Prisma Finance Gains Strong Community Support for Protocol Restart with DAO Approval

Prisma Finance Gains Solid Neighborhood Succor for Protocol Restart with DAO Approval

Prisma Finance has unveiled a intention to cautiously restart operations following a hack that resulted in a loss of $11.6 million and precipitated a momentary stop of the platform on March 28.

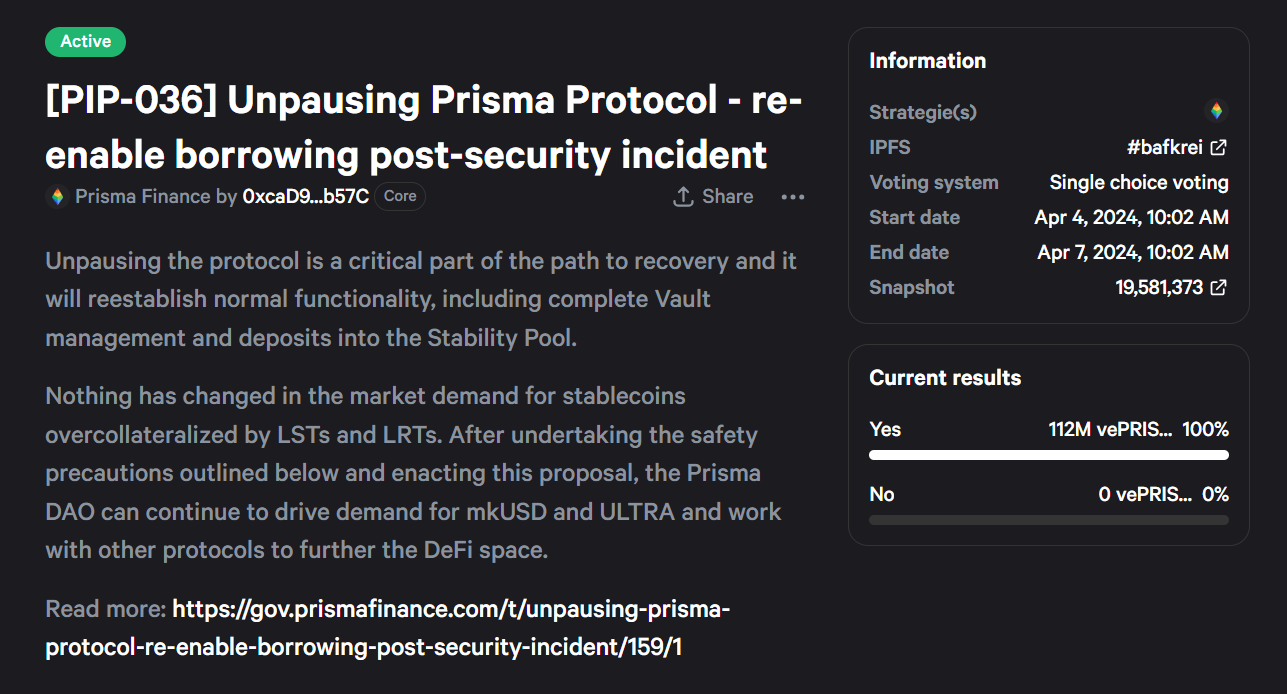

Reinstating borrowing capabilities on Prisma hinges upon reaching consensus via an ongoing neighborhood vote.

Prisma Finance Exploited for $10 Million: Restoration Efforts and Governance Response

On March 28, the decentralized finance (DeFi) protocol Prisma Finance became exploited to steal spherical $10 million price of cryptocurrencies. The exploit at Prisma Finance became executed via a flaw within the migration zap contract, resulting in a loss of roughly $11.6 million.

This contract became supposed to rearrange transitions between trove managers nonetheless became manipulated to extract sources, including wrapped-staked Ethereum (wstETH). The stolen sources had been in an instant transformed to Ethereum (ETH), complicating efforts to be aware and enhance the funds.

The protocol claimed that the core functionality of Prisma Finance remained unaffected. The anxiety became confined to a particular component, the migration zap contract, thereby no longer compromising the protocol.

Unusual Snapshot Vote: [PIP-036] 🌈

As we development in direction of unpausing Prisma, your next step involves this Snapshot vote. This may per chance well convey us closer to re-enabling the skill for our customers to deposit LSTs & LRTs and borrow our overcollateralized stablecoins.

Your participation is… pic.twitter.com/pG81WpFVN3

— Prisma Finance (@PrismaFi) April 4, 2024

Prisma Finance enacted an emergency stop on all trove managers in accordance with the breach. This action has halted all borrowing actions and averted new liquidity from being offered into the protocol, aiming to stabilize the anxiety. On the opposite hand, the Prisma Finance DAO subsequently launched a four-day governance vote the next day, that may per chance well cease on April 7.

As of basically the most recent change, the proposal to renew borrowing actions on Prisma has garnered unanimous toughen, with a 100% “Yes” vote from collaborating DAO members, indicating sturdy neighborhood backing. On the opposite hand, the closing decision may per chance be positive after the balloting time limit.

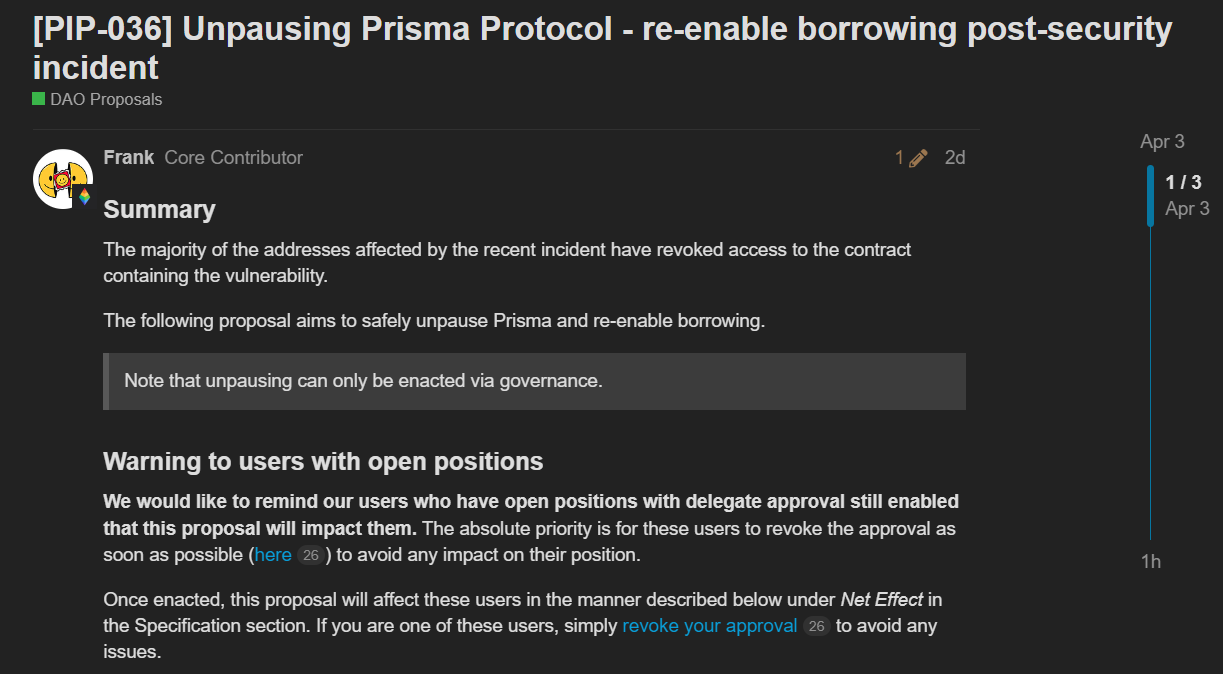

Customers are strongly instantaneous to revoke delegate approvals for launch positions, because the protocol’s unpause may per chance well elevate the likelihood of fund loss. Previously, the protocol had identified 14 accounts that had but to revoke the affected tidy contract, doubtlessly exposing them to a mixed loss of $540,000.

Plans to Resume Borrowing Actions After Exploit

On April 3, core contributor Frank Olson offered a opinion to “safely” unpause the Prisma protocol, thereby reinstating functionalities such because the skill for customers to deposit liquid staking tokens (LSTs) and liquid restaking tokens (LRTs) and borrow overcollateralized stablecoins.

Olson addresses the significance of unpausing the protocol, mentioning that the action is pivotal for the recovery process and reinstating customary operations, including complete Vault administration and deposits into the Steadiness Pool. He also highlighted Prisma’s ongoing commitment to making improvements to security measures, including enticing in continuous auditing products and companies, trojan horse bounty programs, and overall security enhancements.

Particularly, basically based on the forum post by Frank, Prisma Finance has outlined its instantaneous response and drawing shut steps following the hack.

To tackle the exploit, Prisma Finance has proposed a lot of key measures. In the foundation, there may per chance be a essential reduction in protocol-owned liquidity (POL) by reducing the weekly POL amount from $40,000 to $0. Additionally, the distribution to stakeholders may per chance be impacted, with the weekly amount distributed to vePRISMA holders halved from $160,000 to $80,000.

Frank highlighted that these proposed modifications must no longer supposed to be eternal nonetheless are deemed needed now. He talked about,

“As new data comes in about this anxiety, we may per chance well decide to revisiting these parameter modifications 1 week after passage.”

Source : cryptonews.com