What Causes the Kimchi Premium? South Korean Experts Explain

What Causes the Kimchi Top class? South Korean Specialists Account for

Kimchi top rate crypto mark discrepancy is pushed by a lack of South Korean corporate funding in Bitcoin (BTC), verbalize South Korean consultants.

Per Hanguk Kyungjae, a paucity of domestic funding recommendations additionally drives the phenomenon that just nowadays noticed BTC prices in South Korea outpace the remainder of the realm by 10%.

Kimchi Top class: Are South Korean Firms to Blame?

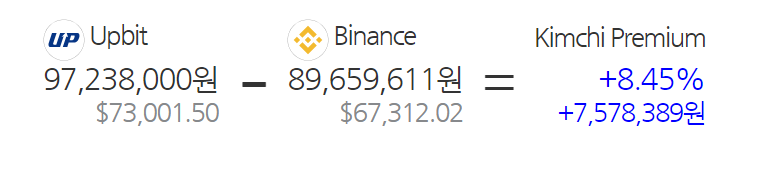

In spite of a present dip in BTC prices, the kimchi top rate held tough at over 8% over the weekend.

Shopping and selling volumes on main domestic platforms additionally remained high, after starting up an exact climb in early February.

The media outlet quoted Hwang Seok-jin, a Professor at Dongguk College, as explaining:

“When in contrast to diversified international locations, there are somewhat few corporations in South Korea that retain Bitcoin. Since the amount of Bitcoin held by institutions is smaller than that held by particular person traders, upward mark rigidity is comparatively high. Here’s especially noticeable at some level of classes of excessive depend on of.”

South Korean data retailers had been captivated when Tesla introduced its Bitcoin investments in early 2021.

Speculation at some level of the 2021 crypto bull market centered on whether or not South Korean corporations would strive to prepare suit.

On the opposite hand, a series of crypto-linked controversies own to this level hampered enormous-title corporations’ bids to make investments in Bitcoin.

Their space off has not been helped by precise circumstances engaging traders who prosecutors accused of exploiting the kimchi top rate.

Stock Market Blues Drive Bitcoin Count on?

Other consultants claimed that South Korea’s wealth in relation to its electorate’ funding recommendations become one other factor.

The Disagreeable Home Product (GDP) in South Korea expanded 2.2 p.c in the fourth quarter of 2023 over the identical quarter of the previous year, following 1.4 p.c increase in the third quarter.https://t.co/c8X3wZxgHS pic.twitter.com/jzvrgW3Xz3

— TRADING ECONOMICS (@tEconomics) March 4, 2024

South Korean wages own been growing yearly for the previous twenty years. Conglomerate staff in the nation salvage bigger than most of their East Asian counterparts, Yonhap reported this week.

On the opposite hand, a “lack of funding sources” persists, due to a “sluggish domestic inventory market,” consultants acknowledged.

Stocks took a fall on Friday after a three-day rally as foreign traders went on a promoting spree amid bigger-than-anticipated inflation in the US. The local forex fell sharply in opposition to the buck. https://t.co/gwQ6OH8JQ5

— The Korea JoongAng Everyday (@JoongAngDaily) March 15, 2024

Kim Younger-ik, a Professor at Sogang College’s Graduate School of Economics, acknowledged:

“Because the domestic inventory market has just nowadays been unhurried and unresponsive, there may be a tendency for traders, especially the youthful technology, to flock to […] cryptoassets.”

Specialists claimed diversified components had been additionally at play, such as bans on in one other country exchanges that eavesdrop on South Korean potentialities.

This factor alone has resulted in liquidity-linked concerns at some level of times of high depend on of. Only five South Korean corporations own licenses that allow them to provide KRW-crypto trades.

The media outlet conceded that a final factor which will space off this routine crypto mark phenomenon may well additionally play a portion. The newspaper wrote:

“The kimchi top rate may well well additionally be proof that South Koreans in general factual own a a lot bigger stage of passion in cryptoassets than folks in diversified international locations.”

Source : cryptonews.com