Bitcoin Price Prediction: Hits $42,400 Amid ETF Ad Buzz & Election Pledges

Bitcoin Impress Prediction: Hits $42,400 Amid ETF Advert Buzz & Election Pledges

In the realm of cryptocurrency, Bitcoin‘s trajectory has captured the market’s consideration all over all but again. As whispers flip into conversations about Bitcoin label predictions, the digital currency has edged up by 0.41 percent, steadying at $42,403.

This refined but optimistic upward push coincides with murmurs that Google would possibly well perchance possibly also begin exhibiting commercials for Bitcoin ETFs as early as Monday—a pass that would possibly well possibly indubitably send ripples by the crypto neighborhood.

Including to the intrigue, political heavyweights Donald Trump and Robert F. Kennedy Jr. procure vowed to quit any efforts by the Federal Reserve to begin a US Central Bank digital currency, would possibly well perchance possibly also soundless they obtain their respective election bids.

This confluence of tech and politics is surroundings the stage for a possibly pivotal week on this planet of Bitcoin.

Google’s Marketing and marketing Turnaround and Crypto Hypothesis

Google will let commercials for lisp cryptocurrency merchandise on its search engine beginning on Monday, possibly at the side of Bitcoin substitute-traded funds (ETFs). The revised policy is in accordance to the SEC’s fresh approval of 11 quandary Bitcoin ETFs.

These substitute-traded funds (ETFs) provide traders a portion in the fund’s Bitcoin holdings, pleasant Google’s advertising and marketing requirements. With 8.55 billion searches processed by Google on each day basis, economists are hopeful about future inflows into Bitcoin ETFs.

Google is making a pass in the crypto put by updating its advert policy to possibly enable commercials for #Bitcoin from the next day!

This most regularly is a game-changer for the #crypto industry. 🔥

Nonetheless endure in options, huge opportunities near with elevated dangers.

As extra commercials about… pic.twitter.com/UR1SFALmH0

— Sumit Kapoor (@moneygurusumit) January 28, 2024

The action was once taken after the SEC accredited the conversion of the Grayscale Bitcoin Have faith into a quandary Bitcoin ETF.

Role Bitcoin ETFs are on hand to the final public, no longer like aged Bitcoin trusts, that would possibly well possibly salvage them a safer replacement for advertising and marketing. The improved visibility and accessibility for widespread traders would possibly well perchance possibly even procure a favorable affect on BTC pricing.

Election Promises Shake Up Crypto Laws Outlook

Every Donald Trump and Robert F. Kennedy Jr. made separate promises to pause the creation of a U.S. central monetary institution digital currency (CBDC) in the tournament that they were elected president. Alongside with his claim that a CBDC would grant the executive “absolute regulate” over American citizens’ price range, Trump highlighted the threat to freedom.

Kennedy promised to pause CBDC initiatives while in role of job and voiced worries about regulate and monitoring. Every contenders procure expressed reinforce for safeguarding individual wallets and Bitcoin.

Dr. Joseph @Mercola and I discuss about monetary freedom in the Twenty first century. As president, I will end the efforts to pass toward a CBDC. #Kennedy24 pic.twitter.com/gao3D1HAeM

— Robert F. Kennedy Jr (@RobertKennedyJr) January 24, 2024

Thanks to Vivek Ramaswamy’s warning regarding the hazards connected with CBDCs, Trump was once in a job to salvage over Receive. Tom Emmer.

Though the Federal Reserve is no longer end to to introducing a CBDC, the candidates’ resistance to it indicates an increasing lack of self perception.

Since increasing distrust of centralized currencies customarily spurs curiosity in decentralized picks admire Bitcoin, this revelation would possibly well perchance possibly even procure a precious plot on the price of the cryptocurrency.

Bitcoin Impress Prediction

Bitcoin (BTC) sees a modest upward push to $42,160, marking a 0.32% amplify all the plot by the 24-hour body. The cryptocurrency maintains its standing, with a market capitalization in the billions and a provide in the hundreds and hundreds.

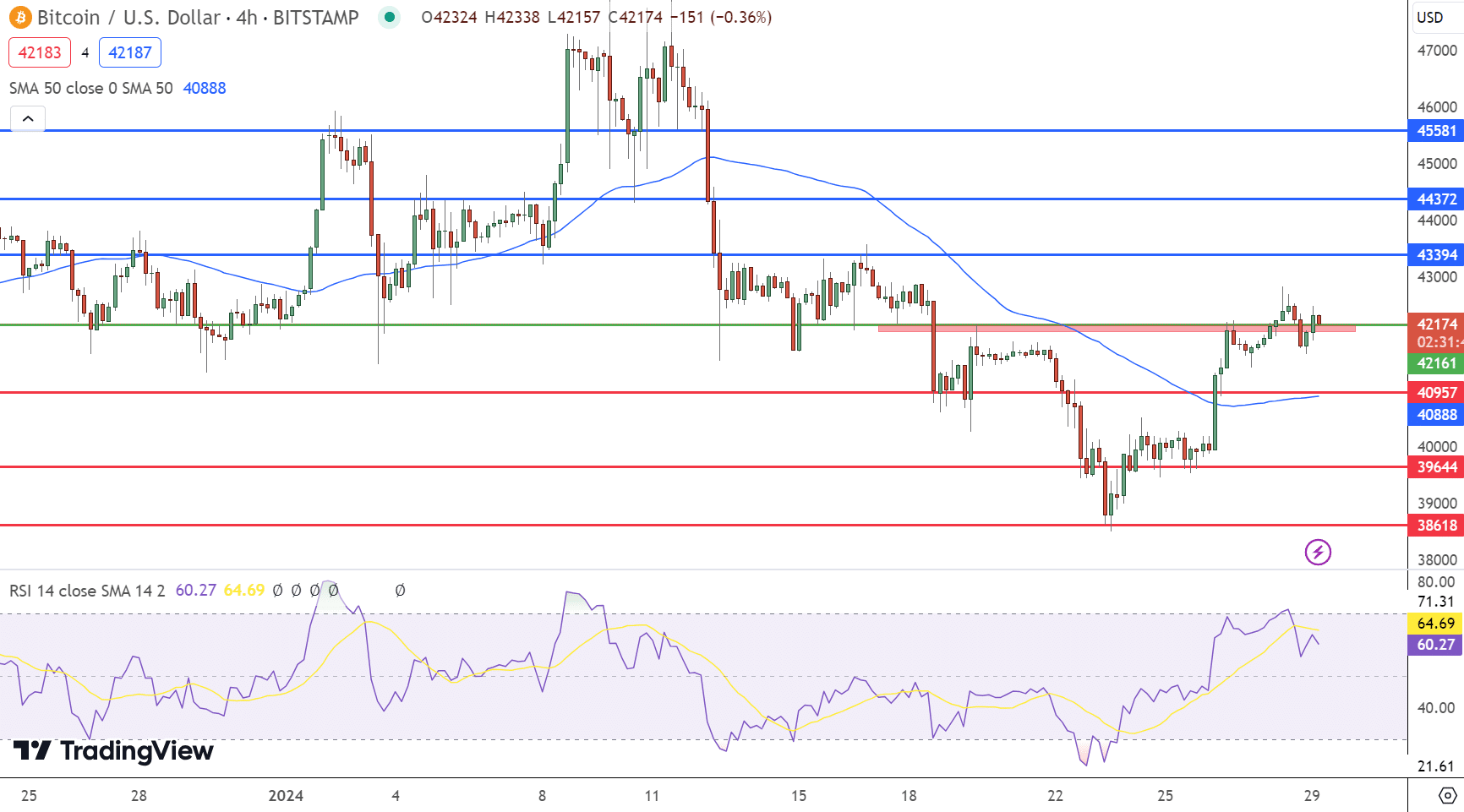

The 4-hour chart finds a pivot point at $42,161. Resistance phases are arrayed above, at $43,394, $44,372, and $forty five,581, anxious upward movements.

📈#BitcoinPricePrediction: BTC edges as much as $42,160, a 0.32% upward push. Market cap in billions, provide in hundreds and hundreds. Pivot at $42,161 with resistance as much as $forty five,581. Helps at $40,957 & lower. RSI at 60 & 50-day EMA at $40,888 tag at bullish constructing. Eyes on $42k+ for balance. #Crypto

— Arslan Ali (@forex_arslan) January 29, 2024

Enhance phases below the pivot are at $40,957, $39,644, and $38,618, possibly providing flooring for label dips.

The Relative Strength Index (RSI) stands at 60, leaning towards a bullish sentiment with out coming into overbought territory. The 50-day Exponential Titillating Moderate (EMA) at $40,888 underpins the present label, reinforcing the bullish bias.

Bitcoin’s buying and selling sample suggests choppiness across the $42,000 label. It confronts resistance end to $43,400, while the EMA and RSI readings settle on an uptrend.

Conclusively, Bitcoin’s constructing stays bullish as lengthy because it stays above the $42,000 threshold. Under this level, warning is warranted, because it would possibly well probably perchance possibly also tag a constructing reversal.

High 15 Cryptocurrencies to Look in 2023

Defend up-to-date with the arena of digital sources by exploring our handpicked series of the ideally suited 15 replacement cryptocurrencies and ICO initiatives to have an gaze on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, making sure knowledgeable advice and extreme insights in your cryptocurrency investments.

Steal profit of this chance to mediate regarding the likelihood of those digital sources and support your self told.

Disclaimer: Cryptocurrency initiatives endorsed in this article must no longer the monetary advice of the publishing writer or newsletter – cryptocurrencies are highly unstable investments with appreciable threat, repeatedly enact your like analysis.

Source : cryptonews.com