Bitcoin Price Prediction: Drops to $39,650 Amid Unconstitutional Canadian Law & GBTC Withdrawals

Bitcoin Impress Prediction: Drops to $39,650 Amid Unconstitutional Canadian Law & GBTC Withdrawals

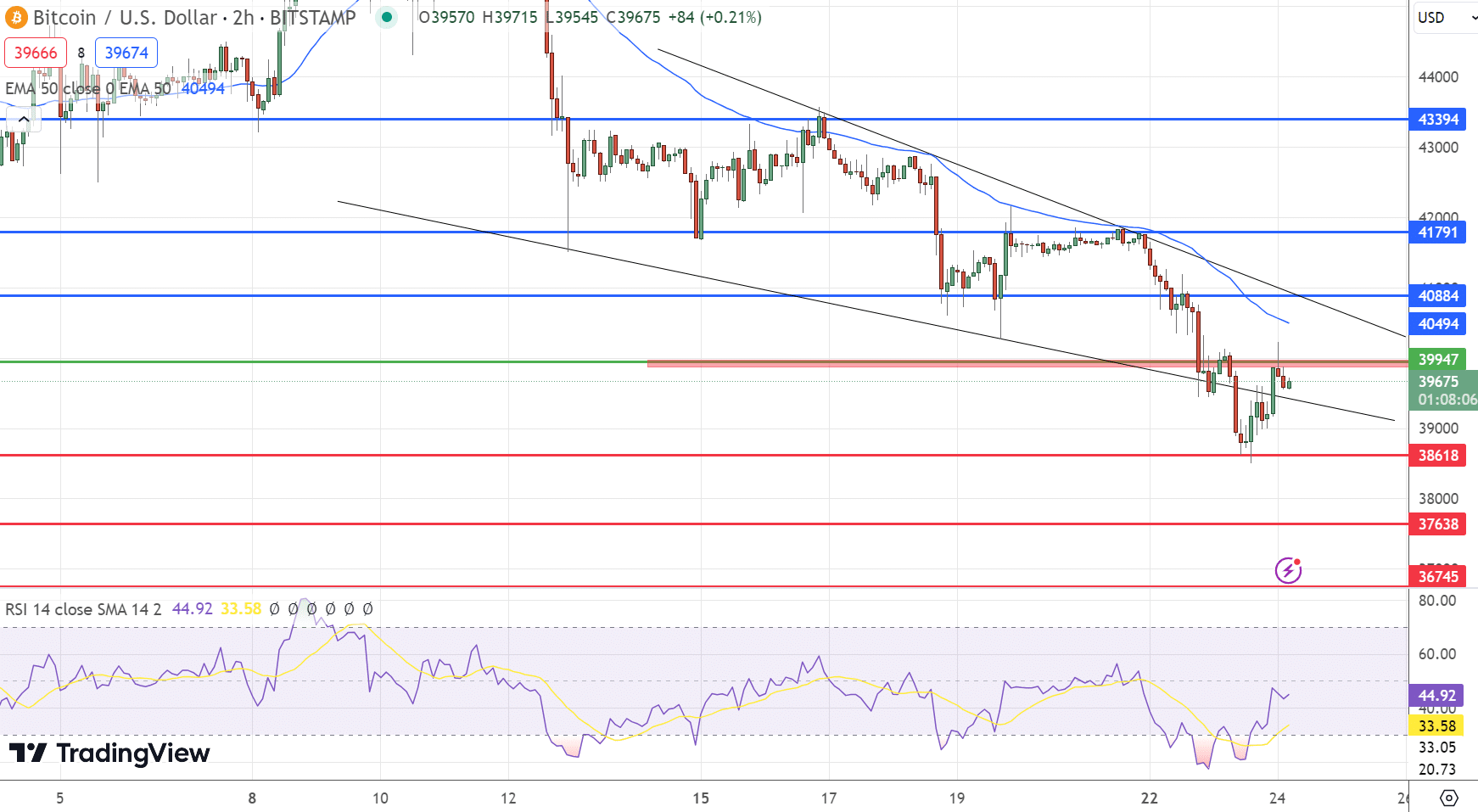

Given the continued events in the crypto market, essentially the most up-to-date Bitcoin label prediction has turn out to be extra and extra complicated as BTC dips to $39,650, influenced by a mix of regulatory recordsdata and investment product dynamics.

On Wednesday, Bitcoin registered a fundamental decline, trading at $39,653, marking a 1% lower.

Contributing to this decline is an effective pattern from Canada. A law stopping cryptocurrency donations to demonstrators change into once ruled unconstitutional.

On the identical time, increased withdrawals from the Grayscale Bitcoin Belief (GBTC) add additional downward stress. This highlights Bitcoin’s sensitivity to political and market forces.

Canadian Law Blockading Crypto Donations Ruled Unconstitutional

The Federal Court docket of Canada has deemed the Canadian authorities’s exhaust of emergency powers to freeze cryptocurrency donations for truckers protesting as unlawful. In February 2022, in response to the “Freedom Convoy” protests in opposition to COVID-19 restrictions, High Minister Justin Trudeau’s authorities employed the Emergencies Act to finish monetary belongings, at the side of cryptocurrencies.

Canada’s exhaust of law freezing protesters’ crypto donations change into once unconstitutional: Court docket https://t.co/IaoJYrFMiK

— Alternate Signals, Alternate Suggestions and Crypto 🇺🇸 (@AlertTrade) January 24, 2024

The court deemed the measure unreasonable and unjustified, declaring that it didn’t qualify as a nationwide emergency. The Canadian Civil Liberties Association celebrates this as a landmark decision. They stress that the Emergencies Act can also aloof be a closing resort.

No matter Finance Minister Chrystia Freeland’s draw to attraction, this ruling highlights the need for judicial oversight in authorities actions on cryptocurrencies.

Given these shapely challenges and the changing authorities see on cryptocurrency donations, Bitcoin’s involvement in funding protests can also face extra scrutiny and cause label volatility.

GBTC Withdrawals Intensify Downward Stress on Bitcoin

Bitcoin has dipped below the $39,000 threshold, marking a two-month nadir largely attributed to well-known investor pullbacks from Grayscale’s Bitcoin Belief (GBTC). Since its transition to a spot Bitcoin trade-traded fund (ETF) on January 11, GBTC has seen an exodus of funds exceeding $3.4 billion.

The persistence of this withdrawal pattern raises market apprehension. Eric Balchunas, an ETF analyst at Bloomberg, reported a staggering $515 million withdrawal on January 23, main to a 13% good purchase in GBTC shares in circulation.

UPDATE

GBTC Outflows abet Coming.

GBTC lost one other 15K #BTC the day gone by.

Total ETF flows had been 📉

GBTC outflows offset

+6K #BTC for Blackrock &

+ 4K #BTC to FidelityFollow dwell updates on our ETF Tracker. pic.twitter.com/QTpdstRwXZ

— Thomas | heyapollo.com (@thomas_fahrer) January 23, 2024

No matter some indications of the outflow abating, there remains a looming tell over capability additional losses. The majority of these contemporary outflows is ascribed to the beleaguered trade FTX, which offloaded a serious quantity of its GBTC holdings.

Bitcoin Impress Prediction

High 15 Cryptocurrencies to See in 2023

Protect up-to-date with the field of digital belongings by exploring our handpicked series of essentially the most efficient 15 substitute cryptocurrencies and ICO projects to retain an see on in 2023. Our checklist has been curated by professionals from Alternate Talk and Cryptonews, making certain professional advice and disturbing insights for your cryptocurrency investments.

Lift abet of this substitute to notion the capability of these digital belongings and abet your self suggested.

Disclaimer: Cryptocurrency projects suggested listed listed below are no longer the monetary advice of the publishing author or newsletter – cryptocurrencies are extremely volatile investments with substantial likelihood, repeatedly attain your maintain study.

Source : cryptonews.com