Unveiling the Dark Web: How Privacy Coins Fuel the Trade of Criminal Material Online

Unveiling the Darkish Web: How Privacy Coins Gasoline the Change of Criminal Field materials Online

Privacy coins are fuelling the proliferation of minute one sexual abuse materials (CSAM), in accordance with Chainalysis’s 2024 Crypto Crime Narrative.

The document highlights crypto’s rising operate as relaxed among darkish web distributors of CSAM.

Bask in deal of things listed on the darkish web, CSAM is steadily provided and provided with Bitcoin.

On the opposite hand, the privacy coin Monero (XMR) now plays a rising operate within the felony financial system.

In step with the document, many CSAM distributors beget adopted Monero, even even supposing data suggests the coin is extra prevalent within the money laundering course of after distributors beget peaceful their earnings, somewhat than within the true purchases.

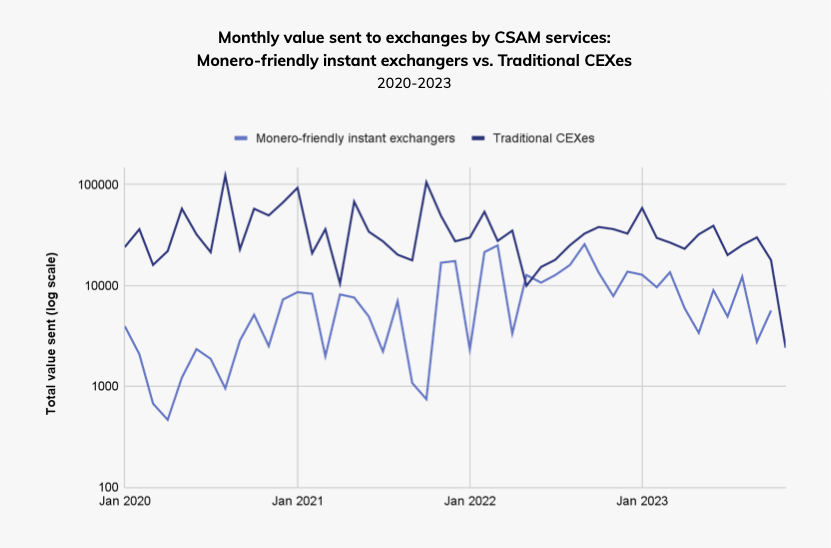

The exhaust of Monero-pleasant quick exchangers by CSAM distributors has grown noticeably in recent times.

Quick exchangers are non-custodial tools for rapid procuring and selling one crypto for one other that vague the transactions they develop.

Coupled with the shortcoming of KYC requirements, quick exchangers are easy laundering tools and platforms for distributors to form Monero, a privacy coin that obscures the money’s vacation converse wallet.

Most steadily, CEXes develop up the supreme recipient of illicit crypto funds from any criminals, nonetheless among CSAM distributors, the easy exhaust of quick exchangers for converting their Bitcoin hauls into Monero is closing the gap.

Privacy Coins’ Lax KYC Permits Money Laundering

Earlier this month, Monero crashed 40% intraday on data that Binance would delist it.

In recent years, regulators beget pressured exchanges to delist privacy coins due to their lack of KYC guardrails.

Binance itself is treading on skinny. The corporate is currently fielding extra than one lawsuits and probes by the Department of Justice, the Internal Revenue Carrier, the US Treasury, the Securities and Change Charge and the Commodity Futures Trading Charge.

The plenty of authorities agencies all roughly allege the identical component: Binance’s lack of KYC and AML guardrails permits laundering and amounts to felony conduct.

On the flipside, crypto’s transparent blockchain has if truth be told helped battle crime.

In 2019, regulation enforcement officers used Chainalysis instrument and prognosis to bring in regards to the shutdown of the supreme CSAM web page by volume of cloth stored, alongside the arrests of the owner and operator.

Chainalysis’s recent crime document presents an example wherein Novel York regulation enforcement officers educated in blockchain prognosis identified the administrator of a mountainous CSAM darkish web retailer, made two arrests, and rescued a 12-year-feeble sufferer.

Source : cryptonews.com