Bitcoin Price Prediction Surges to $43,500 Amidst New ETF Launches and Fidelity Gains

Bitcoin Tag Prediction Surges to $43,500 Amidst New ETF Launches and Fidelity Positive factors

Notably, Invesco has strategically reduced prices for its Bitcoin ETF in a repeat to attract extra merchants. Within the intervening time, the panorama of cryptocurrency investment is extra expanded with the introduction of the major Bitcoin ETF application in Hong Kong.

In a indispensable construction, Fidelity’s Bitcoin ETF has reported gigantic good points of $208 million, effectively offsetting the impact of withdrawals from Grayscale, and underscoring the sturdy appetite for Bitcoin amongst merchants.

Invesco Reduces Charges for Bitcoin ETF to Attract Investors

The Invesco Galaxy Bitcoin ETF (BTCO), a situation Bitcoin substitute-traded fund (ETF) from Invesco and Galaxy Asset Management, now has a payment of 0.25% as an different of 0.39%.

With this transformation, the sponsor cost is now consistent with business norms and would possibly per chance well now compete with even decrease prices equipped by opponents love Ark, 21Shares, Bitwise, and Franklin Templeton.

Dilemma #bitcoin ETF issuers @InvescoUS and @galaxyhq have reduced the payment of its fund to 0.25% from 0.39%. @HeleneBraunn reportshttps://t.co/ok3rLdvUwA

— CoinDesk (@CoinDesk) January 29, 2024

For the major six months or unless the ETF’s holdings exceed $5 billion, Invesco has promised to waive prices.

Even with the payment scale again, Invesco’s Bitcoin situation ETF has trailed within the inspire of competitors love BlackRock and Fidelity by methodology of inflows since its start, coming in at valid over $280 million.

Although the reduce price in prices would possibly per chance well obtain the ETF extra appealing, it has bettering Bitcoin values, which would possibly per chance well obtain bigger market self assurance in cryptocurrency investment merchandise as a complete.

Hong Kong Witnesses Its First Bitcoin ETF Application

Harvest World has signaled the opportunity of a regulated investment direction within the cryptocurrency market by submitting a ask for a situation Bitcoin substitute-traded fund (ETF) to the Hong Kong Securities and Futures Commission.

Investors would be in a situation to commerce fund shares on aged stock markets that are straight correlated with the price of Bitcoin if the placement Bitcoin ETF is licensed. Hong Kong’s embrace of cryptocurrency is in step with worldwide patterns.

NEWS: Hong Kong Securities and Futures Commission has reportedly received its first situation #Bitcoin ETF application.

📰 https://t.co/iJVTndtwvR pic.twitter.com/6LNSGHyb1Y

— CoinGecko (@coingecko) January 29, 2024

The Securities and Commerce Commission’s recent approval of 11 situation Bitcoin ETFs became a huge step ahead for the US financial system.

The application from Harvest World underscores a worthy wider market need for investing ideas that provide exposure to digital resources without requiring valid asset possession.

Although the pause on Bitcoin prices is turning into greater, the approval would possibly per chance well method in current gamers and enhance market self assurance in cryptocurrency investments.

Fidelity’s Bitcoin ETF Compensates for Grayscale’s Withdrawals with $208M Plot

On January 29, Fidelity’s situation Bitcoin ETF, FBTC, reportedly had day-to-day inflows of $208 million, exceeding withdrawals from Grayscale Bitcoin Have faith (GBTC) for the major time for the reason that fund’s inception.

Moreover its ETF conversion day, GBTC’s day-to-day outflows dropped by almost 25%, making it the 2nd-lowest day total.

The success of Fidelity coincides with a payment wrestle within the placement Bitcoin ETF market, since prices for ETFs have no longer too lengthy within the past been reduced by Invesco and Galaxy Asset Management.

And @Grayscale’s $GBTC maintains its liquidity crown — trading $570 million and ~$110 million extra than 2nd situation $IBIT as of late https://t.co/WIAWKwDnqY pic.twitter.com/ma0CE5szLa

— James Seyffart (@JSeyff) January 29, 2024

ETFs domiciled in Europe would possibly per chance be impacted by this payment competition, main merchants to potentially transfer cash to the United States.

As investor hobby in and competition within the cryptocurrency market grows, the simpler inflows into Fidelity’s ETF and the traditional payment competition would possibly per chance well presumably honest have a favorable pause on BTC prices.

Bitcoin Tag Prediction

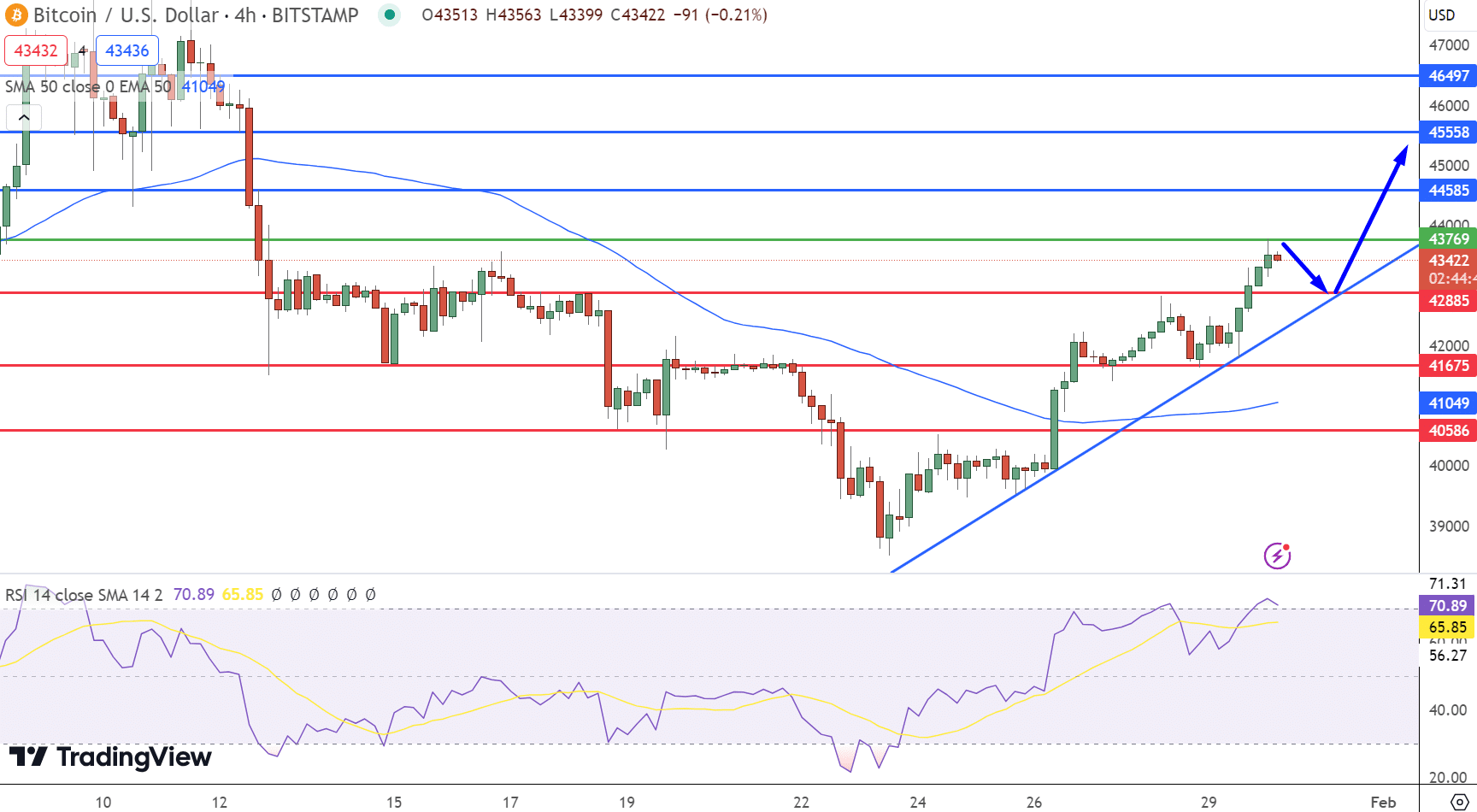

Bitcoin (BTC/USD)‘s key pivot point is identified at $43,769. The rapid resistance levels are positioned at $44,585, $45,558, and $46,497, marking potential barriers for upward tag action.

Conversely, beef up levels are established at $42,885, $41,675, and $40,586, providing potential floors that can per chance well cease any extra decline.

The Relative Energy Index (RSI) is presently high at 70, indicating the market would possibly per chance be drawing method overbought prerequisites. The Challenging Moderate Convergence Divergence (MACD) reveals a cost of 98 and a sign of 586, suggesting the functionality for persisted bullish momentum.

The 50-Day Exponential Challenging Moderate (EMA) is positioned at $41,049, bolstering the bullish stance because the most up-to-date tag stands above this level.

An upward trendline is noticed, providing gigantic beef up end to the $42,885 level. A shatter above the pivot point would possibly per chance well catalyze a indispensable upward transfer. The total pattern for BTC/USD is bullish above the $42,885 assign.

Fast Term Bitcoin Tag Prediction

The asset is anticipated to area the resistance at $44,585 within the upcoming days, contingent on striking ahead its situation above the foremost beef up level.

Top 15 Cryptocurrencies to Glimpse in 2023

No longer sleep-to-date with the realm of digital resources by exploring our handpicked sequence of essentially the most easy 15 different cryptocurrencies and ICO projects to withhold an peep on in 2023. Our list has been curated by consultants from Commerce Talk and Cryptonews, guaranteeing professional advice and nerve-racking insights on your cryptocurrency investments.

Lift good thing about this opportunity to leer the functionality of those digital resources and withhold your self informed.

Disclaimer: Cryptocurrency projects counseled listed listed below are no longer the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with substantial probability, constantly cease your bag analysis.

Source : cryptonews.com