EU Watchdog Warns 90% of Crypto Trading Funneled Through Few Exchanges

EU Watchdog Warns 90% of Crypto Shopping and selling Funneled Thru Few Exchanges

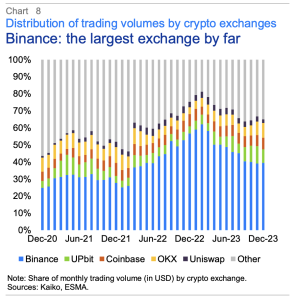

The European Union’s (EU) securities regulator warned in regards to the high concentration of procuring and selling exercise on a runt kind of crypto exchanges. Notably, Binance, a single platform, controls roughly half of of the total market, it acknowledged Wednesday.

Diagnosis from the European Securities and Markets Authority revealed that a mere 10 exchanges address about 90% of all cryptocurrency trades. Additional, the document identified significant variations in market liquidity, with a tendency for bigger exchanges to expose increased ranges of liquidity.

“Whereas this can even very smartly be advantageous from an efficiency standpoint (which implies that of economies of scale), it raises genuinely intensive concerns regarding the implications of a failure or malfunction at a significant asset or switch for the wider crypto ecosystem,” the ESMA acknowledged.

MiCA Rules Yet to Enhance Euro Adoption in Crypto

An examination of the fiat currencies employed in the future of the crypto market revealed a stable dependence on USD and the South Korean won. In the period in-between, the Euro plays a relatively insignificant feature, accounting for about 10% of transactions.

Furthermore, it observed that Markets in Crypto Sources (MiCA) legislation has no longer, to date, resulted in any observable elevate in the use of the Euro in the future of the cryptocurrency market.

However the unique lack of affect, the ESMA expects that MiCA could well emerge as a doable catalyst for say upon its implementation in 2024. This anticipated perform stems from MiCA’s center of attention on strengthening investor protection in the future of the market.

ESMA Disputes Crypto’s Stable-Haven Station

Additional, the ESMA challenged the idea of crypto property performing as a protected haven in the future of periods of broader market afflict. Its document identified a stage of co-fling between crypto property and equities, while additionally highlighting the absence of a consistent relationship with gold, a traditionally identified protected-haven asset.

Licensed Exchanges, Unclear Locations

The regulator additionally highlighted that the inherent opacity of crypto transactions makes it tough to pinpoint their starting do. Yet, a significant fragment of crypto exchanges are learned to be situated in jurisdictions characterised as tax havens.

In line with the ESMA, roughly 55% of transactions are completed on crypto exchanges licensed under the EU’s VASP framework. On the opposite hand, a large proportion of these transactions seemingly occur outside the European Union.

Bitcoin, Ether, and Tether Dominate Crypto Market

One at a time, it learned that a upward thrust in the kind of actively traded crypto property since 2020 has no longer mitigated the loads of concentration in the future of the market. As of Dec. 2023, a mere three cryptocurrencies – Bitcoin (BTC), Ether (ETH), and the stablecoin Tether (USDT) – comprise a large 74% of the total market capitalization and 55% of the annual procuring and selling quantity.

Source : cryptonews.com