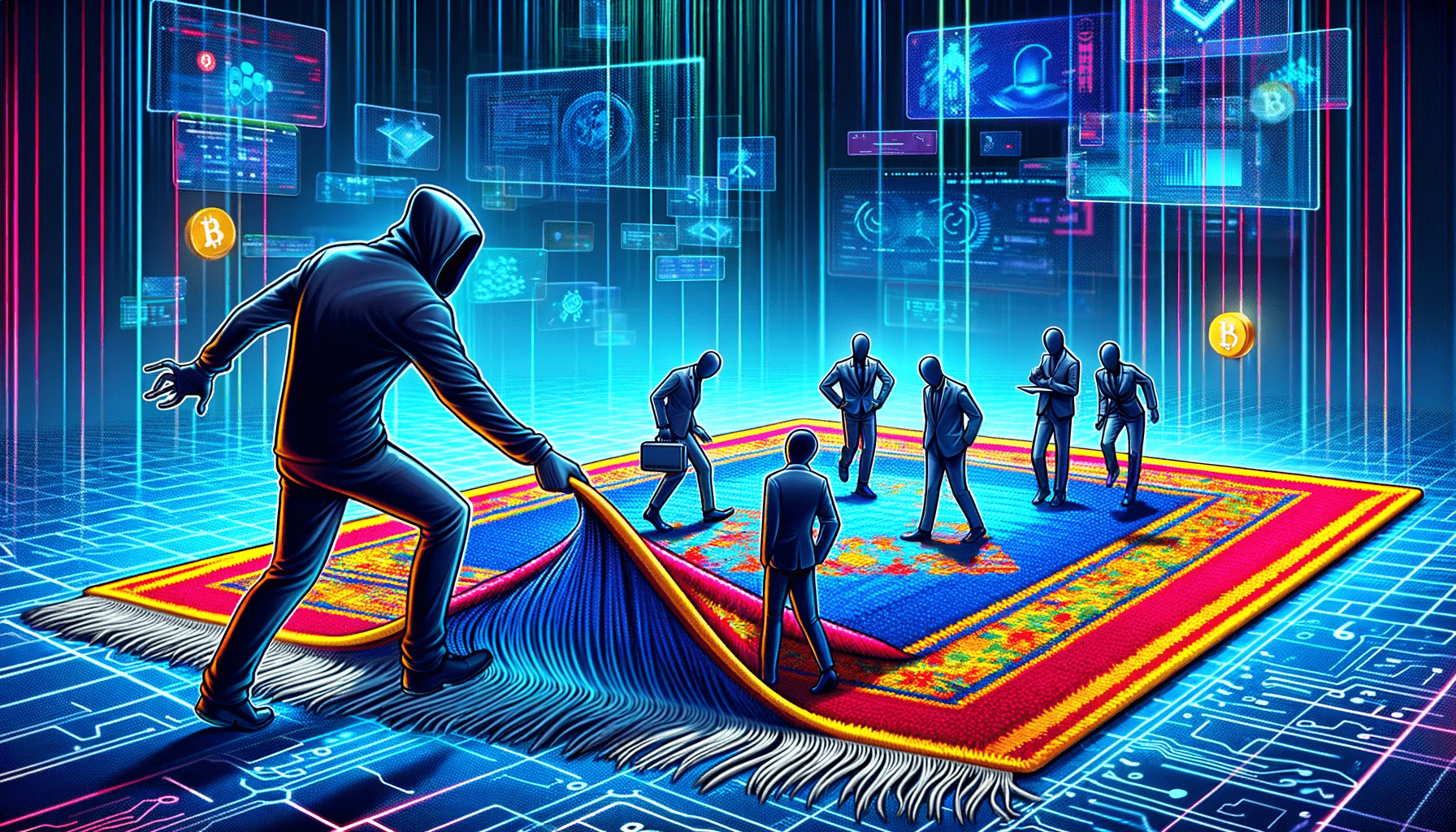

Candy Token Plummets 87% After Lena Network Rug Pull – Here’s What Happened

Candy Token Plummets 87% After Lena Community Rug Pull – Right here’s What Came about

The Lena Community’s newly launched Candy token misplaced almost about all of its cost on Wednesday quickly after the liquidity protocol reputedly rug-pulled the project.

Price data from Dexscreener reveals that the token traded at a day to day high of $3.08 at 12:48 am UTC, sooner than falling to trusty $0.38 at 5:45 am UTC.

One other Crypto Rug Pull?

The token crashed when on-chain data showed that the Lena Community’s deployer tackle had sent 753.11 ETH rate $2.9 million to an tackle connected to the OKX trade. Deposits to exchanges are generally interpreted as exhibiting an investor’s scheme to promote.

The 753 ETH almost about matched the 850 ETH (rate $3.2 million) raised by Lena network in its “Candy Initial Farm Offering” (IFO) introduced closing month, which ended on March 3.

Mere hours sooner than the token went dwell earlier currently, Lena publicly renounced possession of the Candy token contract within the name of “believe and decentralization.”

Crucial announcement 🚨

We now delight in taken a essential step forward in guaranteeing our project’s believe and decentralization – we’ve officially renounced possession of our token contract.

This transfer is all about fostering a safer and additional neighborhood-driven atmosphere. Making issues… pic.twitter.com/hoxbpszWuR

— LENA ⚡ IFO Launching (@LENA_Network) March 6, 2024

“This transfer is all about fostering a safer and additional neighborhood-driven atmosphere. Making issues appropriate the attain it will seemingly be,” wrote Lena.

Lena’s Response

Hours later, Lena hosted a follow-up X Spaces to tackle concerns from neighborhood participants believing they’d been “rug pulled” by founders. The crew admitted on the time that it became “very disappointing” to appear how they’d handled the capital raised from its users, and that they’d a “lack of journey with launching products.”

“We sign the importance of transparency and believe, especially amidst accusations of our project being a scam or facing a most likely rug pull,” the crew added.

Upon announcing the elevate in February, Lena claimed that CANDY would “launch avenues” for Web 3.0 liquidity, and offers its holders a “strategic abet.” Particularly, CANDY holders might perhaps moreover leverage LENA’s DeFi platform for lending, borrowing, and GameFi asset auctions.

“$CANDY token holders will accumulate pleasure from future conversion opportunities to $LENA, bettering token utility, including revenue sharing,” read a press free up on the time.

Knowledge from Immunefi means that over $200 million in cryptocurrency has already been misplaced to hacks and scams in 2024. That’s a 15.4% amplify in comparison with 2023, largely on account of non-public key and pockets compromises.

“We build a question to that 2024 will seemingly search doubtlessly the most tall losses in Web3 ever by attain of volume of funds,” acknowledged Immunefid Comms Lead Jonah Michaels to Cryptonews.

Source : cryptonews.com