Russian Crypto Exchange Transactions Worth $52B Last Year – Central Bank

Russian Crypto Change Transactions Value $52B Final Year – Central Financial institution

Russian crypto alternate transactions amounted to almost $52 billion in 2023, the nation’s Central Financial institution has printed.

The monetary institution says over $51.67 billion rate of Bitcoin (BTC) and Ethereum (ETH) transactions it monitored on “well-known crypto exchanges” was once “potentially” traceable to Russian citizens.

Nonetheless, by the Central Financial institution’s hold admission, most Russians attain not even employ major crypto exchanges to commerce money. And that can counsel that the “true” figure will be unheard of upper.

Russian Crypto Change Use Dwarfed by P2P Market?

The Central Financial institution made the crypto claims in its annual file on the Financial Year 2023. The file’s authors wrote:

“Diagnosis of the cryptoasset market indicates a potentially excessive stage of involvement of Russians in the market. As of the quit of 2023, the volume of Bitcoin and Ethereum transactions on the biggest crypto exchanges – potentially attributable to Russians – amounted to 4.78 trillion rubles.”

Likely, this figure doesn’t reveal the entire checklist, alternatively.

Per the monetary institution’s hold calculations, the look-to-look (P2P) market has become “the well-known channel for acquiring cryptoassets in Russia.”

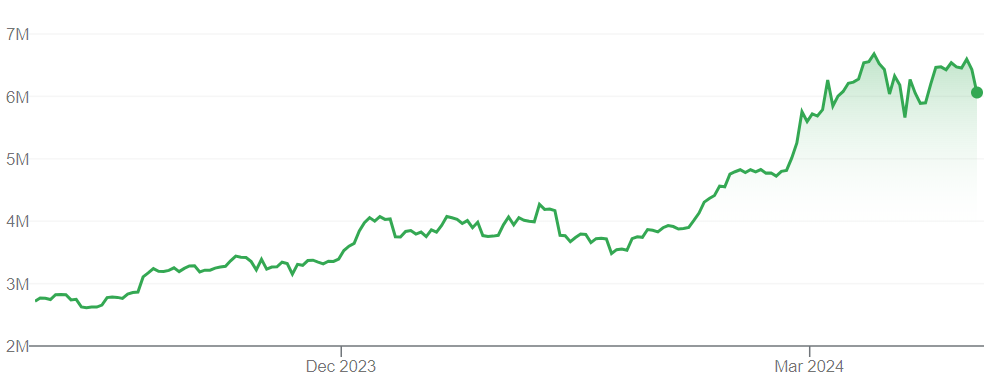

The monetary institution has beforehand stated that “in the well-known half of of 2023,” the typical monthly volume of P2P transactions “among Russians” increased “by bigger than 50%.”

How Does Russian Central Financial institution Calculate Crypto Change Data?

The monetary institution famed that its alternate-associated knowledge was once in line with calculations made the usage of the blockchain analytics draw Prograchniy Blockchain (literally “Transparent Blockchain”).

The draw is the brainchild of Rosfinmonitoring, the nation’s anti-money laundering agency. Rosfinmonitoring developed the draw in 2021, and claims it’ll rate citizens’ transactions across a couple of blockchain networks.

Per a Kommersant file from 2023, Rosfinmonitoring claimed that its draw is so lawful that it even helped police solve a crypto-powered contract killing case.

The draw offers executive users with knowledge on both the sender and the recipient of cryptoasset transactions.

1/4

Bloomberg: “Russia’s central monetary institution acknowledged it has no better alternate choices than the Chinese language yuan for its reserves after two years of the Kremlin’s warfare on Ukraine and the next seizure of its world property. As of March 22, Russia’s…https://t.co/GnKrSNaJLU through @markets— Michael Pettis (@michaelxpettis) March 30, 2024

In June 2023, a Russian IT firm claimed that nearly $300 million rate of crypto trades are made readily accessible “on daily foundation” on the nation’s P2P market.

The monetary institution, in the intervening time, claimed in December final twelve months that it seen a “plunge” in the necessity of Russians the usage of major foreign crypto alternate platforms to amass and sell crypto.

Source : cryptonews.com