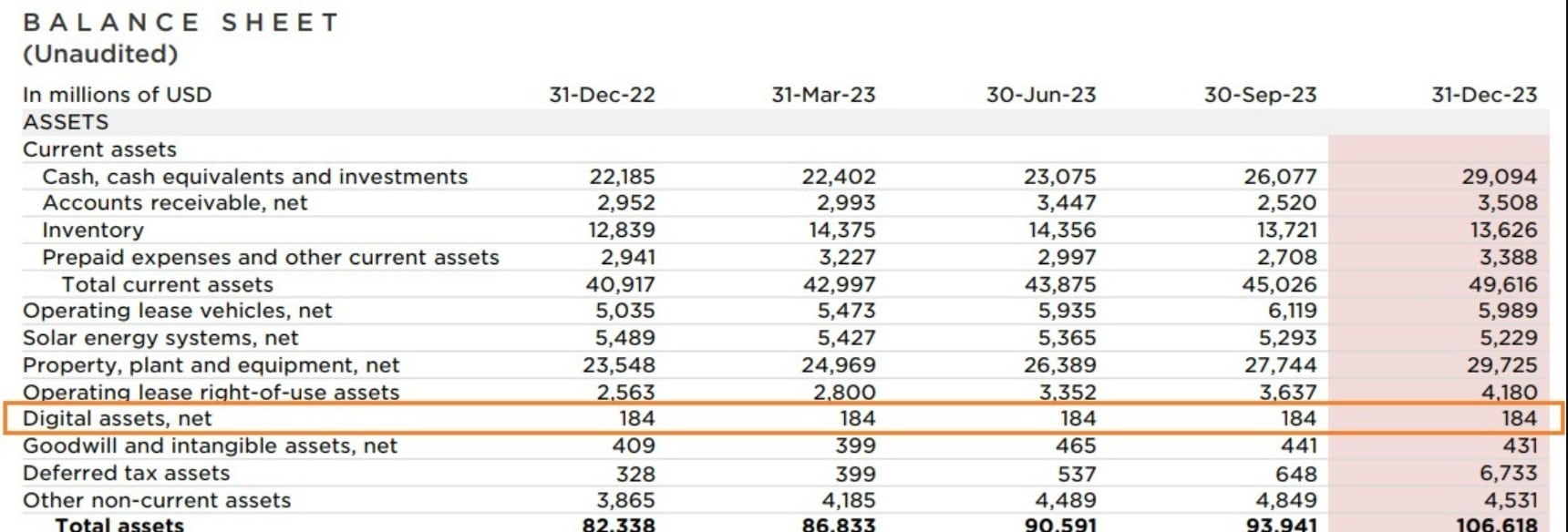

Bitcoin Price Prediction: Rises to $40,125 Amid Tesla's $184M Holding and GBTC Stability

Bitcoin Ticket Prediction: Rises to $40,125 Amid Tesla’s $184M Conserving and GBTC Stability

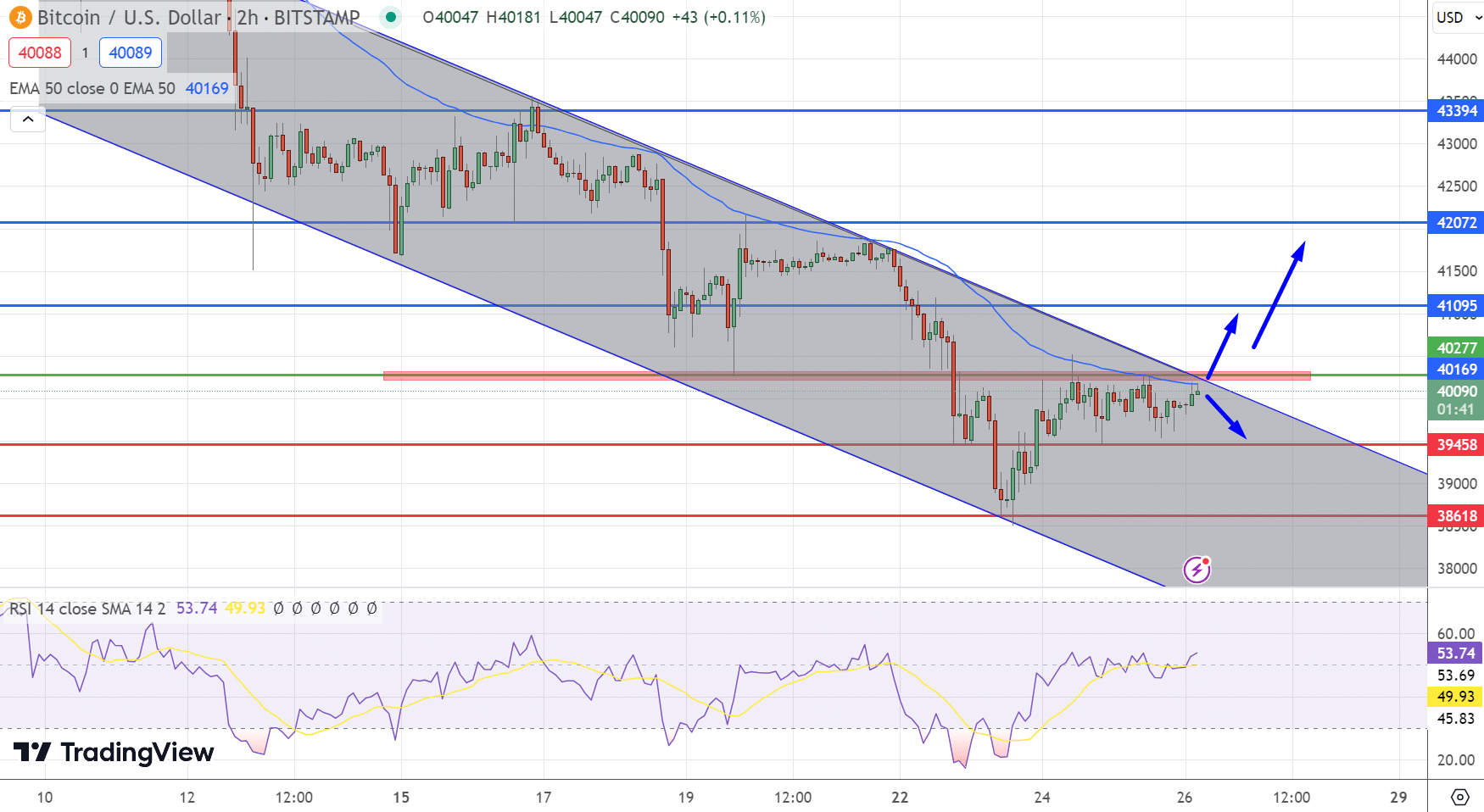

In the realm of cryptocurrency, Bitcoin’s impress prediction continues to plan attention as the digital foreign money experiences a modest amplify, buying and selling at $40,125, up by 0.30%. This surge aligns with foremost developments in the crypto panorama.

Particularly, Tesla’s most as a lot as the moment monetary disclosure finds a huge investment in Bitcoin, with digital resources totaling $184 million on its steadiness sheet, underscoring a stable company endorsement of the cryptocurrency.

Furthermore, market analysts from JPMorgan counsel a discount in promoting rigidity for Bitcoin, as profit-taking activities on Grayscale’s Bitcoin Trust (GBTC) seem like subsiding. Nevertheless, the scenario will not be uniformly optimistic.

Fitzgerald Cantor raises concerns in regards to the prolonged plod profitability of Bitcoin miners, especially in gentle of the upcoming halving tournament, which would possibly additionally misfortune the monetary viability of on the very least 11 mining entities. These diverse factors collectively shape the hot and future dynamics of Bitcoin’s valuation.

Bitcoin Ticket Prediction

High 15 Cryptocurrencies to Leer in 2023

Assign up-to-date with the arena of digital resources by exploring our handpicked series of the top 15 different cryptocurrencies and ICO projects to abet an peep on in 2023. Our checklist has been curated by specialists from Industry Discuss and Cryptonews, ensuring knowledgeable advice and serious insights in your cryptocurrency investments.

Make essentially the most of this probability to sight the functionality of these digital resources and retain yourself told.

Disclaimer: Cryptocurrency projects instantaneous on this text will not be the monetary advice of the publishing creator or newsletter – cryptocurrencies are extremely unstable investments with grand anxiousness, repeatedly perform your be pleased study.

Source : cryptonews.com