Bitcoin Price Prediction as BTC's Monthly Volume in January Hit Highest Level Since September 2022 – Bull Market Starting?

Bitcoin Trace Prediction as BTC’s Monthly Quantity in January Hit Very best Stage Since September 2022 – Bull Market Starting?

In a rare turn of events, Bitcoin‘s 24-hour trading quantity surged 15.30% to $16.01 billion, indicating a well-known uptick in investor engagement and marking the most effective quantity since September 2022.

This develop, over 10% for Bitcoin, pushing its price beyond the $43,000 threshold, changed into partly pushed by Grayscale’s diminished Bitcoin gross sales and a solid US inventory market.

Upcoming events fancy the US Federal Reserve meeting and January’s job experiences could well merely affect market trends.

Despite capacity uncertainties, Bitcoin’s market capitalization grew by 2% to $1.66 trillion within 24 hours, highlighting the impact of increased trading exercise on its market valuation.

Federal Reserve’s 2024 Hobby Fee Approach

Jerome Powell, the Federal Reserve Chair, has confirmed plans to nick curiosity rates three instances in 2024. This strategic decision is aimed at leveraging the sturdy U.S. economy and controlling inflation, with an goal to decrease the benchmark curiosity rate to 4.6% from its fresh 23-year peak.

Powell’s optimism relating to the U.S. economy is evident as he highlights a solid job market and minimizes recession dangers.

Despite acknowledging the Fed’s preliminary dead response to inflation, he anticipates an disclose in 2024, pushed by the resolution of offer chain points and the results of outdated rate will enhance.

Jerome Powell said in an interview broadcast Sunday night that the Federal Reserve stays no longer off beam to decrease curiosity rates three instances this year, a run that is anticipated to open as early as Would possibly maybe maybe merely. https://t.co/v3V5xCSj3S pic.twitter.com/Th2MplNIkV

— NEWSMAX (@NEWSMAX) February 5, 2024

Powell’s commitment to fastidiously phased curiosity rate reductions has bolstered self belief in the U.S. economy, which could well well alleviate concerns contained in the crypto market.

This come is anticipated to foster a determined outlook, benefiting Bitcoin and the broader cryptocurrency landscape.

DonAlt’s Bitcoin Forecast: Hitting $60K?

Crypto analyst DonAlt predicts Bitcoin could well well attain $60,000 if it surpasses well-known boundaries. He identifies $38,000 and a severe differ between $44,000 and $forty five,000 as preliminary hurdles.

Surpassing $forty five,000 is pivotal for aiming at $60,000, because it could well well signify overcoming major resistance levels.

Bitcoin Would possibly maybe maybe Cruise to $60,000, Says Crypto Analysthttps://t.co/jtp4wPKv3T

— BH NEWS (@bhnewsnet) February 5, 2024

Despite capacity challenges, resembling the introduction of location Bitcoin ETFs, DonAlt stays determined about Bitcoin’s possibilities, downplaying the probability of a decline to $30,000.

He advocates for a bullish outlook could well merely aloof Bitcoin preserve its build above $44,000.

Despite inherent dangers, his optimistic stance suggests that Bitcoin’s trajectory is keenly watched by investors, with the anticipation that adhering to his forecast could well well pressure attempting to search out momentum and for sure affect Bitcoin’s market price.

Bitcoin Trace Prediction

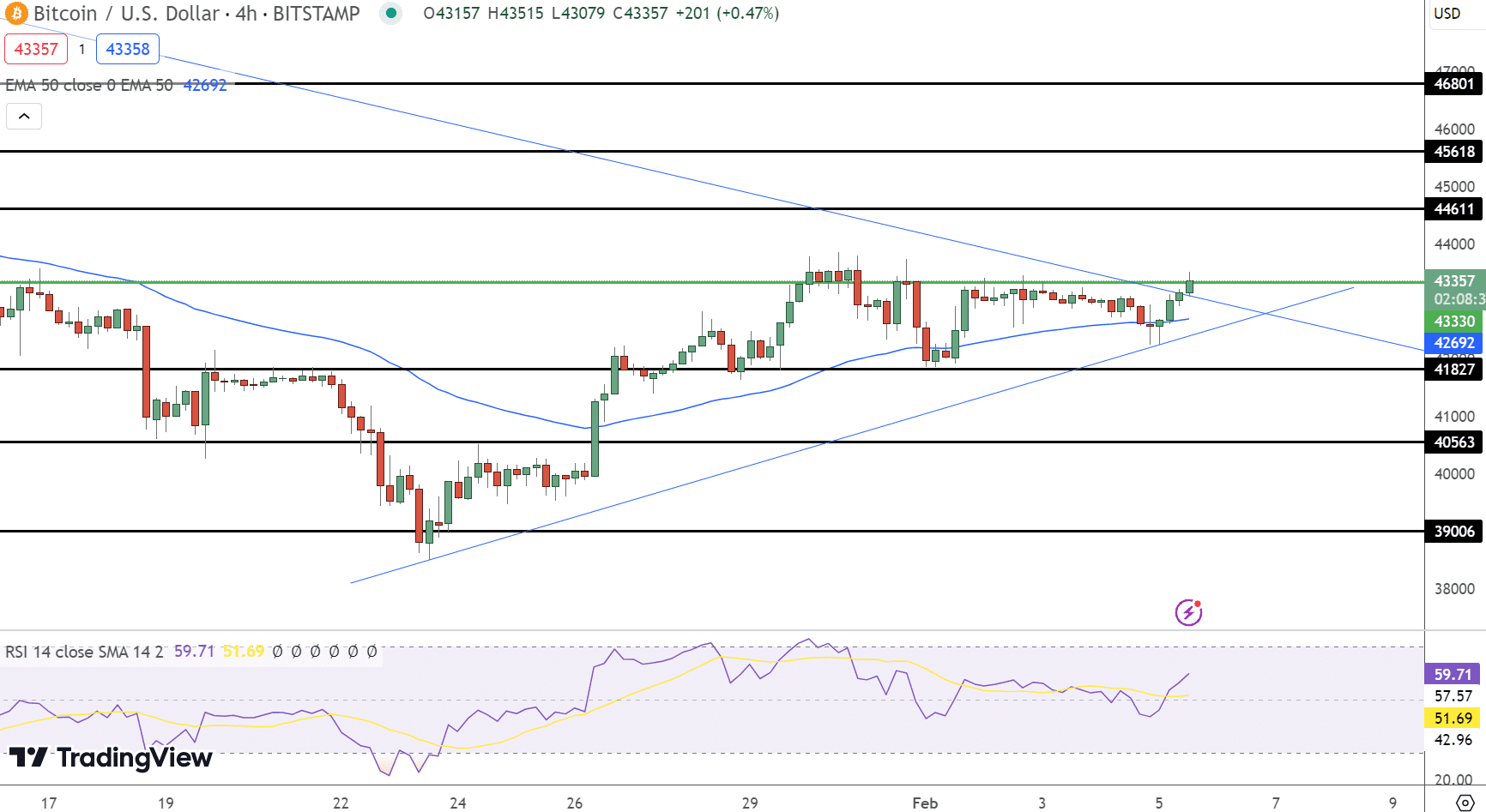

Bitcoin (BTC/USD) reflecting a limited uptick with its fresh tag at $43,362, marking a virtually 1.85% develop. On the 4-hour chart the pivot level stands at $43,330, signaling a cozy steadiness in market sentiment.

Resistance levels are identified at $44,611, $forty five,618, and $46,801, hinting at capacity hurdles for upward actions. Conversely, support levels at $41,827, $40,563, and $39,006 offer a cushion against downward stress.

The RSI at 59 tilts against a fairly bullish sentiment, while the 50 EMA at $42,692 affords a backdrop of underlying energy. The chart displays a double prime sample, signaling resistance around the pivot level.

This formation, coupled with a closing candlestick under this threshold, suggests a severe juncture for Bitcoin’s trajectory.

In conclusion, the trend oscillates between bearish under $43,330 and bullish above, indicating a market at a crossroads, watching for clearer indicators for direction.

High 15 Cryptocurrencies to Glance in 2023

Stay unsleeping-to-date with the enviornment of digital property by exploring our handpicked series of the most effective 15 replacement cryptocurrencies and ICO initiatives to preserve an perceive on in 2023. Our list has been curated by mavens from Alternate Talk and Cryptonews, ensuring expert advice and severe insights for your cryptocurrency investments.

Rob income of this opportunity to survey the aptitude of these digital property and support your self told.

Disclaimer: Cryptocurrency initiatives suggested here are no longer the financial advice of the publishing creator or publication – cryptocurrencies are extremely volatile investments with undoubtedly extensive possibility, repeatedly in finding your indulge in overview.

Source : cryptonews.com