Genesis and Winklevoss’ Gemini Discussed Merger Plans Before Collapse, Court Filings Show

Genesis and Winklevoss’ Gemini Talked about Merger Plans Sooner than Give procedure, Courtroom Filings Demonstrate

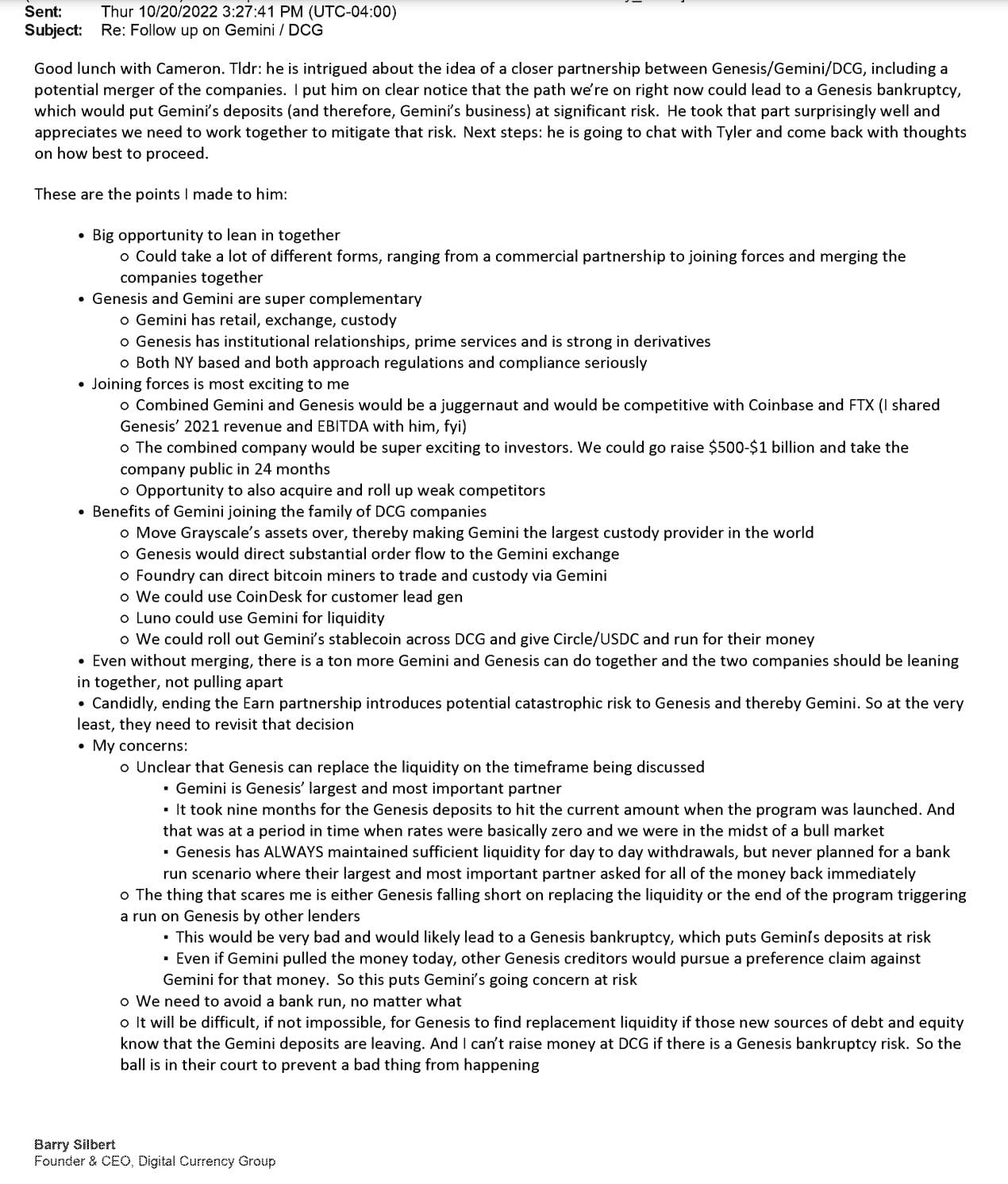

Digital Forex Community (DCG) founder and CEO Barry Silbert proposed a seemingly merger of Genesis and Gemini in step with an e-mail switch relief in 2022, novel courtroom filings prove.

Succor then DCG owned the now-bankrupt crypto lender Genesis. If the proposed “industrial partnership” had long past ahead the opinion would get been to compete with cryptocurrency exchanges Coinbase and FTX, with plans to then carry the firm public in 24 months after elevating $500-1 billion.

Within the e-mail switch, Silbert acknowledged there may well be the seemingly to “be a juggernaut” if the 2 companies joined forces. DCG’s Silbert had proposed the opinion to Cameron Winklevoss in 2022, who turned into then going to focus on plans along with his twin brother, Tyler Winklevoss and come in relief with concepts and plans on how most efficient to proceed.

Genesis and the Gemini “Plan” Program

Genesis and Gemini had jointly equipped an “Plan” program that allowed customers to create passion on their cryptocurrency holdings. Genesis had to freeze buyer withdrawals in November 2022. In January 2023, Genesis Global filed for Chapter 11 bankruptcy safety in Original York searching out for $1.1 billion on behalf of its Plan program customers.

Gemini switch reportedly withdrew roughly $280 million from Genesis Global accurate months sooner than the crypto lender initiated a freeze on buyer deposits and within the extinguish filed for bankruptcy.

Genesis and Gemini additionally faced charges from the U.S. Securities and Replace Rate in January 2023, alleging that the Plan program constituted an unregistered sale of securities.

DCG Settles Over $1 Billion in Debt

In January DCG acknowledged it had successfully settled over $1 billion in debt, in conjunction with the big amount of nearly $700 million owed to its bankrupt subsidiary, Genesis. The announcement came from DCG’s Silbert, who took to the social media platform X to portion the news.

The debt settlement direction of started after Genesis filed a lawsuit in opposition to DCG and its affiliate, DCG Global Investments (DCIG), in September.

Source : cryptonews.com