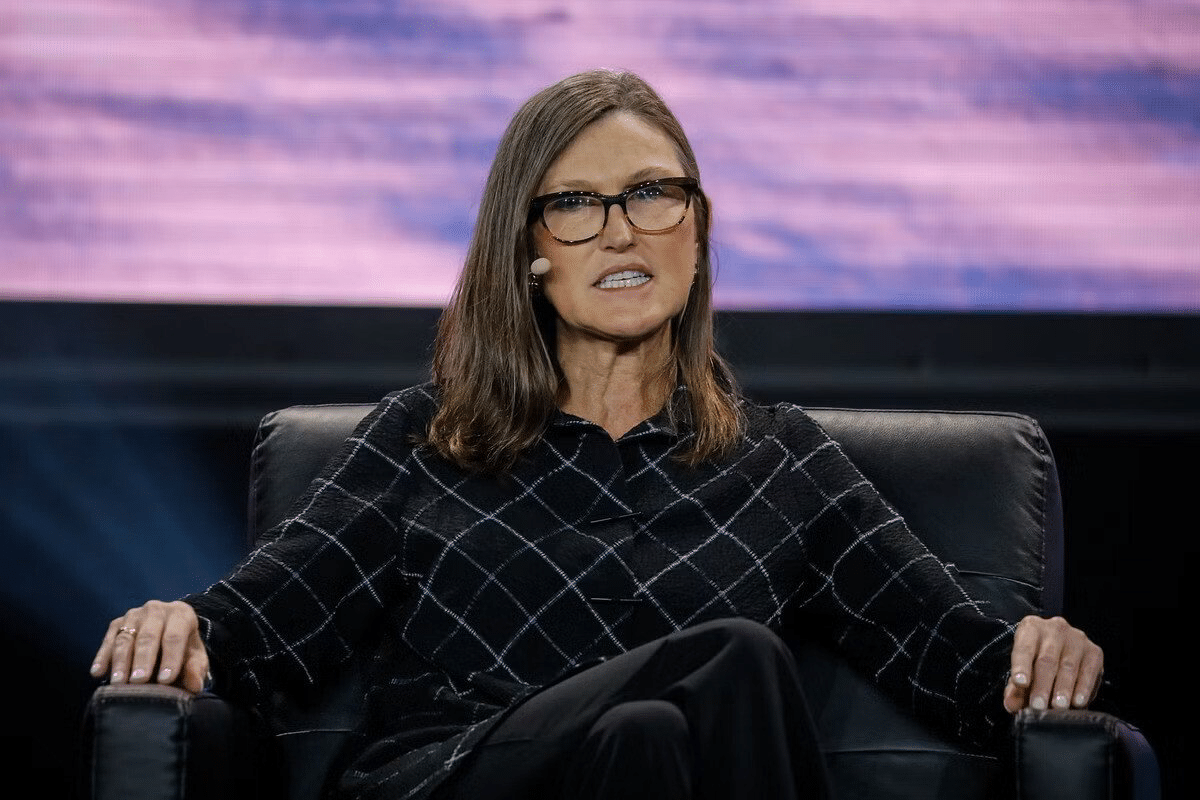

ARK CEO Cathie Wood Calls Bitcoin The “Biggest Of All Crypto Ideas”

ARK CEO Cathie Wood Calls Bitcoin The “Greatest Of All Crypto Suggestions”

Cathie Wood – CEO of tech-focused funding supervisor ARK Invest – says her conviction in Bitcoin (BTC) remains unshaken despite the asset’s most modern “sell the tips” market wipeout.

Bitcoin climbed for four months in a row after Bitcoin asset supervisor Grayscale bested crypto-skeptical federal regulators in court docket.

The tournament bolstered market self belief that a Bitcoin map ETF would finally originate within the US within the next few months. Yet after the product finally hit the market earlier this month, the asset’s bullish momentum rapid circled.

“We’re very mad that Bitcoin is now within the ETF wrapper, and ensuing from this fact very accessible at very low prices,” acknowledged Wood for the length of an interview with CNBC on Wednesday.

CATHIE WOOD: The selloff has no longer alarmed our level of watch the least bit – we think #Bitcoin is one amongst a really mighty investments of our lifetimes 👀🙌 pic.twitter.com/trObEG0gSe

— Bitcoin Info (@BitcoinNewsCom) January 24, 2024

Wood’s funding company owns one amongst 9 fresh Bitcoin ETFs to originate on January 11. After eight days of trading, the fund holds $480 million in sources.

The CEO acknowledged that Ark anticipated a sell the tips tournament after the originate, noting how bankrupt crypto alternate FTX has already sold almost $1 billion worth of shares within the Grayscale Bitcoin Belief (GBTC).

“I non-public some of us anticipated [Bitcoin’s price] to preserve quite of more than it has,” she acknowledged. “But this has no longer alarmed our level of watch the least bit.”

Wood went on to name Bitcoin “one amongst a really mighty investments of our lifetimes,” highlighting its arena of abilities as a international, rules-basically basically based monetary machine. “We predict its the biggest of the total crypto tips available within the market,” she added.

Bitcoin VS Altcoins

Bitcoin’s origins lie in an strive by cryptographers to safe a fairer construct of cash per bank bailouts for the length of the 2008 monetary disaster. The asset’s wealthiest promotors esteem BlackRock CEO Larry Fink now symbolize it as “digital gold,” with its completely mounted provide of 21 million money.

Fidelity, fund supervisor with a most neatly-liked Bitcoin ETF, published a account in January 2022 claiming Bitcoin need to peaceable be “belief to be separately from various digital sources.” Then once more, each Fidelity and BlackRock are at this time pining to originate a map Ethereum ETF, pending regulatory approval.

Within the intervening time, Franklin Templeton has additionally taken a multi-chain means to crypto. The asset supervisor has donned laser-eyes in its profile characterize on X, and claimed that it is persevering with to video show and toughen networks beyond Bitcoin, Ethereum, and Solana.

Source : cryptonews.com