Coinbase Exchange Advisory Council Adds Former UK Chancellor to Team

Coinbase Alternate Advisory Council Adds Outdated faculty UK Chancellor to Team

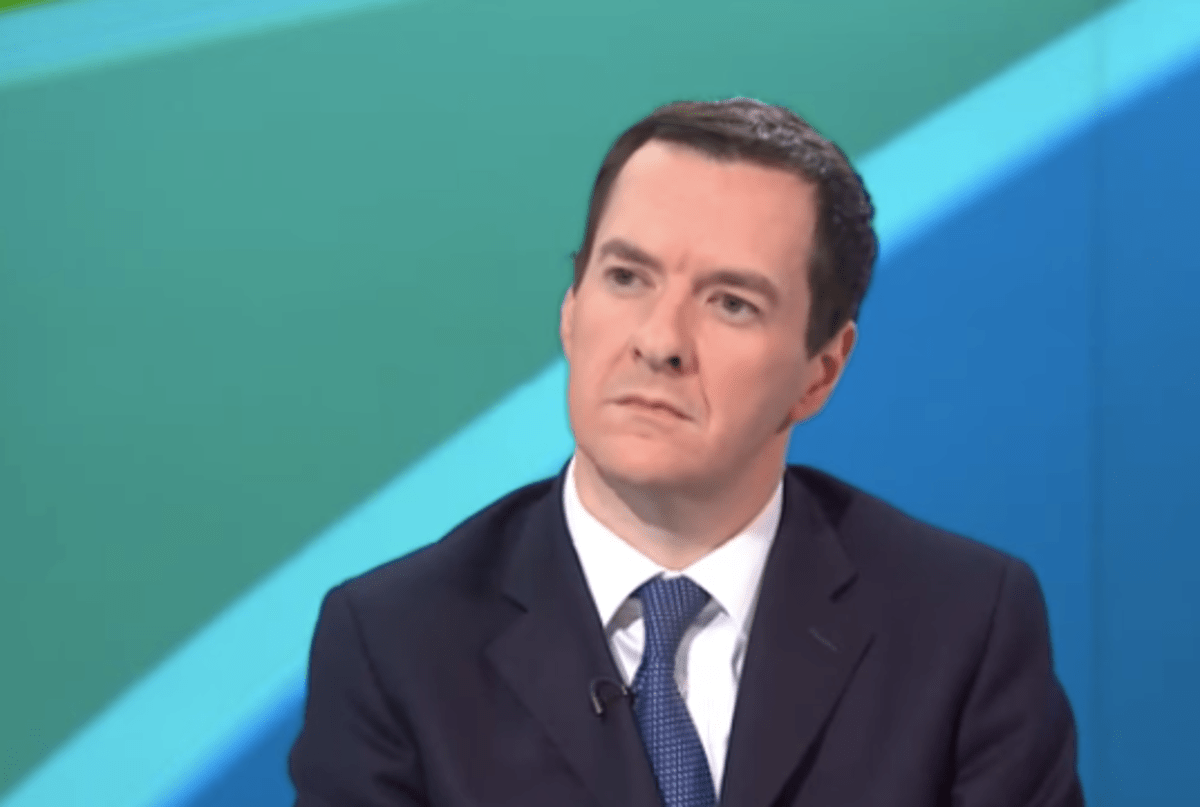

The sphere’s second-finest crypto commerce, Coinbase, launched on January 31 the addition of archaic UK Chancellor of the Exchequer George Osborne as an guide to its council.

Coinbase’s Chief Policy Officer (CPO), Faryar Shirzad, disclosed this in an legitimate announcement on X (formerly Twitter).

Shirzad revealed that Osborne would bring his years of expertise overseeing the UK’s financial affairs to Coinbase as it expands globally.

We’re very delighted to have @George_Osborne be half of @coinbase’s World Advisory Council. George is one of basically the most skilled and considerate leaders in government and industry, and we’re grateful to have his advice and counsel as we form larger Coinbase across the enviornment.…

— Faryar Shirzad 🛡️ (@faryarshirzad) January 31, 2024

Advisors Transitioning from TradFi to Crypto

The latest pattern makes Osborne the most modern archaic UK Chancellor to transition from the mature regulated financial into a blockchain-backed financial company.

His instantaneous successor, Phillip Hammond, joined crypto custody company Copper in 2021 as an guide earlier than changing into chairman of the board of directors.

Before he used to be appointed an guide with Coinbase, Osborne served as a Chancellor between 2010 and 2016.

Coinbase’s unusual guide is determined to affix a acquainted nine-man panel that involves heavyweights savor John Anzalone, Dr. Tag T. Esper, Chris Lehane, and 7 others. This transfer will form him the most modern and tenth advisory council member because the crypto commerce seeks to align with world regulators.

Coinbase has been a number one power in establishing digital assets and blockchain know-how in its dwelling soil. Founded in 2012 and headed by Brian Armstrong, Coinbase’s particular person-friendly interface has pushed many crypto rookies into the Web3 landscape.

The platform went public through a Nasdaq itemizing in 2021. Coinbase has then expanded into France, Spain, Singapore, and Bermuda in a advise to amplify digital asset adoption worldwide.

It has confronted vital limitations in its dwelling country, the US, as regulators criticize the commerce for providing earn entry to to unregistered crypto-backed securities, alternatively.

One such appropriate model venture is an ongoing discourse with the US Securities and Alternate Commission (SEC). Headed by Gary Gensler, the SEC is charging the crypto commerce with providing unregistered assets.

The safety company states that crypto assets offered on Coinbase tumble beneath the ‘Howey Check’ as a result of perceived sense of profit know-how from particular person investments.

Coinbase has since discredited these views and acknowledged that the federal government company just isn’t pondering extraordinary cases surrounding cryptocurrencies.

US Lack of Readability Riding Crypto Adoption In a foreign country

US regulators have ramped up efforts to checkmate scandalous action in the crypto ecosystem in the final two years. Hence, many crypto-backed enterprises have attain into the crosshairs of quite a lot of government companies.

Dapper buying and selling platforms savor the Binance commerce had been fined billions of dollars for violations of their industry practices.

Binance’s Market Share Nears 50% Recovery

In the early hours of November 22, 2023, the US Division of Justice imposed a excellent of $4.3 billion on #Binance, main to the resignation of CEO #CZ. While this would possibly maybe occasionally perhaps perhaps have gave the impact savor an endpoint, it as an different marked the starting up of a… pic.twitter.com/Ak4N8PaJ1Z

— Creat-IO (@Creat_io) January 31, 2024

Coinbase is also in a appropriate model tussle with the SEC as it seeks to present readability on crypto asset rules.

Amidst all this, a wide different of crypto companies are urging US companies for clearer regulatory guidelines to be optimistic that compliance. For now, a dynamic compromise has but to be carried out, forcing many crypto exchanges to stare pasture in diversified areas.

The Coinbase commerce has established its EU operations in Ireland largely due to compliance with the MiCA (Markets in Crypto Asset) regulation.

The Coinbase global expansion continues 🇮🇪

Ireland has been chosen for our EU MiCA hub.

Right here’s why 👇 https://t.co/mpc2t2u5EI

— Coinbase 🛡️ (@coinbase) October 19, 2023

MiCA, which seeks to bring regulatory readability to the crypto home, is the European Union’s (EU) effort to form it steady for investors. The MiCA crew fair currently revealed two consultation papers where ‘reverse solicitation’ used to be launched.

💫💫EU begins sorting MiFID-regulated securities out of crypto assets💫💫

MiCA passed in 2022, but points of it are soundless being labored out. Defining a financial instrument is a wide excellent request.

💠On Jan. 29, the European Securities and Markets Authority (ESMA)…

— Harley Lawrence (@HarleyLawr58926) January 30, 2024

Reverse solicitation lets in third-country crypto corporations to aid EU purchasers if the client initiates the contact. The papers are due for feedback on April 24, 2024.

Source : cryptonews.com