Crypto-Linked Violations Rack Up $2.8B in SEC Fines in 2023

Crypto-Linked Violations Rack Up $2.8B in SEC Fines in 2023

A Cornerstone Be taught file published Wednesday confirmed that crypto fines in opposition to digital asset market contributors hit $2.89b by the high of 2023.

That’s an 11% soar from the $2.6b in fines imposed by 2022.

The findings show that because the crypto market grows, so does the SEC’s arrangement in preserving investors.

Lawmakers globally, and specifically within the US, personal sought to stability industry rules with innovation.

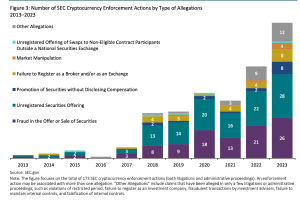

The file additional confirmed that the SEC initiated a total of 46 crypto-associated enforcement actions, a Fifty three% soar compared with 2022.

Fraud and unregistered securities offerings were the most frequent allegations.

Additionally, actions alleging unauthorized securities promotion, market manipulation, and failure to register as dealer-sellers increased.

Every Coinbase and Binance, two predominant avid gamers within the industry, faced enforcement actions all by the identical time in June.

The file moreover highlighted external businesses and organizations that assisted.

Federal businesses esteem the US Attorneys’ offices, the Federal Bureau of Investigation (FBI), the Commodity Futures Shopping and selling Commission, and the Inside of Income Service often supplied their pork up.

Crypto fines and enforcement actions hit new heights in last two years

Under SEC Chair Gary Gensler’s administration, global support has notably increased.

Alternatively, definite Republican lawmakers personal criticized his manner, fearing his strikes might well also push innovation out of the nation and anguish American competitiveness.

“The collection of SEC enforcement actions brought within the crypto residence has ramped up all by the last two years,” Simona Mola, a most important at Cornerstone Be taught, stated within the file.

“We will have the choice to be observing to gaze what 2024 brings, specifically in light of the SEC’s fresh approval of the first Bitcoin ETFs.”

Despite the Chairman’s apparent deep skepticism about cryptocurrencies, the SEC currently current 11 space Bitcoin ETFs.

This marks a necessary derive for the industry, and the approval is belief a couple of sport changer as it opens doorways for many new investors.

SEC Chair Gensler made it definite that though specific space Bitcoin ETFs bought approval, the company didn’t at present endorse Bitcoin itself.

Moreover, the company emphasised its dedication to enforcing requirements of habits for transactions engaging the current funds.

Earlier, a Monetary Instances file printed that a total of $5.8 billion in penalties were imposed on crypto corporations by world authorities in 2023.

Source : cryptonews.com