South Korea’s Crypto-keen K Bank Aims for IPO Amid BTC Boom

South Korea’s Crypto-alive to Ok Monetary institution Objectives for IPO Amid BTC Enhance

Ok Monetary institution, a South Korean neobank that has viewed hasty bid thanks laregely to its crypto operations, is remark to originate an initial public offering (IPO) recount.

Unnamed monetary sector officers mentioned on March 10 that Ok Monetary institution’s board of directors has signed off on the poke.

The aim monetary institution now reportedly has the “purpose of itemizing on the South Korean KOSPI stock market within the year.”

Ok Monetary institution – A South Korean Crypto Success Story?

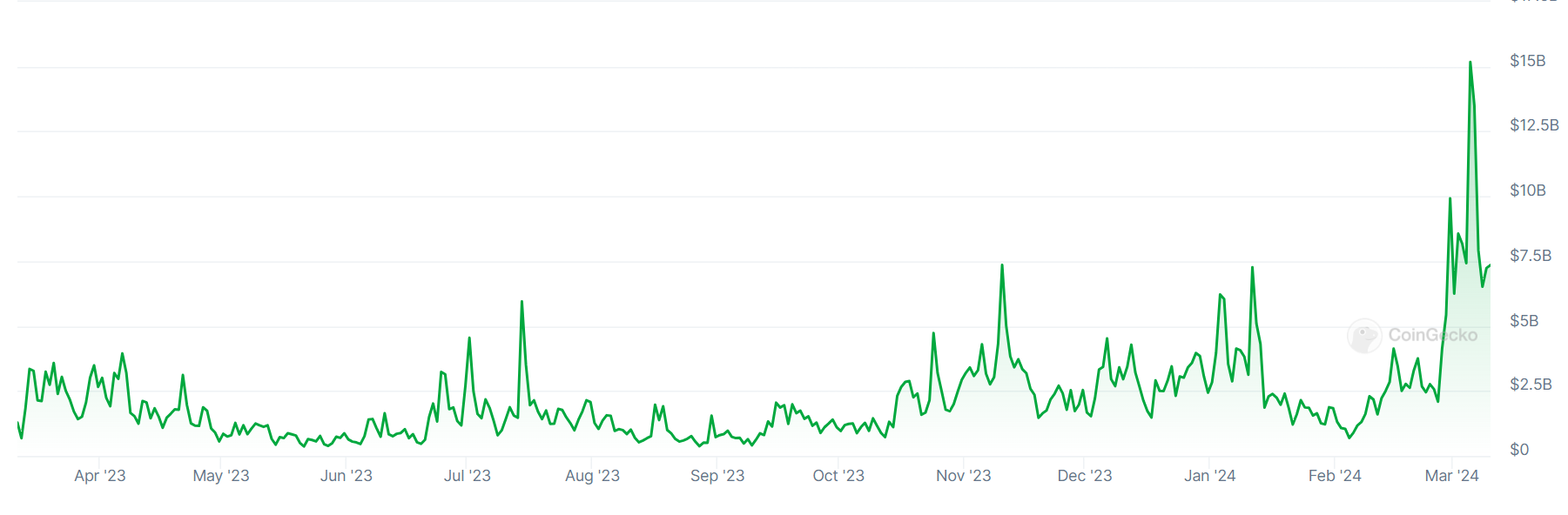

Per the news outlet Viva100, the company is banking on “anticipated advantages” from a “fresh lengthen in hobby in Bitcoin” amongst crypto-alive to South Korean retail traders.

Ok Monetary institution supplies “staunch-name” banking providers (fiat on/off ramps) to Upbit, the nation’s greatest crypto alternate.

Right thru the coronavirus pandemic, this partnership proved a extensive success, as Ok Monetary institution used to be the correct platform that allowed fresh users to register for accounts on-line.

Crypto accounts contain proved current ever since, with Upbit-linked accounts mute making up a natty section of the monetary institution’s revenues.

Ok Monetary institution has viewed a hasty upward push in customer registrations at some stage in outdated BTC bull markets. The monetary institution appears to be like confident of an additional lengthen as Bitcoin continues to interrupt all-time designate files.

The media outlet mighty that a fresh CEO, the digital finance educated Choi Woo-hyung, has currently taken over at Ok Monetary institution, fostering a “obvious inner and exterior atmosphere for IPO preparation.”

More South Korean Crypto Companies to Launch IPOs?

The media outlet claimed the neobank reached out to “predominant securities firms” earlier this year.

In February the monetary institution reportedly “selected NH Investment & Securities, KB Securities, and the Monetary institution of The United States (BofA) as hottest negotiation partners.”

The outlet also claimed that the monetary institution has begun an “inner recruitment job” because it forms a devoted “IPO team.”

A outdated recount to rob the monetary institution public in South Korea ended in disappointment. Ok Monetary institution handed a preliminary KOSPI itemizing screening test whereas pursuing an IPO recount in 2022.

Nonetheless, the monetary institution used to be derailed by a 2022 stock market lunge. The sluggish market pressured it to successfully shelve its plans in February 2023.

South Korean shares are undervalued in contrast to many of their guests. Now the authorities is making an try to repair the “Korea Gash worth” by making company boards extra responsible to shareholders https://t.co/HQphLNY7lh

— Bloomberg Markets (@markets) March 6, 2024

But Ok Monetary institution surpassed the 10 million prospects trace at the tip of February 2024, because the BTC designate began to upward push. The media outlet wrote:

“The realistic number day-to-day of most up-to-date prospects this year elevated bigger than three occasions as hasty as final year. The fresh upward pattern in Bitcoin is also acting as a obvious factor for the Ok Monetary institution [IPO bid].”

In 2021, at some stage within the final BTC bull market, Ok Monetary institution posted revenues of $22.2 million in price earnings from Upbit-linked accounts.

The Monetary institution of Korea’s policy board is about to lose all of its early inflation fighters, collectively with uncertainties to forthcoming efforts to tamp down designate power, a worn policy director mentioned https://t.co/cWrDp7ngMg

— Bloomberg Markets (@markets) March 5, 2024

Slack final year, Upbit’s closest rival Bithumb unveiled plans to launch its contain IPO recount. With retail traders returning to the market in power, the procuring and selling platform and its recount is often buoyed as BTC costs continue to climb.

On the hight of the 2021 BTC bull market bid, South Korean market analysts claimed that the Upbit operator Dunamu used to be planning to contain a examine Coonbase onto the Contemporary York Stock Commerce.

Source : cryptonews.com