UK Police Seized $1.77 Billion in Bitcoin from Chinese Investment Fraud + More Crypto News

UK Police Seized $1.77 Billion in Bitcoin from Chinese Investment Fraud + More Crypto News

Salvage your day-to-day, bite-sized digest of blockchain and crypto knowledge – investigating the stories flying below the radar of on the present time’s knowledge.

In on the present time’s crypto knowledge resolution:

- UK Police Seized £1.4BN of Bitcoin from Chinese Investment Fraud

- Industry Leaders Band Together to Originate the Digital Sources Affiliation

- Digital Asset Product Volumes Surge Over 200% in January

__________

UK Police Seized £1.4BN of Bitcoin from Chinese Investment Fraud

The UK Metropolitan Police has seized more than £1.4 billion ($1.77 billion) value of bitcoin (BTC). That is one in every of the biggest crypto seizures of by legislation enforcement globally, in accordance to the Financial Times.

The seized funds came from an massive investment fraud in China, a London court docket heard on Tuesday.

Jian Wen, 42, is on trial, accused of laundering Bitcoin on behalf of her feeble employer, Yadi Zhang (real name Zhimin Qian). The latter is an alleged fugitive from the Beijing authorities. She has also fled the UK.

In 2018, the UK police seized four devices retaining more than 61,000 BTC from a security deposit field and a property the assign aside Wen and Zhang lived.

By the time the police had recovered all this BTC in July 2021, its mark used to be about £1.4 billion.

Per the prosecution, Zhang had dedicated investment fraud in China between 2014 and 2017. She stole some £5 billion from over 128,000 merchants, therefore changing it into BTC.

Wen will not be accused of involvement on this fraud but of helping Wen convert BTC into fiat, property, and luxury objects within the UK.

Wen claims to contain been Zhang’s “carer” and that she believed Zhang won all bitcoin legally. The prosecution, nonetheless, argued on Monday that Wen used to be a “entrance particular person” paid to “encourage Ms Zhang within the background.”

Industry Leaders Band Together to Originate the Digital Sources Affiliation

Within the most as much as date crypto knowledge, the Digital Sources Affiliation (DAA) announced its knowledgeable originate. Per the clicking free up shared with Cryptonews, it’s a groundbreaking transnational group dedicated to fostering guilty model and adoption of institutional digital resources.

The DAA committee is made up of industry leaders who deem within the manner ahead for digital resources, it stated. These encompass:

- Henry Zhang, Founder & CEO of DigiFT;

- Chia Hock Lai, CEO of Onfet;

- Danny Chong, CEO of Tranchess;

- Daniel Lee, Head of Web3 at Banking Circle;

- Steven Hu, Head of Digital Sources, Commerce & Working Capital, Long-established Chartered;

- Chang Tze Ching, CEO of Shining Point Worldwide Digital Sources.

The DAA originate represents a key step ahead within the financial industry to facilitate higher collaboration between industry gamers and key stakeholders, stated the clicking free up.

It added that by bringing together financial institutions, fintechs, abilities services, and moral and regulatory experts, the DAA objectives to bridge the outlet between TradFi and the transformative doable of tokenized real-world resources (RWA).

The DAA will present a platform for stakeholders to reach together to: portion knowledge and ideal practices thru working groups, conferences, and on-line resources; gain industry standards; have interaction with policymakers and regulators to promote guilty moral and regulatory frameworks that foster innovation while mitigating dangers; and empower future leaders thru training, mentorship, and industry placements.

Digital Asset Product Volumes Surge Over 200% in January

In January, following the approval of the preliminary Bitcoin web disclose online ETFs, the field’s complete resources below management (AUM) noticed a length of relative balance, in accordance to Digital Asset Administration Overview by on-chain analytics firm CCData. The portray significant a small develop of 1.fifty three% to $50.7 billion.

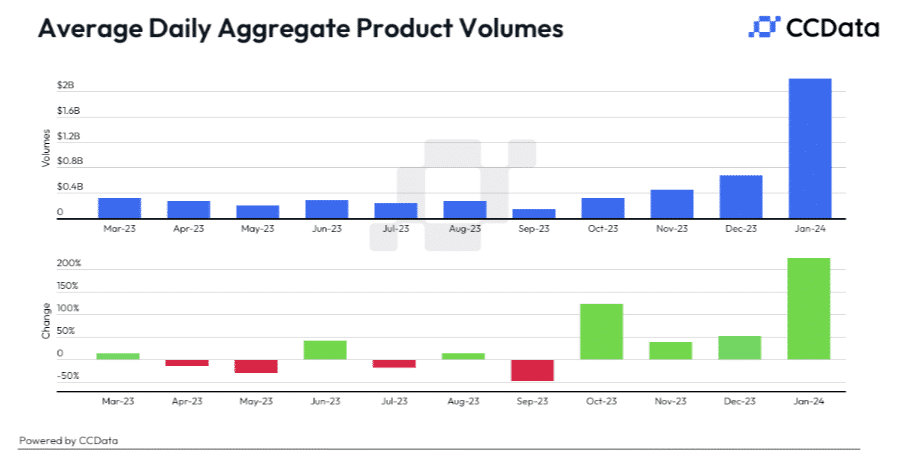

Within the period in-between, the moderate day-to-day mixture trading volumes contain proven a essential upward model, surging to $2.19 billion. The 224% develop also can also be attributed to the ETF originate and a broader uptick in market sentiment.

“This used to be the fourth consecutive month-to-month develop in moderate day-to-day product volumes for the industry,” it stated.

The portray extra significant that every ETF’s price structure influences inflows and trading volumes. Costs are in overall “a key determinant for merchants in a aggressive market,” and “decrease fees develop an ETF’s charm.” Because of the this fact, many ETF services only within the near previous reduced their fees.

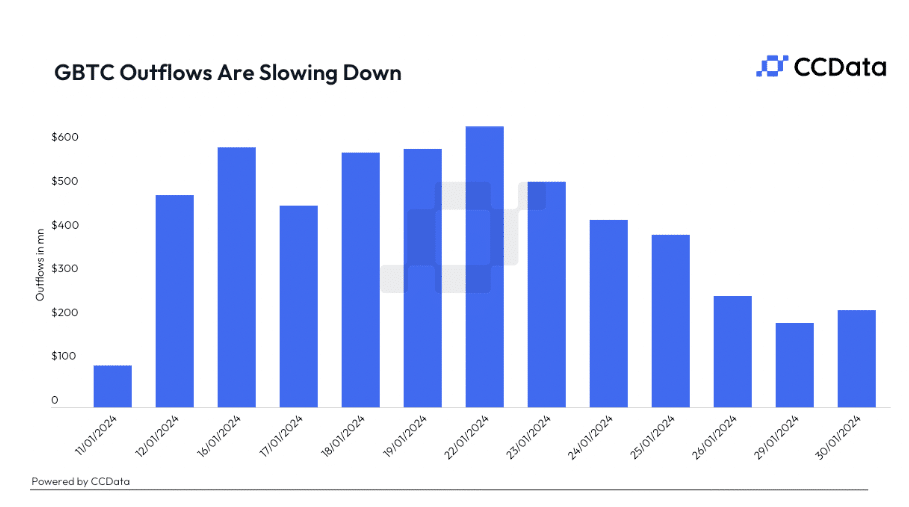

Within the period in-between, Grayscale’s outflows contain started slowing down. Since changing to a web disclose online Bitcoin ETF, GBTC has registered $5.23 billion in outflows. But on January 22, it recorded $641 million, and $221 million on January 30.

“The general inflow figures, even when negative, build not undermine the encouraging trajectory now we contain seen within the ETF market. This holds particularly compatible when Grayscale is excluded from the equation.”

The model, CCData argues, suggests growing self belief within the digital asset jam. That is most likely fueled, moreover ETFs, by the increasing acceptance of digital resources by institutions as a true investment class.

Within the period in-between, Grayscale maintained the industry’s perfect AUM in January, at $29.1 billion. BlackRock and Constancy recorded over $2 billion, making them the 2nd and 4th biggest companies by AUM of their first month of trading. Bitwise led the AUM develop with 81.2% to $1.32 billion.

XBT Provider and 21Shares had AUMs of $2.32 billion and $2.15 billion, respectively. VanEck noticed a 20.6% upward thrust, while ETC Team, CoinShares, and CI Financials noticed declines of spherical 10%.

Source : cryptonews.com