10x Research Founder Who Predicted Bitcoin’s Pre-Halving All-Time High Turns Bearish

10x Research Founder Who Predicted Bitcoin’s Pre-Halving All-Time Excessive Turns Bearish

10x Research Founder Markus Thielen who predicted Bitcoin’s newest pre-halving rally to all-time highs has turn out to be bearish on possibility property comparable to technology shares and cryptocurrencies.

In a CoinDesk interview in February 2024, Theilin acknowledged that “Bitcoin rallies an reasonable of 32% in 60 days earlier than the halving”. Citing it to be upheld as exact inflows into US-essentially essentially based ETFs indicated optimism among broken-down merchants.

This used to be supported by critical RSI indicators which historically “presaged accelerated uptrends” and would trust Bitcoin kind an reasonable sort of 54% within the following 60 days in a “rally to 74,611 by April 11, 2024,” according to 10x Research.

https://x.com/10x_Research/web narrate/1768085626178720022

This played out, with Bitcoin hitting an all-time excessive of $73,000 on March 14th, bigger than a month sooner than the upcoming halving on April 20th – correct looking the prediction.

10x Research is additionally credited with predicting Bitcoin’s bottom. in November 2022, proving them to be consistent and official.

We Offered Every little thing – 10x Research Blames Inflation

Last night, 10x Research expressed their outlook on the most recent assert of the market pronouncing “We are bearish on possibility property (shares + crypto),” as addressed in a newsletter.

Thielen introduced the decision to sell all of 10x Research’s tech shares on the launch closing night. “Entirely about a excessive-conviction crypto cash” stay of their portfolio.

“Our growing difficulty is that possibility property (shares and crypto) are teetering on the fringe of a huge ticket correction,” Thielen acknowledged.

This conclusion used to be essentially influenced by “chronic inflation,” a prevalent deliver tough the web narrate and the aim for Bitcoin’s step encourage from its all-time excessive.

Bond markets now project now not as much as three cuts and 10-365 days treasury yields are surpassing 4.5%, indicating a “compulsory tipping point for possibility property.”

A 25 classic point price sever is a gadget worn by the Federal Reserve to fight inflation, elevating federal funds by 0.25%. This raises passion charges on lending products.

Traders possess recently scaled encourage pricing for 25 foundation point Fed price cuts this 365 days to now not as much as three from six within the starting put of the 365 days, info from CMEGroup divulge.

The 10-365 days Treasury yield has been pushed up 40 foundation elements to 4.61% this month, the very best since November 2023. This critical upward thrust has diminished the enchantment of investing in excessive-possibility, excessive-reward property comparable to tech shares and cryptocurrency.

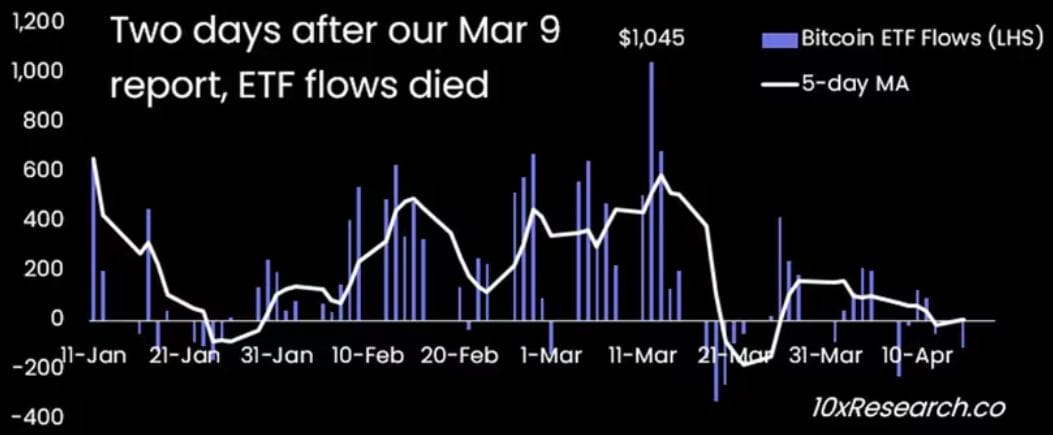

Thielen noted that the rally that resulted in Bitcoin’s all-time excessive used to be “pushed by the expectation that passion charges would be sever, and this memoir is being seriously challenged now.” Including that “inflows into the previously thriving space substitute-traded funds (ETFs) possess dried.”

10x Research Says Bitcoin ETFs are Shedding Hype

Following the SEC greenlighting space Bitcoin ETFs in January, the cryptocurrency gained a full recent target market, allowing merchants to kind publicity to Bitcoin without the prefer to straight hold it.

Since then, these ETFs possess gained widespread adoption, with roughly $12 billion flowing into them. The majority of this inflow occurred closing quarter, ensuing in a surge within the Bitcoin ticket to recent all-time highs. On the numerous hand, they’d lost momentum by April.

Thielen commented on this, pronouncing that after “initial novelty hype, ETF flows are inclined to hotfoot out unless prices continue increasing—which they’ve now not completed since early March.”

The correction is anticipated to take enact after the hype surrounding the upcoming bitcoin halving subsides, which can assume in regards to the per-block forex emission halve to a few.125 BTC from 6.25 BTC, developing artificial scarcity, due to this reality utilizing demand.

Source : cryptonews.com