Bitcoin (BTC) Price Briefly Retakes $68,000 as US Dollar Dips on Dovish Remarks from Fed Chair Powell

Bitcoin (BTC) Sign In fast Retakes $68,000 as US Dollar Dips on Dovish Remarks from Fed Chair Powell

The Bitcoin (BTC) designate briefly retook $68,000 on Thursday amid a dip within the US dollar following dovish remarks from US Federal Reserve Chair Jerome Powell, coming interior about 2% of the myth highs it printed earlier within the week.

Final at $67,500, the Bitcoin designate is up roughly 14% versus the lows it printed earlier this week at under $60,000.

After hitting a contemporary ATH on Tuesday, a wave of profit-taking took the market off guard.

A subsequent cascade of leveraged lengthy liquidations drove the Bitcoin designate briefly aid under $60,000.

Nonetheless solid continued salvage inflows into map Bitcoin ETFs intended the BTC designate stumbled on solid toughen.

And macro headwinds are coming into play on Thursday, as traders up their bets on advance-term Fed rate cuts.

Fed Chair Powell remarked on Thursday that the central monetary institution is “not far” from reaching some extent of ample self perception that inflation is heading aid to the Fed’s 2.0% needs to originate up cutting hobby rates.

In further life like phrases, Powell is announcing that the Fed isn’t removed from cutting hobby rates.

Macro traders answered by upping their bets that rate cuts originate up by June.

As per the CME’s Fed Watch Instrument, the market-implied odds of at least one 25 bps rate lower by June jumped above 75% from under 70% in the end ago.

That weighed on the US dollar as momentary US yields fell, and supported tech stocks.

Crypto tends to private a particular correlation to tech stocks, and a harmful correlation to the US dollar and yields.

The place Subsequent for the Bitcoin (BTC) Sign?

Merchants will likely be monitoring whether or not the Bitcoin designate can retest Tuesday’s myth highs sooner than the tip of the week.

Final up over 55% within the previous 30 days, some traders are getting nervous that Bitcoin has rallied too rapidly, too far this aspect of the upcoming halving.

Traditionally, the Bitcoin designate step by step rallies but then suffers a correction spherical the time of the halving.

Nonetheless others think the introduction of a contemporary supply of inquire of from map Bitcoin ETFs formula this time spherical would per chance well be varied.

Amid macro tailwinds, dangers seem tilted in direction of contemporary upside this month, with Bitcoin doubtlessly space to push into the $70,000s and beyond.

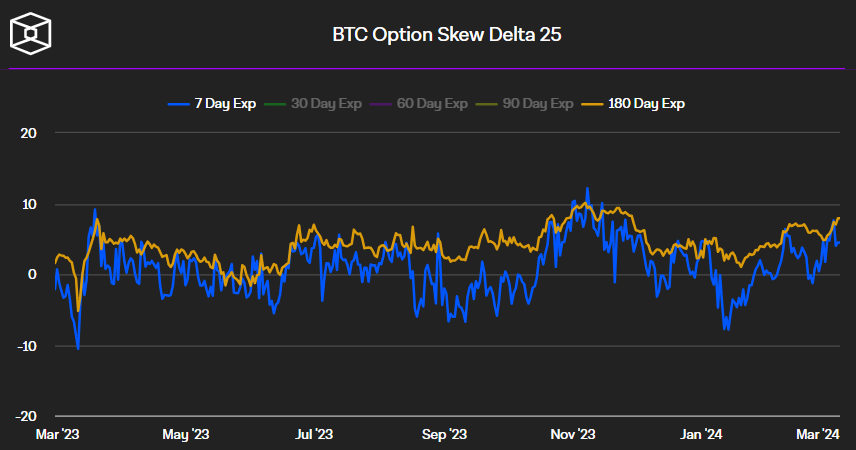

Still, BTC option market pricing suggests nerves in regards to the advance-term outlook, but increased self perception that the lengthy-term outlook is for certain.

That’s reflected in a 7-day 25% delta skew on Bitcoin choices of 4.5, versus a 180-day 25% delta skew on BTC choices of virtually 8, as per files supplied by The Block.

A undeniable 25% delta skew means that option traders are paying a top rate for bullish calls versus an identical bearish places.

The likelihood that Bitcoin will hit $100,000 in 2024 is level-headed very excessive.

Source : cryptonews.com