Is ORDI Going to Crash? ORDI Price Drops 20% in a Week as New Bitcoin Protocol Goes Viral

Is ORDI Going to Wreck? ORDI Mark Drops 20% in a Week as Recent Bitcoin Protocol Goes Viral

The ORDI token, a main BRC-20 token carefully tied to Bitcoin’s performance, has experienced a predominant 20% mark descend in the wake of the Grayscale sell-off.

This decline is allotment of a broader mark decline affecting BRC-20 tokens, raising questions about capacity additional decreases.

$ORDI mark needs to interrupt $Forty eight level to counsel that wave 1 has fashioned a prime.

It’d be life like to hunt for entry parts in the toughen dwelling’s. But constantly scale in, commence with low portions and make investments extra when it goes lower. pic.twitter.com/soG95d48tI

— Man of Bitcoin (@Manofbitcoin) January 23, 2024

Trader sentiment stays mixed, as ORDI mark continues battle toughen – leaving consumers patiently ready on the aspect-lines expecting a decisive movement.

ORDI Mark Analysis: As BRC-20 Tokens Mark Upright is ORDI token Crashing?

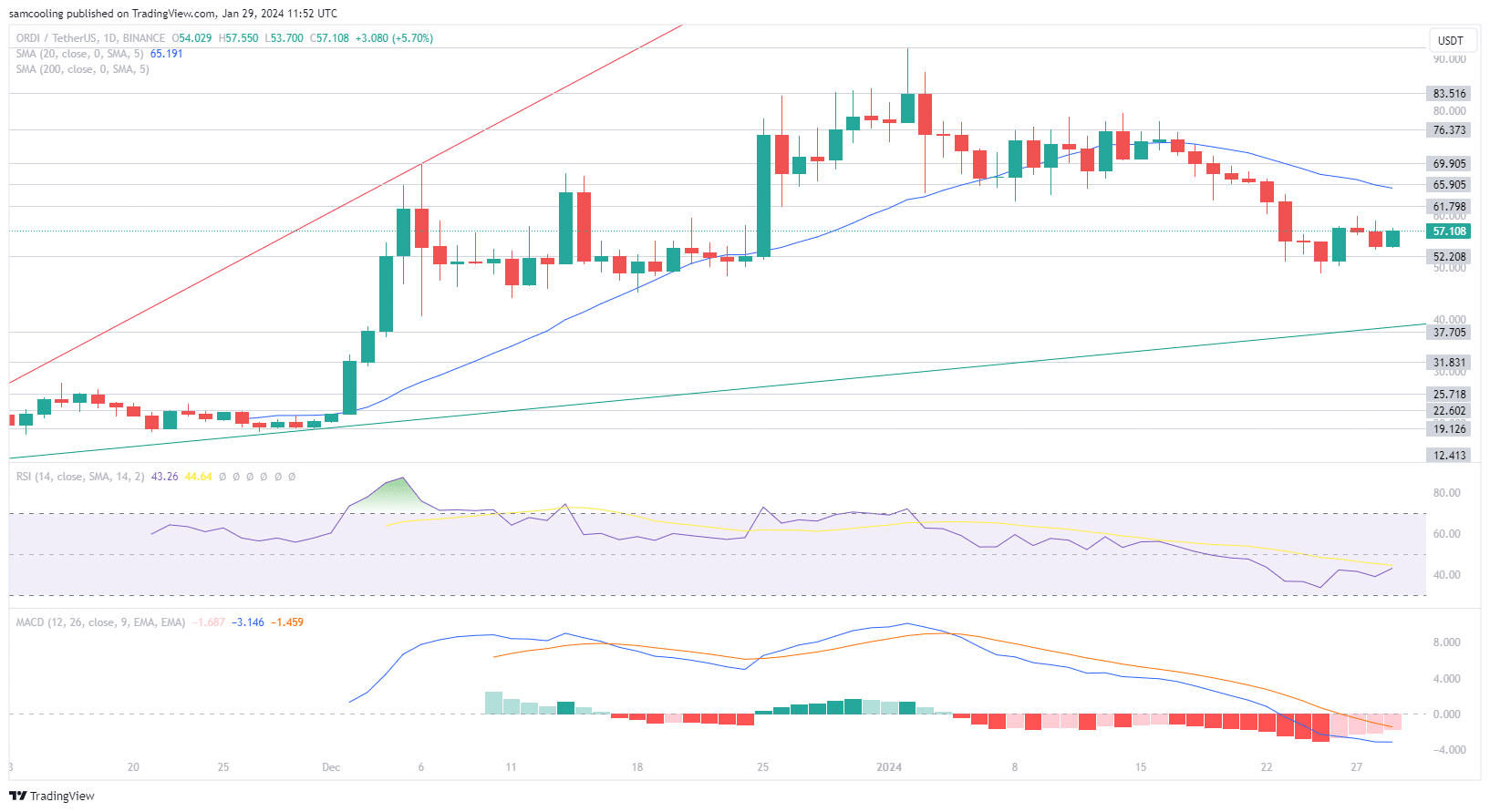

Amid the BRC-20 wide retracement, ORDI is in the meanwhile buying and selling at a market mark of $57.44 (representing a 24-hour commerce of +6.28%).

This comes amid a predominant retracement from an all-time excessive at $92.25 on January 2, which has up to now viewed ORDI token bleed-out -38%.

Yet, a properly-defended historical toughen level at $52.20 suggests that mark movement will seemingly be pushing towards an attempted push-up support above a now descendant 20DMA (stood at $65).

Lower toughen is afforded by the bottom of the buying and selling channel down at $40 in the tournament of a breakdown movement.

Alternatively, in a particular ticket, the RSI indicator has cooled-off vastly amid the retracement movement, with a contemporary bullish ticket at 43.26 – suggesting ORDI mark is now oversold and attributable to movement up quickly.

Alternatively, amid the stalled rally momentum, the MACD conflicts this ticket at a bearish -1.6.

Total, ORDI mark diagnosis finds the significance of the continuing consolidation above $52, with the RSI calling for a jump, the 20DMA denominates a transparent level to reclaim.

This leaves ORDI token with an upside target at $69.9 (a doable +22.69%).

While plan back possibility is proscribed by the lower trendline at $40 (a doable -29.seventy 9%).

Attributable to this reality ORDI mark diagnosis finds a possibility: reward ratio of 0.76, a spoiled entry rate expecting a decisive movement, nevertheless with out a doubt no longer crashing quickly.

But while ORDI token finds an unappealing entry amid the BRC-20 retracement, an even bigger play is rising in the Bitcoin Minetrix presale.

ORDI Mark Analysis Replacement? Recent Bitcoin Cloud Mining Project BTCMTX Smashes $9.7M Raised

Dive into the revolutionary world of Bitcoin Minetrix and its pioneering stake-to-mine machine – as the skyrocketing presale smashes +$9,739,174 raised – as Stage 22 draws to an discontinue with lawful Forty eight-hours left.

Providing an enticing 75% Staking APY, Bitcoin Minetrix presents a platform where users can buy, stake, and then see as the rewards commence amassing.

The particular essence of passive profits in the crypto world has never been this accessible.

Only Forty eight hours left except the conclusion of Stage 22 for #BitcoinMinetrix!

What motivates you essentially the most to affix the #Bitcoin mining world? 🌐 pic.twitter.com/YVNjP3ERrD

— Bitcoinminetrix (@bitcoinminetrix) January 29, 2024

With the Bitcoin Minetrix come, gone are the days of heavy initial capital and navigating complex mining contracts.

$10M In The Crosshairs: Bitcoin Minetrix Surges Previous $9.7M – Poised to Outperform ORDI Mark Analysis

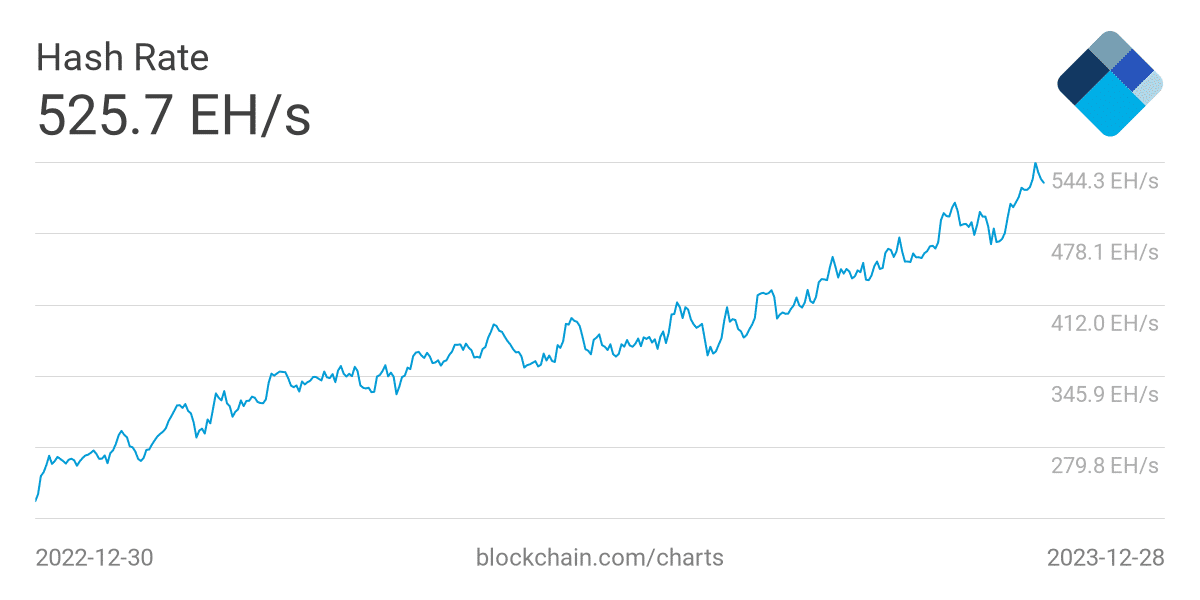

Since the 2021 Bull Speed, Bitcoin mining has defied expectations by enterprise something of a renaissance in community enhance.

Bitcoin’s Hash Rate (a measure of the complete amount of computational energy directed at mining Bitcoin blocks) has surged to an unheard of all-time excessive of 525 Exahashes per 2d (EH/S).

This dramatic enhance has been fuelled by a vital amplify in the size of Marathon Digital and Insurrection Platforms’ mining operations.

The realm’s ideal Bitcoin miner – Marathon – reported that for Q3 2023 it had a suggest hash rate of 14.2 EH/s (a 500% enhance YoY), round 4% of the total community hash (mining round 1153 BTC per month, or, $42.2M USD).

Within the interim Insurrection Platforms reported a brand novel file hash rate of 10.9 EH/s (mining round 368 BTC per month, or, $13.3M USD), with Insurrection’s operations anticipated to grow to twenty.2 EH/s by summer 2024.

But while the all-time excessive in Bitcoin community hash rate is wholesome for Bitcoin community security, and clearly winning for increasing mining operations, it has also begun to lose notion of the usual promise of Satoshi Nakamoto’s decentralization.

Bitcoin mining in 2023 is basically the most centralized it has ever been in its brief 15-year historical previous.

Why Has Bitcoin Mining Change into So Centralized?

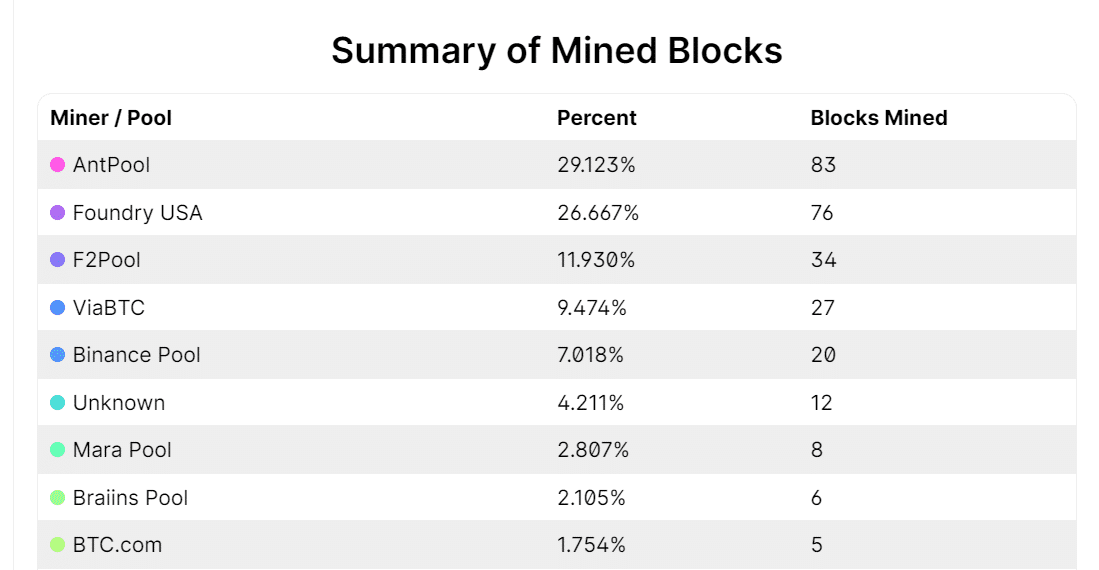

A smarter seek at the abstract of mined blocks over the previous Forty eight-hours finds that a horrifying 55.seventy 9% of all Bitcoin block rewards fade to lawful two Bitcoin mining pools.

AntPool took the ideal fragment at 83 blocks mined (29.123%), while 2d ideal mining pool Foundry USA mined 76 blocks (26.667%).

This dwarfs the favor of blocks mined by even third-plan F2Pool (34 blocks mined, round 11.93%), highlighting the increasing earn 22 situation of elevated mining centralization.

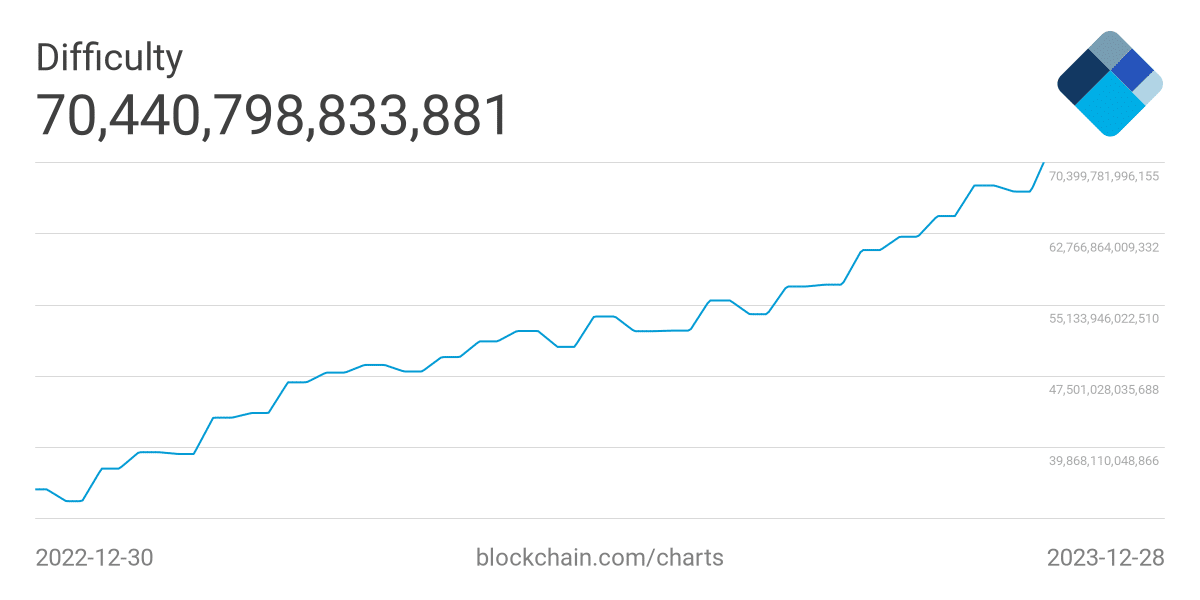

This heightened community exercise, and elevated centralization of mining energy has was clearly mirrored in the consequent all-time excessive in the challenge rate for mining Bitcoin.

For the time being standing at 70,440,798,833,881 – it has never been extra powerful for particular person contributors to personal interaction in winning Bitcoin mining.

This earn 22 situation of heightened community challenge, fuelled by elevated competition and centralization of mining energy, has created the need for novel alternate choices for the retail investor to rob half in Bitcoin mining – both for community decentralization and preserving Bitcoin as a winning exercise for the actual person.

Enter Bitcoin Minetrix, which was once launched to ship secure and transparent Bitcoin mining rewards for the retail investor via an revolutionary, decentralized Bitcoin cloud mining come.

Key Highlights of the BTCMTX Earnings Over ORDI Mark Analysis Verdict:

- Distinctive Edge in the Market: In an alternative crammed with a spacious favor of cloud mining platforms, Bitcoin Minetrix carves a distinct segment for itself. As the principle-ever tokenized Bitcoin cloud mining initiative, it presents an computerized machine that’s geared for cloud-based entirely Bitcoin mining, environment a brand novel usual for the alternate.

- Safety First with Ethereum Blockchain: Bitcoin Minetrix operates on the tried and depended on Ethereum blockchain. This ensures prime-notch security and reliability, permitting users to sidestep the hazards linked with external mining pools, and offering a safeguard in opposition to capacity fake cloud mining companies.

- Championing Upright Decentralization: At its core, Bitcoin Minetrix upholds the ethos of decentralization. In an age where centralization continually introduces vulnerabilities, Bitcoin Minetrix breaks the mildew, redistributing mining profits from tall companies to particular person retail consumers via its novel Stake-to-Mine machine.

- Tapping into the Bitcoin Halving Opportunity: Perfectly poised to fabricate the most of the upcoming Bitcoin halving, Bitcoin Minetrix presents consumers with a golden different. The impending halving might maybe maybe seem daunting for miners attributable to reduced block rewards, nevertheless historically, such events personal pushed up Bitcoin’s fee. Bitcoin Minetrix presents a platform for consumers to tap into this capacity surge, sans the linked capital risks.

- The BTCMTX Presale Opportunity: The continuing BTCMTX presale has already garnered predominant passion, with over $9.1m raised towards its $9.5M plan. At a aggressive mark of lawful $0.013 per token, early consumers personal a assorted probability to be at the forefront of this stake-to-mine evolution.

The Bottom Line: Don’t Omit BTCMTX

In sum, Bitcoin Minetrix is made up our minds to redefine the Bitcoin panorama. With its revolutionary methodologies, stringent security measures, and the tall capacity of its stake-to-mine mechanism, it beckons as a profitable different for early-fowl consumers.

Stable your plan on this transformative slither by joining the BTCMTX presale this day.

Aquire BTCMTX Right here

Disclaimer: Crypto is a excessive-possibility asset class. This text is equipped for informational functions and doesn’t constitute investment advice. You potentially can lose all your capital.

Source : cryptonews.com