Michael Saylor Says There Is No Reason to Sell Bitcoin Anytime Soon

Michael Saylor Says There Is No Motive to Sell Bitcoin Anytime Soon

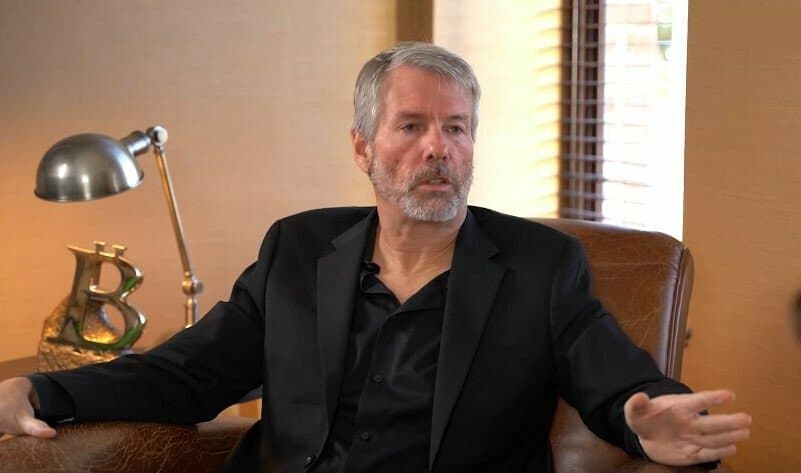

MicroStrategy executive chairman and co-founder Michael Saylor says there may per chance be not a motive to promote any of his Bitcoin anytime rapidly, in an interview with Bloomberg’s Katie Greifeld on Tuesday.

Saylor said the approval of an arena Bitcoin ETFs is a rising tide that’s going to lift all boats – this phrase is metaphorically associated with the premise that as the market improves this may per chance well perchance abet all contributors.

“Right here’s a rising tide, it’s gonna lift all boats”

“But in the occasion you see at what the distance ETFs are doing – they’re facilitating the digital transformation of capital and daily tons of of hundreds of hundreds of bucks of capital is flowing from the ragged analogue ecosystem into the digital economy,” adds Saylor.

“I’m going to be attempting to search out the stay eternally,” including “Bitcoin, is the exit approach,” Saylor told Bloomberg.

Pent-up Seek files from for Bitcoin ETFs

The MicroStrategy chairman is making his rounds in the media and was as soon as currently quoted asserting there may per chance be over a decade of pent-up achieve a matter to for Bitcoin alternate-traded funds, in an interview with CNBC.

“There’s 10 years of pent-up achieve a matter to of us been waiting for these ETFs and at final, mainstream investors are ready to access Bitcoin and I suspect that’s what’s driving the surge of capital in the asset class,” said Saylor.

The MicroStrategy chairman discussed the pronounce of the crypto trade, the rollout of bitcoin ETFs, bitcoin’s hiking valuation, and future plans.

Within the interview, Saylor also outlined that MicroStrategy will doubtless be rebranding as a Bitcoin trend company. He outlined, that the rebrand was as soon as a natural resolution this potential that of the corporate’s success in its Bitcoin approach and uncommon reputation as the realm’s largest publicly traded holder of Bitcoin.

Saylor highlighted plans to obtain application, generate cash mosey, and leverage the capital markets to procure more Bitcoin for shareholders and promote the growth of the Bitcoin network.

Saylor’s BTC Holdings Reach $10B

MicroStrategy’s Bitcoin investment has soared beyond the $10 billion label, proudly owning over 190,000 BTC as Bitcoin’s cost climbs previous $50,000. This achievement underscores MicroStrategy’s self belief in Bitcoin’s prolonged-time duration possibilities and its utility as an inflation hedge, writes Arslan Butt from Cryptonews.

Since joining the Bitcoin market in August 2020, MicroStrategy’s BTC portfolio has expanded considerably, even amidst the endure market’s challenges in early 2022. Despite experiencing a downturn in its fourth-quarter earnings and profit, MicroStrategy, below Michael Saylor’s leadership, persisted to bolster its Bitcoin holdings, procuring a additional 850 BTC for $37.2 million in January on my own.

Source : cryptonews.com