Bitcoin Price Holds Above $70,000 Level Following Violent $4,500 Price Swing – Where Next for BTC?

Bitcoin Trace Holds Above $70,000 Level Following Violent $4,500 Trace Swing – Where Next for BTC?

The Bitcoin (BTC) mark seen wild trading stipulations on Tuesday, in brief hitting unique all-time highs above $73,000 rapidly after the liberate of hotter-than-anticipated US inflation recordsdata, sooner than without observe dropping into the $68,000s.

BTC has since recovered over 3.5% from earlier session lows to $71,000, with its violent $4,500 mark swing having wiped out positions held by leverage trader rate over $100 million, as per coinglass.com.

The Bitcoin mark’s sturdy rebound from sub-$70,000 intra-day lows will embolden the bulls, who live very great in alter.

Bitcoin is up 12.7% in seven days and 42% within the past 30 days, as per CoinMarketCap.

Utilizing the upside has been a mixture of bullish fundamentals.

These encompass mountainous continuous inflows into the honest lately launched residing Bitcoin ETFs and FOMO as Bitcoin gears up for its four-yearly halving event.

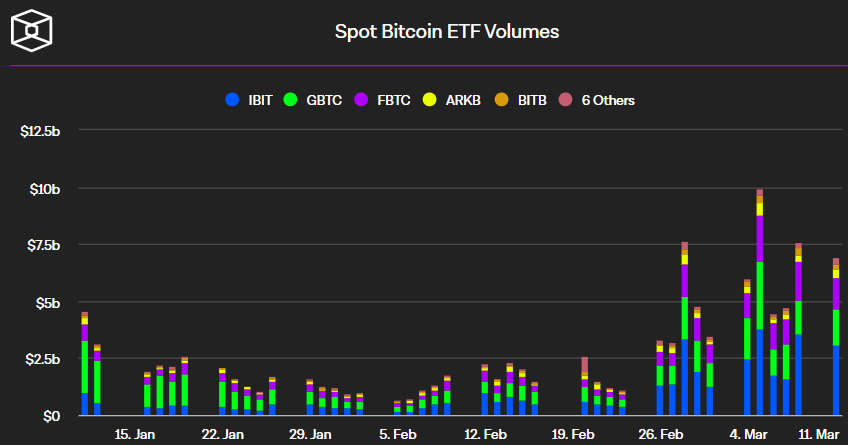

Field ETF trading volumes clocked in at shut to $7 billion on Monday, as per The Block recordsdata.

Final week, volumes averaged over $6.5 billion per day.

That’s a more than 6x jump from early February when each day volumes were averaging spherical $1 billion per day.

Where Next for the Bitcoin Trace?

And whereas the most fresh hotter-than-anticipated US inflation figures has pushed merit on Fed rate slash expectations, with the CME Fed Look Machine displaying that cash markets now mark a 32% of no rate cuts by June (up from 28% on Monday), analysts enact no longer ask this to have a protracted lasting impact on the unique bull market.

“There would possibly possibly be honest too great bullish momentum in crypto,” Nansen analyst Aurelie Barthere acknowledged in a compare gift.

“We enact no longer ask a large promote-off for crypto as this repricing has took procedure within the past few months without questioning the bull market.”

The velocity at which unique BTC tokens are issued to community validators (or miners) is scheduled to halve next month.

With the provision shock of the halving looming coupled with a large inflow of most up-to-date seek recordsdata from from the ETFs, Bitcoin mark dangers live tilted strongly to the upside.

While there would possibly possibly well without peril be transient setbacks, Bitcoin stays in a length of mark discovery because it scales all-time highs.

In such eventualities, investors tend to focal point on major spherical numbers as their mark targets.

$100,000 is one such stage that the market is probably going to be fixated on.

There stays an exterior likelihood that Bitcoin can rally here sooner than the April halving.

Source : cryptonews.com