coffee with them but? Potentially fully a couple of areas settle for a pockets switch for that, but adoption does appear to be transferring along.”

Source : cryptonews.com