Over $520M in Longs Liquidated as Bitcoin Price Drops Below $68,000

Over $520M in Longs Liquidated as Bitcoin Label Drops Below $68,000

The cost of the leading cryptocurrency Bitcoin confronted a deep correction from its all-time highs staunch by means of early Asian hours on Friday. Bitcoin is procuring and selling below $68,000, almost about 7.5% down in the closing 24 hours. The cost correction precipitated big liquidations as your entire community saw over $657 million positions liquidated in the closing 24 hrs.

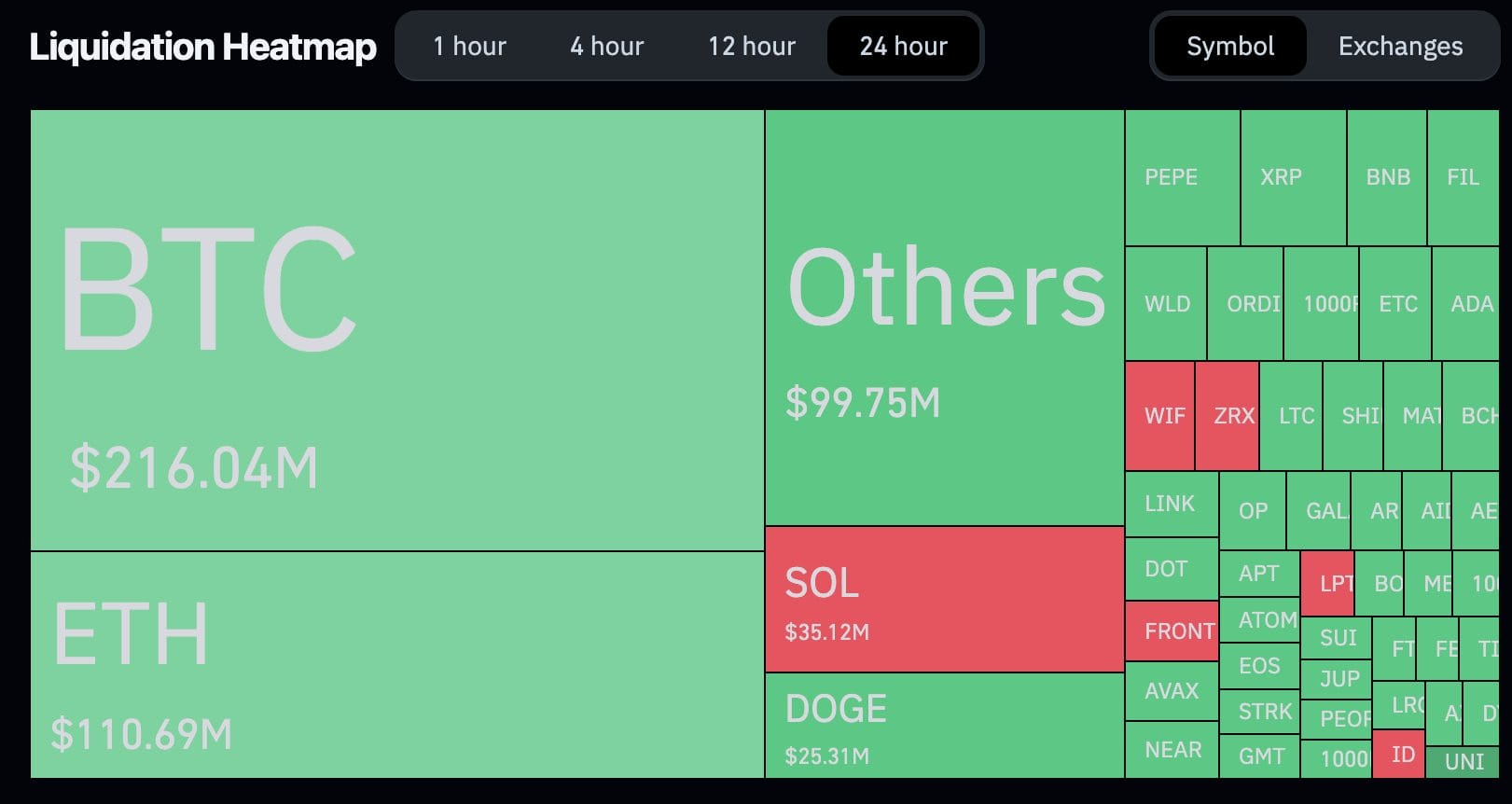

As per Coinglass records, over $522 million in longs and $137 million in fast positions bear been liquidated in the closing 24 hrs. Out of which $216 million in BTC longs were liquidated. Most liquidations took place on Binance and OKX with $248 million and $236 million, respectively.

The 2nd-most inspiring cryptocurrency in market cap Ethereum also dropped below $4,000 this present day. At demonstrate procuring and selling at $3,700, ETH is down almost about 7.3% in the closing 24 hrs.

Bitcoin Diagram ETFs File $132M in To find Influx

The total procure inflow of Bitcoin spot ETFs on March 14 became as soon as $132 million. Grayscale ETF GBTC had a single-day procure outflow of $257 million. The Bitcoin spot ETF with a actually great single-day procure inflow on the day became as soon as the BlackRock ETF IBIT, with a procure inflow of $345 million, as per SoSoValue records.

The present entire historic procure inflow of IBIT has reached $12.37 billion. Followed by VanEck ETF HODL, the one-day procure inflow is roughly $137 million, and the present entire historic procure inflow of HODL is at $364 million. As of press time, the entire procure asset value of Bitcoin spot ETFs is $57.86 billion, the ETF procure asset ratio (market value as a proportion of the entire market value of Bitcoin) reached 4.16%, and the historic cumulative procure inflow has reached $11.96 billion.

On March 12, spot Bitcoin ETFs recorded a staggering $1.05 billion in procure inflows, absolute top single-day procure inflow since the open date.

Source : cryptonews.com