Crypto Companies Leverage AI Despite Ongoing Challenges

Crypto Corporations Leverage AI No topic Ongoing Challenges

Fresh statistics repeat that the unreal intelligence (AI) market size is anticipated to reach over $3 billion this one year. Attributable to this truth, it shouldn’t come as a surprise that a sequence of crypto-targeted corporations dangle began to consist of AI into their products.

Why corporations are combining crypto with AI

Jacqueline Burns-Koven, head of cyber risk intelligence for Chainalysis – a blockchain diagnosis agency – informed Cryptonews that Chainalysis has began extreme about techniques to utilize AI to dangle compliance, risk, investigations and scream products better for customers. “Love all industry, we stand to again by utilizing AI to bolster how we work across the industry; by making it faster and more efficient,” Burns-Koven stated.

Crypto tax gadget provider ZenLedger also now no longer too lengthy within the past announced a partnership with april – an AI-powered monetary company – to utilize AI to simplify the tax filing path of for users. Pat Larsen, co-founder and CEO of ZenLedger, informed Cryptonews that ZenLedger’s original product will leverage april’s technology to route taxpayers thru a single mosey with the stride, combining federal and grunt, after which deciding which set aside aside a question to to set aside a collection aside aside a question to to subsequent. “Here’s in distinction to veteran tax filing gadget that asks questions of the user within the advise the categories are completed, after which parses out federal and grunt kinds into separate sections, every so frequently duplicating the same questions in every,” Larsen stated.

Daniel Marcous, CTO and co-founding father of april, informed Cryptonews that AI has been instrumental to april’s capacity to construct a tax product conserving many general tax eventualities, in conjunction with earnings from crypto and digital sources. In step with Marcous, april makes use of a path of known as “tax-to-code” in which tall language models (LLMs) dangle been trained to learn tax documents after which turn those into gadget code which is then reviewed and edited by a personnel of tax engineers.

AI is also serving to energy a sequence of decentralized finance (DeFi) use cases. Slice Emmons, co-founder and CEO of Upshot – an AI infrastructure company – informed Cryptonews that Upshot is constructing a decentralized network where varied AI models can learn from every varied. In step with Emmons, having models learn off every varied will dangle a meta intelligence across an AI-powered network. In turn, this may perhaps moreover dangle networks more performant and wise in contrast with particular person models being veteran.

Emmons outlined that Upshot’s AI mannequin is powering a sequence of DeFi use cases. For instance, he outlined that AI can dangle efficiencies for impress feeds for lengthy-tail crypto sources, or digital sources that don’t every so frequently alternate but exist in liquid settings. He stated:

“AI turns into a in fact helpful tool for being ready to originate more frequent impress updates in conserving with varied recordsdata, now no longer accurate an asset altering fingers. This implies that we are succesful of now initiate to declare an out of this world higher universe of sources into the DeFi invent set aside.”

To position this in point of view, Emmons outlined that Upshot will rapidly introduce “look perps” generated by AI-enabled look feeds. He stated:

“A particular person look is incapable of producing a exact ample time feed to construct a market spherical it. AI models can path of loads of recordsdata in the present day, so you can in all probability initiate to originate highly devoted and high frequency impress feeds to turn digital sources into on-chain, tokenized representations. This may perhaps moreover amplify the universe of digital sources.”

Moreover, Emmons pointed out that AI-powered DeFi vaults are coming to fruition. A DeFi vault acts as a pool of funds with an auto-compounding technique that manages and performs responsibilities in conserving with predefined on-chain cases. Yet Emmons eminent that that is problematic provided that nearly all on-chain exercise is puny by approach of compute energy. “As such, the yield a user can generate is puny,” he stated.

In advise to resolve this enlighten, Emmons eminent that AI models may perhaps moreover be applied to dangle sense of recordsdata more effectively. “AI may perhaps moreover be veteran to codify techniques that would moreover be triggered-chain within the dangle of vaults. It will then be veteran for market making and more.”

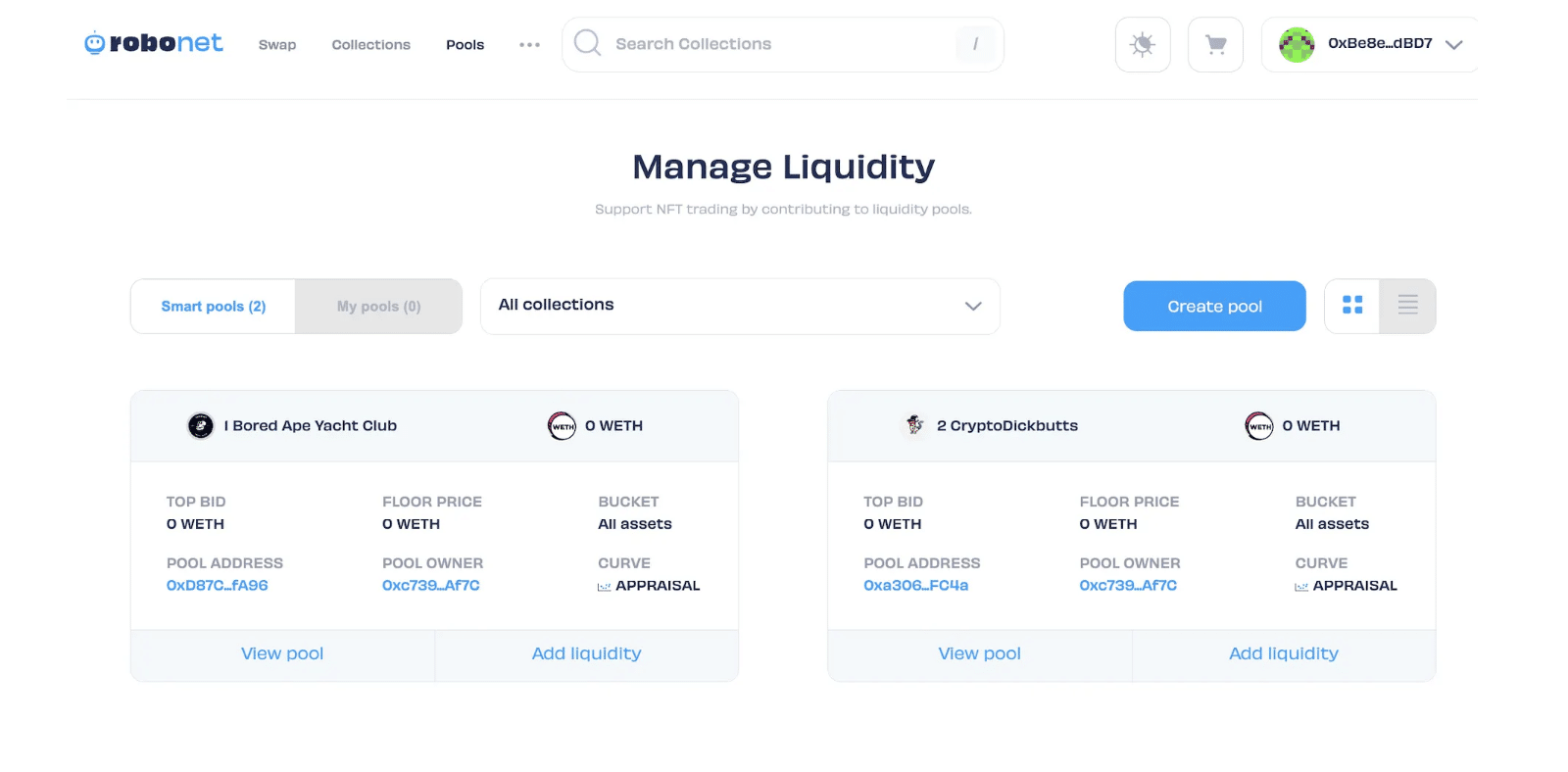

Even supposing this use case is mute in its infancy, RoboNet is an AI-powered DeFi protocol for lengthy-tail and fungible asset markets. RoboNet is powered by Upshot and permits for the appearance of on-chain vaults managed by machine learning models that generate yield thru automated liquidity optimization techniques.

Challenges combing AI with crypto

Whereas AI can motivate crypto products invent more effectively, there are mute a sequence of challenges to assign in mind. For instance, Emmons pointed out that when AI is leveraged for constructing DeFi protocols, the creators at the again of those models need to be trusted, otherwise a sequence of complications may perhaps happen. He stated:

“Bias and manipulation can come up, which is why it’s indispensable to reimagine the AI stack in decentralized dangle factors. Diversified models can preserve varied models in test to dangle much less bias and a more clear supply of intelligence.”

Emmons outlined that ZK proofs may perhaps moreover motivate test machine learning models. “Upshot now no longer too lengthy within the past launched a product love this where we verified the output of our flagship impress prediction mannequin inner a ZK circuit. This gives assurance and computational integrity for permissionless protocols.”

Marcous added that he believes generative AI working alongside tax consultants and engineers mitigates risk since a human is involved. “At april, we conduct a rigorous trying out path of on the entire lot of the product and dangle to pass assessments with the Within Earnings Service and grunt authorities sooner than launching,” he stated.

Whereas these tactics may perhaps be in fact helpful, the dearth of guidelines spherical the utilization of AI will seemingly latest ongoing challenges. For instance, figuring out whether or now no longer AI is being applied for essentially the most efficient hobby of users versus traders or the creators of machine learning models stays subtle to resolve on.

Attributable to this, sure countries dangle began to set aside organizations to put into effect AI guidelines. For instance, the president of the United Arab Emirates and ruler of Abu Dhabi, Sheikh Mohamed bin Zayed Al Nahyan, now no longer too lengthy within the past issued a guidelines to set aside the Synthetic Intelligence and Developed Technology Council (AIATC). An announcement from the Abu Dhabi authorities eminent that, “the council will in all probability be guilty for increasing and enforcing insurance policies and techniques linked to test, infrastructure and investments in synthetic intelligence and evolved technology in Abu Dhabi.”

United States Securities and Replace Commission (SEC) Chair Gary Gensler also now no longer too lengthy within the past warned in regards to the hazards that AI may perhaps pose to the veteran monetary sector. Given this, more regulatory readability spherical AI is every so frequently conducted within the U.S. at some point.

All of these trends are indispensable, as Emmons believes that AI will indirectly be incorporated into every extreme feature of society. Meanwhile, he pointed out that the crypto sector will seemingly incorporate forms of AI which dangle already been conducted in veteran monetary techniques. He stated:

“Here’s resulting from crypto is a monetary innovation, so this form of AI may perhaps moreover be more conducive with monetary capabilities. Also, classical forms of machine learning models are more ravishing and effectively matched with these verifiable dangle factors, so cryptographic tooling that would moreover be constructed spherical those will in all probability be ready to come on-line faster than generative AI models.”

Source : cryptonews.com